June 18th 2009

Currency Hedging: Is it Worthwhile?

While volatility in the financial markets has certainly declined from the record highs of October, a spike in the last week means that it is still problematic, and hence relevant. With this post, I will examine one theoretical method that has the potential both to limit volatility and to improve returns: currency hedging.

Generally speaking, there are a few situations in which currency hedging is useful: international equity/bond investing, currency investing/trading, and inflation hedging. The latter typically involves using commodities/metals to hedge against inflation, which is typically proxied by the Dollar. In other words, inflation hawks might buy gold/oil to offset a declining Dollar. This dynamic is currently on display in commodities markets, where “Speculative money has increased oil’s sensitivity to dollar movements, and if the dollar continues to strengthen, this will weigh on prices.” This type of hedging, however, is probably the most nuanced, and I will set it aside it for another post.

Generally speaking, there are a few situations in which currency hedging is useful: international equity/bond investing, currency investing/trading, and inflation hedging. The latter typically involves using commodities/metals to hedge against inflation, which is typically proxied by the Dollar. In other words, inflation hawks might buy gold/oil to offset a declining Dollar. This dynamic is currently on display in commodities markets, where “Speculative money has increased oil’s sensitivity to dollar movements, and if the dollar continues to strengthen, this will weigh on prices.” This type of hedging, however, is probably the most nuanced, and I will set it aside it for another post.

Hedging indirect exposure to currencies (from overseas investments) involves the separation of currency risk from credit/equity risk. In other words, if you are an American invested in a European stock, you may wish to hedge against fluctuations in the Euro (which impact you insofar as the stock is priced in and pays dividends in Euros, but your account is denominated in Dollar), so that you are exposed only to fluctuations in the stock, itself. Simply, this would involve selling Euros simultaneously with buying the stock; the amount of Euros that you sell depends on what level of exposure to currency risk you are comfortable with. If you buy $100 worth of stock in a European company and buy $100 USD/EUR, then you are fully hedged.

Hedging direct exposure to currencies is inherently more sophisticated. For example, if you sold $100 EUR/USD, you can’t hedge your position by simply buying EUR/USD, or you will negate any return without changing the level of risk. Instead, you can use financial derivatives (options, forwards, futures, swaps), which if executed properly, are tantamount to buying insurance on your portfolio. For example, if you are long the Dollar, you can buy put options in order to protect yourself from significant downside. Likewise, if you are short the Dollar, you can buy calls to achieve the same end.

The advantage of options is that strategies can be as complex as you want; likewise, they can be as simple as buying calls or selling puts. Other derivatives, however, have another component: carried interest. Since forwards/futures/swaps are all contracts (an option represents a right, other derivatives represent obligations), they are priced to take short-term interest rate differentials into account. Simply put, “For currencies with high short-term interest rates, there is a positive “carry” associated with hedging, while for currencies with low short-term interest rates, the “carry” is negative.”

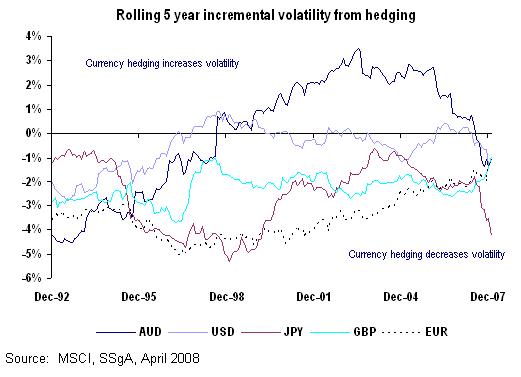

I pulled that snippet from a study on currency hedging that I read recently. According to this report, “For most base currencies, over most periods, hedging seems to have reduced the volatility of international equity portfolios.” [See chart below]. However, while hedging seems to reduce risk, it doesn’t necessarily boost return. “Again, given one man’s meat is another’s poison, one would expect the results to be distributed evenly around the horizontal axis, and that is in fact the case.” In other words, one currency’s gain is inherently another’s loss. Still, if you could maintain the same returns but limit volatility, why wouldn’t you?