June 12th 2009

BOC Nervous about Loonie Appreciation, but Not Enough to Take Action

Canada right now seems to typify the contradiction between political posturing and economic reality. GDP dropped by a whopping 5.3% in the first quarter- less than what the Central Bank had predicted but greater than thr 3.7% drop in the previous quarter. “The economy will shrink by 3 percent this year, the central bank predicts. That would be the biggest drop since 1933, according to Statistics Canada. The unemployment rate has also been at a seven-year high of 8 percent the last two months.” The most grim statistic is that “Canadian exports fell an annualized 30.4 percent in the first quarter, led by the automotive industry.” This is particularly problematic for Canada, whose economy is 30% depending on such exports.

Meanwhile, Canada’s Prime Minister, Steven Harper, is bandying the term “green shoots” around, and has declared “The worst is behind us now.” I guess it just depends on which statistics you choose to cite. After all, “April data…showed new jobs were created for the first time in six months and sales of existing homes rose the most in more than five years. Credit markets are also improving, with the Bank of Canada’s composite index of financial market conditions rising to its strongest level last month since September.” Still, a majority of surveyed economists forecast economic contraction for at least another quarter.

At least the Bank of Canada seems to have two feet planted firmly on the ground. It has warned investors not to expect a rate hike (from the current record low of .25%) for about a year, although it admits that could change depending on inflation. The BOC has thus far abstained from unveiling a massive “quantitative easing” plan to match that of the UK and US, which were subtly gibed for not having viable “exit strategies.” In addition, while Canada’s outstanding public debt has surged past $500 Billion, the country’s debt/GDP ratio is still the lowest in the G8 and projected to remain stable (despite projections of deficit for the next five years). In short, inflation inflation is probably not a realistic concern.

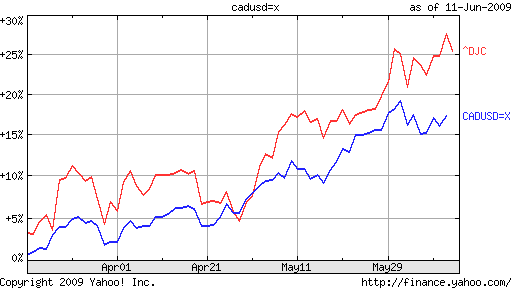

What is worrying to the Bank of Canada is the rise in the Loonie, which has surged 14% since March and shows no signs of stopping. In its decision last week to maintain rates at current levels, the BOC referred to “the unprecedentedly rapid rise in the Canadian dollar (which reflects a combination of higher commodity prices and generalized weakness in the U.S. currency).” Given that it can’t cut rates any further and is reluctant to devalue the currency through printing money, the only real option is for the Central Bank to intervene directly in currency markets, last done in 1998. Analysts, though, reckon that this is extremely unlikely.

What would it take for the Loonie to return to a more sustainable level? A decrease in risk appetite, for one thing. If investors got spooked and returned to the Dollar, this would probably crunch the Canadian Dollar. More likely, at least in the short-term, seems to be a retreat in commodity prices. The Loonie has pretty closely tracked the recovery in commodity prices [see chart below], any any pullback in oil and metals would likely be reflected in decreased demand for the currency. A recent report in the NY Times suggested that the surge in Chinese buying activity – which was clearly correlated with rising prices – may soon come to an end. The inevitable fall in commodities prices that would follow will certainly help officials at the BOC to sleep better.