May 10th 2011

What the Forex Markets Tell Us about Gold & Silver

All investors, regardless of stripe, must now be aware both of the bull market for gold/silver and the bear market in the US dollar. Despite all of the rhetoric, however, it seems that little is actually understood about how these two phenomena are actually connected. Ultimately, this connection (or lack thereof) has serious implications for both markets.

Many gold investors insist they are buying gold as a proxy for shorting the dollar. Commentary on gold prices is full of apocalyptic warnings about the current financial system and criticism of fiat currencies, which are backed by nothing except for good faith. They argue that buying gold is the best (or even the only) hedge against the eventual collapse of the dollar.

Unfortunately, I don’t think this argument holds up to close scrutiny. First of all, gold and silver [I am including silver in this analysis not because of any deep relationship to gold, but only because of the association ascribed by other commentators and an observable market correlation] prices have risen much faster over the last year (and decade, for that matter) than even the strongest currencies. Furthermore, gold is rising faster than the dollar is falling. In terms of the Swiss Franc – which is to forex markets as gold is to commodities markets – gold has risen more than 17% since the start of 2010.

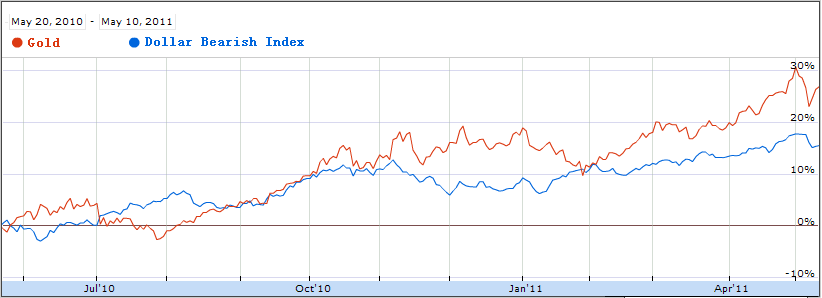

Second, the putative correlation between gold and forex markets asserts itself sparingly (as you can see from the chart below, which plots gold against an index that shows dollar bearishness), and in difficult-to-understand ways. For example, gold stalled during the financial crisis, while the price of silver suffered a veritable collapse. Does it make sense that when financial anxiety was highest, interest in gold and silver ebbed? Along similar lines, the recent rally in the dollar followed the recent correction in gold and silver – NOT the other way around. If anything, this shows that gold investors are taking their cues from the broader commodity markets, and not from forex markets.

Third, the macroeconomic case for gold is flimsy. While I don’t think it’s fair to attack gold on political grounds, I still think it’s reasonable to try to ascertain what forces are supposedly being hedged against. If it is inflation that gold buyers are worried about, why aren’t other all investors equally concerned? Based on futures markets – whose credibility is just as solid as gold markets – inflation expectations are around 2-4% across the G7. If instead it is sovereign debt default that gold investors are concerned about, again, I have to ask why other markets don’t share their concerns. Credit default swap rates are higher for Japanese and European debt than for US Treasury securities, but the yen and euro remain positively buoyant against the dollar. Again, how do gold investors explain this contradiction?

To me, it seems obvious that gold and silver are rising for reasons that have very little to do with fundamentals. Monetary expansion has driven a wave of money into financial markets, and a significant portion of this has no doubt found its way into gold, silver, and other metals. In fact, it seems that last week’s correction was driven partly by higher margin requirements for speculators. Finally, their cause is being helped by low interest rates, since the opportunity cost of holding gold (which doesn’t pay interest) in lieu of dollars (which does) is currently close to zero. When interest rates rise, it will certainly be interesting to see if there is any impact on gold.

In the end, I don’t have a strong understanding of gold and silver markets. For all I know, their rise is genuinely rooted in supply/demand, as it should be. My only wish is that investors will stop pretending that it has anything to do with the dollar.

May 11th, 2011 at 5:15 am

Hi Adam,

I read your blog posts regularly and I first want to thank you for writing such an interesting blog. Your last post about precious metals and dollar weakness is particularly interesting to me. I have a few comments, although I am just a private investor and not an expert by any reasonable standard I do not belong to the group of apocalyptic gold fans. Rather, I am just naturally curious about financial markets.

First, as I understand the argument for using gold to short the dollar, it is a broader argument that goes for all fiat currencies, not just the dollar. Swiss francs or Euros are also backed by nothing except for good faith. Evaluating the dollar strength in terms of another fiat currency is then really a comparison of the good faith in the dollar versus the good faith in another currency. In terms of gold, the Swiss Franc also depreciated over the last years, but less so than the dollar. One could reverse the question: Why shouldn’t the Swiss franc depreciate against gold when it is a fiat currency and during a financial crisis where the Swiss economy is heavily exposed to financial services?

