May 28th 2011

High-Frequency Traders Descend onto Forex Markets

According to a recent report by the Wall Street Journal, high-speed traders are quickly establishing themselves as the main force in forex markets. Just like in other financial markets, a significant portion of trading volume is dominated by computerized trading, in which huge blocks of currency can change hands multiple times in mere milliseconds. While this is certainly old news for hedge funds and other institutional traders, it may come as a slight surprise to retail traders, many of whom still see forex as the neglected stepsister of stocks, bonds, and other assets. Nonetheless, there are a number of implications for the forex markets, and retail traders would be wise to heed them.

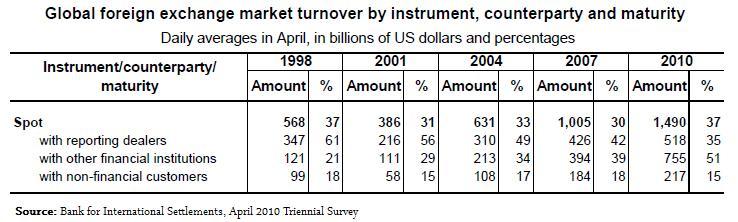

Here are the facts: “High-frequency trading accounted for roughly 30% of all foreign-exchange flows, as of 2010, compared with 13% in 2004, according to Boston-based consulting firm Aite Group. (By contrast, 66% of global stocks trading is high frequency.” According to Aite Group, it will jump to 42% by the end 2011 and to 60% in 2012. “About 85% of the currency market’s growth in volume from 2007 to 2010 came from financial institutions like hedge funds [represented as other financial institutions in the chart below] rather than Wall Street’s traditional bank currency dealers, thanks partly to high-frequency traders.”

According to the Wall Street Journal, this is changing the way in which currencies are traded. Previously, for big blocks of currency, traders would have to manually request a quote from Wall Street brokerages, which still dominate forex trading through the interbank market. The brokerage would match up buyer and seller (or step in and fulfill one of the roles itself) and take a cut, in the form of the spread. Retail traders, on the other hand, have never known such a troublesome process, having always been afforded electronic quotes and instant execution. However, the price paid for this convenience comes in the form of wide spreads, since both your retail broker and its representative on the interbank markets must both earn a profit.

In fact, wide spreads recently came under attack by Karl Deninger and sparked a fierce debate about whether it is still possible for retail traders to turn a profit using high-frequency (albeit non-computerized) trading methods. Fortunately, the Wall Street Journal is reporting that spreads have already fallen to one pip (though it didn’t specify the currency pair) thanks to new systems that have been set up to cater to high-frequency traders. It seems only a matter of time before these systems are either adapted to the retail market and/or replace the interbank market as the market-maker for retail brokerages. (Given that a handful of banks are currently under investigation by the SEC for deceptive quoting practices, a changing of the guard probably isn’t such a bad thing!)

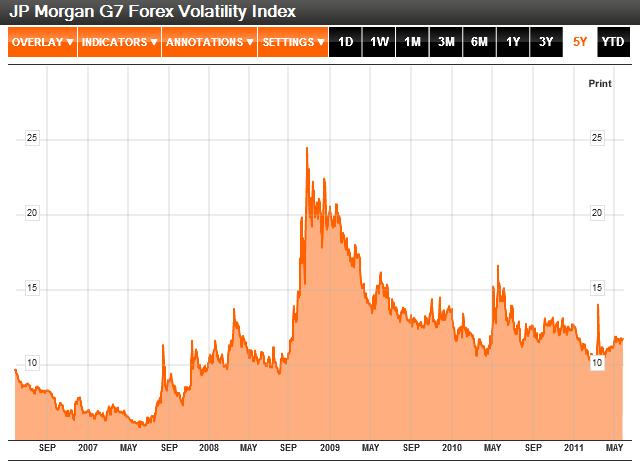

In addition, while high-frequency trading has increased liquidity and lowered spreads, it has probably increased volatility. Sudden spikes quickly becomes exacerbated as automatic stop orders flood the market. You can see from the chart below the abundance of such spikes, the most recent one on March 11 caused by the Japanese natural disasters. Overall volatility is also at elevated levels, though it’s impossible to know how much of this is due to an increase in high-frequency trading and how much is simply due to post-financial crisis uncertainty. In any event, retail traders with ultra-short time horizons have no choice but to play the same game, by maintaining active stop-loss orders. Traders should also consider reducing leverage, since sudden spikes can trigger margin calls and wipe out entire accounts. (For the record, of the dozens of interviews I have conducted over the last couple years, I have yet to find one expert that condones the use of leverage greater than 5:1.In my opinion, leverage is still nothing more than a cynical marketing tool), but I digress…)

Ultimately, I think this is just further evidence that day-trading forex is only going to become more difficult. According to a research paper (that I spotlighted in an earlier post), algorithmic trading has already caused a decline in the power of technical analysis. Presumably, this is because computerized trading systems are better than humans at identifying trends and faster at executing trades designed to profit from them. In the end, outsmarting computers is unlikely, since both human traders and their electronic counterparts use the same forms of deductive reasons to spot potential trading opportunities. At the same time, the algorithms are still “stupid.” They are designed by humans and can only consider the variables that have been inputted them, which are inherently technical in nature. To beat them, you merely have to beat their human designers. In practice, this probably means designing more creative strategies based on more complex analytical tools and/or considering fundamental factors in addition to technical ones.

May 29th, 2011 at 7:17 am

u algos are gone,since im in da haus

May 30th, 2011 at 3:23 pm

Not sure that HFT is so common in forex. The interesting thing is that many banks (price makers) do quote-and-cover (aka auto-heding) using algorithmic pricing and algorithmic trading. The main major players are inter-connected and all react on price movements on ICAP / EBS. That seems to create interesting dynamics.

June 12th, 2011 at 11:36 am

Hi Adam,

High speed computerised trading has been around for many years now, and this method of trading can produce high returns indeed, but as you said, it’s only available to institutional investors! and i believe, you need a very large account to show some profit out of this! Spreads have lowered indeed, but only for the big players as you mentioned, as retail brokers still have to make a living out of their retail accounts, a market which is not to be neglected!

Indeed high speed trading has increased liquidity, which is only good, but on the other hand, it produces the sudden spikes you were talking about, which can wipe out accounts, exit positions, provided that a stop loss is used, and all this is good also; but for whom? for the retail broker of course!

In my opinion, retail traders should look at Fundamentals first, and blend that with some technical knowledge!