May 29th 2009

Foreigners Continue to Fund US Trade Deficit

Economists generally and Dollar bears specifically both love to harp on the perennial US trade imbalance. Despite the halving of the trade deficit (reported by the Forex Blog last week), the gap between exports and imports remains sizable; it is projected at about a $350 Billion for 2009.

The more important data point, however, concerns capital flows. This is applies mainly currency traders, which are less intrinsically worried about the US trade imbalance than how the rest of the world feels about supporting such a balance. For example, if the entire trade deficit is recycled (i.e. invested) back into the US, than theoretically a trade deficit presents nothing to worry about, at least not in the short run. [Of course, such a trend may not be sustainable for the long-term, but that is outside the purview of this post].

The Dollar’s de facto role as the world’s reserve currency has historically ensured that this has been the case. This phenomena has even been strengthened by the credit crisis, as the initial spike in risk aversion generated a steady demand for Dollar-denominated assets. However, there was concern that this demand was leveling off over the last few months as risk aversion ebbed, and foreigners collectively sold a net $95 Billion worth of American assets. Over this period, the Dollar by no coincidence has declined across the board, against both emerging market currencies as well as the majors.

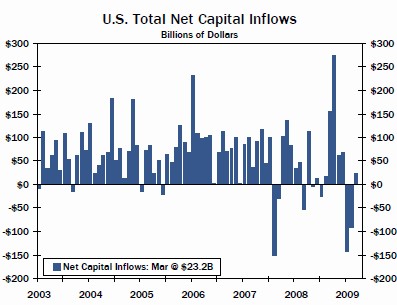

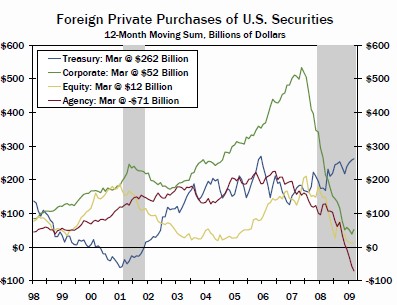

In March – the most recent month for which data is available – this trend reversed itself. Net capital inflows totalled $23.2 Billion, close to the $27 Billion US trade deficit. Especially surprising is that foreign demand for US Treasury securities remained strong – to the tune of $55 Billion – despite low yields. Moreover, the two most important customers both chipped in: “China, the largest holder of U.S. Treasury securities, increased its holdings of government bonds further in March to $767.9 billion. In February, it held $744.2 billion. Japan’s Treasury holdings stood at $686.7 billion in March, compared with $661.9 billion in the prior month.”

Even demand for equity securities remained strong, as foreigners purchased $12 Billion in March alone. Foreign demand and the rising stock market are probably now reinforcing each other. Meanwhile, US investors collectively continue to pull money from abroad and return it to the US; over $100 Billion has already been returned to the US in this way.

Taken at face value, this is certainly good news. Given all the bad news, the fact that capital is still flowing into the US is worth celebrating. At the same time, the fact that the Dollar continues to fall suggests that this more to the story than meets the eye…

Note: Both Charts courtesy of International Business Times.

May 30th, 2009 at 6:39 am

[…] Adam Kritzer shows that despite all the gloomy forecasts, money still flows into the US. […]

May 31st, 2009 at 1:19 pm

Well written article…

The US for a time being (probably throughout the remainder of the recession) will have an imbalance on their trades. I assume you will see that drastically change once the economy grows again.