June 10th 2009

Bubble in Emerging Markets FX?

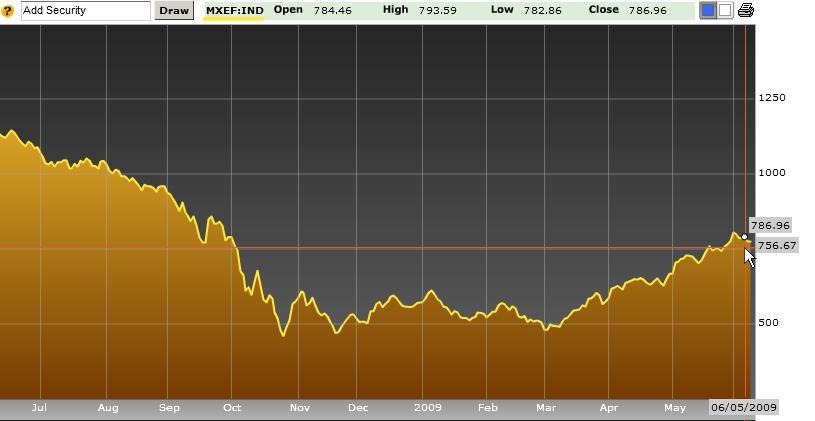

What’s wrong with a little optimism? Well, nothing, in theory. In practice, however, unbridled investor optimism usually spells disaster. Consider that emerging market stocks (based on the MSCI emerging-markets index) now trade for 15x-earnings, the highest level since December 2007. Does anyone remember what happened next? The index plummeted 22% in a matter of months.

Here are some more statistics. The MSCI index is now at an eight-month high, following a record 61% rise since February. $12 Billion have poured into emerging markets in the last four weeks alone. Consider this against the backdrop that “Earnings at companies in the MSCI emerging-markets gauge trailed analysts’ estimates by an average of 41 percent in the first quarter.”

Here are some more statistics. The MSCI index is now at an eight-month high, following a record 61% rise since February. $12 Billion have poured into emerging markets in the last four weeks alone. Consider this against the backdrop that “Earnings at companies in the MSCI emerging-markets gauge trailed analysts’ estimates by an average of 41 percent in the first quarter.”

Meanwhile, “The extra yield investors demand to own developing nations’ bonds instead of U.S. Treasuries fell…to 4.19 percentage points, according to JPMorgan Chase & Co.’s EMBI+ Index.” The index has now erased nearly all of its losses from the last year. In some ways, this is even more unbelievable than the rally in stocks, since it indicates that despite the current recession and strained finances, investors are just as willing to lend to companies in developing countries as they were prior to the downturn!

Who cares about stocks- tell me about currencies! “Unsurprisingly stock markets in Asia have been highly correlated with regional currencies over recent months, with almost all currencies in Asia registering a strong directional relationship with their respective equity markets.” The Indonesian Rupiah is up 11% this year and the Indian Rupee is now up 4%, to highlight only a couple. Only a few months ago, these currencies were tracking at double-digit percentage declines!

A culling of analysts’ soundbites reveal the usual lack of consensus. On the one hand, “The pattern signals an ‘imminent’ drop;” “Fund flows at their extremes are contrary indicators;” and “Investors are starting to doubt the sustainability of how much longer this very sharp rally can continue.” But for every bear there’s a bull: “There’s a lot of money looking for decent returns and that’s going to continue driving emerging markets.” In short, you can find literally thousands of analysts and their respective forecasts to support either hypothesis.

I would argue that the sustainability of this rally (both in stocks and in currencies) hinges on a return to GDP growth in emerging markets. [The IMF forecasts 1.6% growth in 2009 and 4% in 2010]. But given the gap between share prices and earnings, I’m frankly not convinced that investors actually care about whether the rally is supported by actual data. Instead, investors have complacently been swept up by the same herd mentality that produced the bubble of 2008, and could potentially lead to a rapid and painful collapse in what looks to be the bubble of 2009.

June 11th, 2009 at 5:41 am

“I would argue that the sustainability of this rally (both in stocks and in currencies) hinges on a return to GDP growth in emerging markets. [The IMF forecasts 1.6% growth in 2009 and 4% in 2010]. But given the gap between share prices and earnings, I’m frankly not convinced that investors actually care about whether the rally is supported by actual data. Instead, investors have complacently been swept up by the same herd mentality that produced the bubble of 2008, and could potentially lead to a rapid and painful collapse in what looks to be the bubble of 2009.”

Excellent stuff. Keep it up!