Gold is definitely not the only hedge against a weak dollar, but so far it has been a more profitable one than a hedge using Swiss francs would have been.

Second, I believe that the gold price stalled during the financial crisis because of a reduced fear of inflation. In fact, there were much discussion (at least in the media) about the possibility of outright deflation, induced by the effects of the financial crisis to the real economy (I use the term “real” in the economists’ sense of the word; production of goods and services.).

Another reason could be that dollars had to be realized (by selling gold) because they were needed elsewhere for, say, liabilities in dollar or capital requirements.

As for silver, it seems to me that there is more speculation in silver than in gold. The volatility of silver is much higher than that of gold, and the bull market in silver during the recent months bears a strong resemblance to a bubble. That is supported by the burst last week, especially if is was, indeed, induced by higher margin requirements. That view could also explain why silver, as you wrote, had a veritable collapse during the financial crisis. The fundamental reason, fear of disinflation of deflation, is the same as for gold, but the effect is exaggerated.

Third, the differences in (apparent) inflation expectations between gold prices and futures markets is an interesting question. Are you referring to bond futures? Otherwise, what about bond markets? US government bond yields are also on the low side, as I recall. The CDS rates versus exchange rates is a similar conundrum. It could be related to timing issues, a belief in “orderly” sovereign defaults and sound monetary policy, or maybe excessive focus on interest rate differentials. I really don’t know

All that said, I think that any price that is strongly trending invites speculation. That will exaggerate price moves in either direction. I think we have just witnessed that in silver, but gold seems more persistent and more restrained. After all, there are many factors influencing the price gold, and it is difficult to say which ones are dominating others at which times.

Anyway, I hope I haven’t wasted your time with these comments. I look forward to your next blog post!

Sincerely,

Lasse Jaeger

May 11th, 2011 at 9:34 am

the difference between 1980s and the 21 st century is that the FREE markets in the 1980s was able to divert the Inflation from its domestic only markets fundamental into expanding and developing the 3rd world which was a lower cost producer of the same goods and this allowed for a temporary time of price stability across the broad on the supply of human needs . Now that this development phase has reached capacity it is reviling that raw material supply will be the next challenge as Population growth is predicted to be Unsustainable in the next 20 years due to water shortages and food shortages , and I think this is feeding the Uncertainty in the durable goods markets and created the fear which is driving the investors to the commodities as the security they seek . The future is Uncertain on how the Population of the world is both sustained and allowed to continue to grow and if it is zeroed out in terms of growth what does this mean for the Supply-side fundamental of the current economic structure the world in using ????? And you Cannot Deny this debate because the policy makers that advise the G-7 and the US President are very astute in this area of societal thinking with over 30 years in the analogical fundamental of the kind of future the world faces , and I believe this too is changing the way Investors are looking at their investments and this uncertainty is also driving the safe heaven investments into the Hard asset classes because fiat currencies are used for supply-side expansion of vital human needs and if the technocratic society is telling the Policy makers there is No Use in trying to continue to expand the supply that Earth cannot continue to provide the needs of a unsustainable human population then this is having an effect on the investors thinking . http://www.globalresearch.ca/index.php?context=va&aid=7735 http://www.universityworldnews.com/article.php?story=20091211105819323

May 11th, 2011 at 9:35 am

Too consider a thought outside the norm of Everyday thinking in terms of supply-side economic expansion and the resistance that we see coming from Government Policies that seem to be anti growth in the industrialized sense , What if a 98 years ago when the first World War was fought that it stemmed from a Population growth in the Eurasia region that was out pacing supply capability and that led to struggles strife and WAR and Genocide ?? Are we seeing a Repeat again only worldwide now ? Was this the reason why the elite back almost 100 years ago new that this was the only way to continue to create supply but at the same time if and when the ability to sustain world population was met with Peak abilities because earth is a Finite element the need to central banking method like the Federal Reserve a designed means to an ends , to reel in the Money if at some point in time the elites figure Earth reaches it human carrying capacity ??

