June 8th 2009

Chinese Yuan Inches Towards Reserve Currency Status

The last week brought a few more developments in China’s quest to turn the Yuan into a viable reserve currency. Don’t get me wrong – I used the term “inches” in the title of this post for a reason – the Yuan will not supplant the Dollar anytime soon, if ever. Still, China deserves credit for their resolve on forcing the issue, as well as for providing an alternative to the Dollar monopoly.

An important boost came from Russia’s Finance Minster, who suggested that, “This could take 10 years but after that the yuan would be in demand and it is the shortest route to the creation of a new world reserve currency,” as long as it was accompanied by economic and exchange rate liberalization. The Head of the World Bank, Robert Zoellick, agreed: “Ultimately, that’s a good thing. And ultimately it’s good if you’ve got, I think, some multipolarity of reserve currencies to create, to make sure that people manage them well.”

These soft endorsements were precipitated by comments from a top Chinese banker that companies should start to issue bonds denominated in Yuan. “Guo Shuqing, the chairman of state-controlled China Construction Bank (CCB), also said he is exploring the possibility of issuing loans to trading companies in yuan, allowing Chinese and foreign companies to settle their bills in yuan rather than in dollars.” This would serve two ends simultaneously; not only would Chinese capital markets be strengthened, but the Chinese Yuan would benefit from the increased exposure. Already, “HSBC and Standard Chartered have both said they are preparing to issue bonds denominated in yuan” and international monetary institutions might not be far behind.

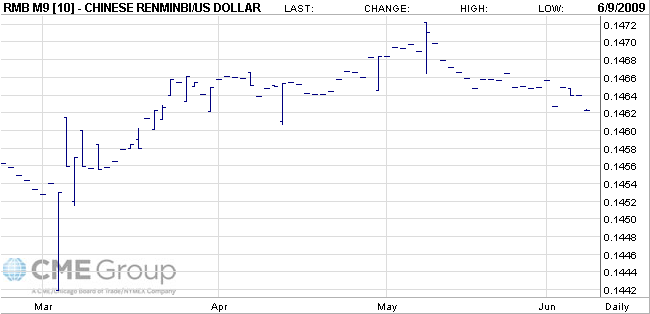

Conspiracies aside, the Chinese Yuan will become a reserve currency when it is ready to become a reserve currency. I’m sure this seems self-evident, but it’s important for China (and China watchers) not to get ahead of itself. It doesn’t make sense for risk-averse investors to hold a currency that is still essentially pegged to the US Dollar and that isn’t fully convertible. If there’s no pretense that the Yuan fluctuates in accordance with market forces, and if investors aren’t guaranteed the ability to withdraw RMB if need be, what possible reason would they have to hold it in the first place?

Summarizes one columnist, “China would have to gradually make the yuan convertible on the capital account; it needed a more liquid foreign exchange market; its bond markets and banking system needed to be more developed; and there had to be proper monitoring of cross-border capital flows.” The importance of having functioning capital markets cannot be understated. Simply, investors and Central Banks buying Yuan would not want to simply invest in paper currency; instead they would want stocks and bonds that trade transparently.

Currently, foreign investors are limited to savings accounts and investing/lending to firms that record earnings opaquely and are ultimately subject to the whims of the Central government. This system has functioned well in the past, only because investors were betting generally on the Yuan’s appreciation, and not necessarily on specific opportunities within China. If China wants the Yuan to be a serious contender with the Dollar, it needs to give investors more and better options. Ironically, if China had taken these steps in the past, it wouldn’t have found itself with $2 Trillion worth of Dollar assets that it is desperately trying to dispose of.