Heres a List of Quotes by the Population control expert thats still actively advising Governments and our current President ; http://en.wikiquote.org/wiki/Talk:Henry_Kissinger , http://www.population-security.org/11-CH3.html , Who controls the food supply controls the people; who controls the energy can control whole continents; who controls money can control the world. “Wherever a lessening of population pressures through reduced birth rates can increase the prospects for such stability, population policy becomes relevant to resource supplies and to the economic interests of the United States.” heres more on the con job ; http://www.wnd.com/?pageId=85442 , http://www.youtube.com/watch?v=GThfWVCfjVo&feature=player_embedded , this talks about the Trilateral Commission effect of the Plan for Population Control http://www.globalresearch.ca/index.php?context=va&aid=7735

http://www.dailymail.co.uk/sciencetech/article-1346357/World-faces-overpopulation-disaster-number-people-set-rise-75-million-EACH-YEAR.html

The Ideology that makes up the advisory list in the Whitehouse is clear with an Agenda , Obama Returns to End-of-Life Plan That Caused Stir

http://www.nytimes.com/2010/12/26/us/politics/26death.html?_r=3&partner=rss&emc=rss

Everything they are doing is to bring control over the worlds Population growth , they been planning this time for 40 years http://www.green-agenda.com read the quotes . I say we the people need to consider Our right to be Separate from the rest of the world in terms of Pulling our troops out of the world theater and coming home securing our Boarders and tell the rest of the world do whatever with your World market , we the people of the USA only consume 1/3rd of our food we produce and so we will maintain our right to LIBERTY and if you try and take us out we will end it all for all .

Austin Chief Sustainability Officer Lucia Athens Affirms Global Population Reduction Agenda http://www.youtube.com/watch?v=2sTjVhvAgas

http://www.metacafe.com/watch/621153/cia_predicts_the_future_2015_water_resources/ http://www.metacafe.com/watch/621146/cia_predicts_the_future_2015_overpopulation/

http://ngm.nationalgeographic.com/2011/01/seven-billion/kunzig-text

I have understood the population explosion intellectually for a long time. I came to understand it emotionally one stinking hot night in Delhi a couple of years ago… The temperature was well over 100, and the air was a haze of dust and smoke. The streets seemed alive with people. People eating, people washing, people sleeping. People visiting, arguing, and screaming. People thrusting their hands through the taxi window, begging. People defecating and urinating. People clinging to buses. People herding animals. People, people, people, people. —Paul Ehrlich

http://dieoff.org/page1.htm , this is the Home Page to the Technocrats scientific explanations on PEAK EARTH

May 11th, 2011 at 9:53 am

All thats going on is a Consolidation of existing supply sources , no expansion is in progress .

GEORGE SOROS CONVENES ‘BRETTON WOODS II, http://www.libertynewsonline.com/article_301_30417.php

Now George Soros is taking over our food industry!

http://www.rumormillnews.com/cgi-bin/forum.cgi?noframes;read=201463

20 Signs That A Horrific Global Food Crisis Is Coming

Courtesy of Michael Snyder, Economic Collapse

http://theeconomiccollapseblog.com/archives/20-signs-that-a-horrific-global-food-crisis-is-coming

http://www.cattlenetwork.com/cattle-news/latest/Corn-planting-lags-by-53-percent-from-2010-121113309.html

May 11th, 2011 at 9:57 am

This is the face of International Bolshevism

http://creation.com/a-tale-of-four-countries

http://www.atheismresource.com/2010/stalin-killed-for-political-reasons

http://www.mailonsunday.co.uk/news/worldnews/article-1038774/Holocaust-hunger-The-truth-Stalins-Great-Famine.html

http://www.usatoday.com/money/industries/retail/2011-03-30-wal-mart-ceo-expects-inflation_N.htm

http://www.cattlenetwork.com/cattle-news/latest/Jolley-Droughts-and-floods-food-and-fuel.html

http://www.cattlenetwork.com/cattle-news/Soaring-food-prices-lead-to-global-unrest.html?ref=159

http://www.cattletradercenter.com/articleview.aspx?count=20&path=/cattle-news/latest&lid=11

The only way to control inflation is by EXPANDING the supply of that which is Inflating in price …… what we are doing is not expanding supply , only expanding the money supply that is chasing a shrinking supply .

May 11th, 2011 at 9:59 am

the longer we ignore these truths about supply and demand , and continue to just all be DEER in the HEADLIGHTS on the road to serfdom we will end in utter struggle, conflict and war .

May 11th, 2011 at 2:29 pm

Adam the above posts are very relative to your reasons why investors are scared to death of the durables markets having any recovery in terms of supply-side economic growth fueled by the Fiat Commercial paper markets funding Supply-side expansion growth because there is a resistance to this kind of future growth in about 40 % of the Population in the world of which are made up of the elite societies who control the funding for supply-side expansion , the Technocrats that make up the broad members of the most prestigious Environmental organizations and think tanks the world over . The links to articles above are form a lot of these very technocrats that advise our Governments .

May 11th, 2011 at 4:08 pm

Hi Adam,The assumption is that Gold is going to be the currency of the future, assuming the constant demise of the $, and being the most widely used, the next best thing the world understands, excellent site by the way, DTTM

November 4th, 2011 at 8:15 am

We love your lovely blog and pls carry forward.