November 26th 2009

Central Banks of the World: Unite!

Karl Marx would be pleased…well, maybe not. In any event, the world’s Central Banks are tired of the weak Dollar, and are separately taking matters into their own hands. [Before I continue, I should probably acknowledge the inherent dangers of lumping every Central Bank together under one umbrella. Still, given the current market environment, and the fact that all Central Banks are acting uni-directionally, it seems like a fair categorization].

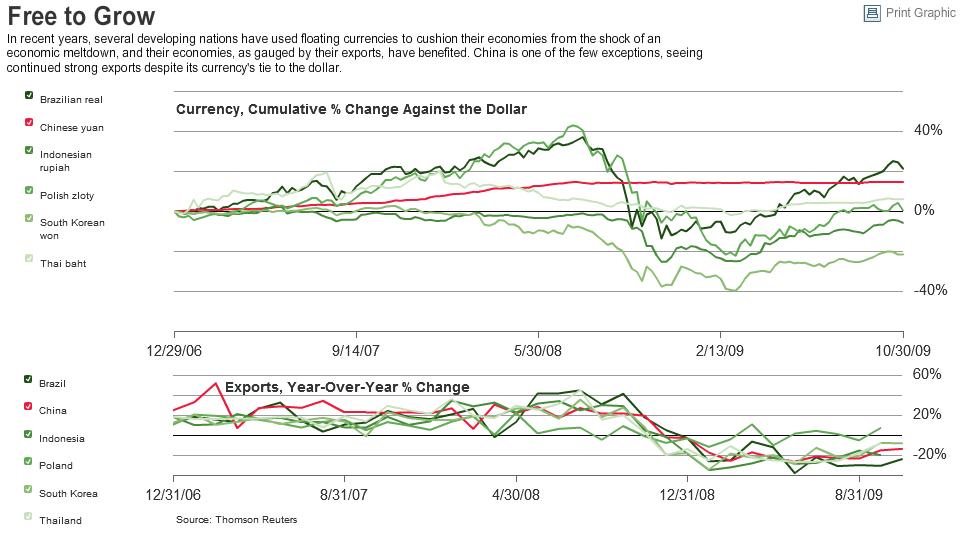

As I was saying, Central Banks – especially in the developing world – are extremely unhappy with the Dollar’s continued decline, and with the opposing strength in their respective currencies. Over the last year, these Central Banks have waded into the forex markets, one after another, in a non-concerted effort to stem the gains in their currencies. As the Dollar’s decline has gained new momentum, so have they redoubled and intensified their efforts.

In the last couple weeks alone, at least a dozen (and these are only the ones on my radar screen) have issued threats and/or taken action aimed directly at the “speculators,” which are blamed for the across-the-board rise in emerging market currencies and asset prices. Their concerns are twofold: that currency appreciation could choke off economic recovery, and that speculative investment is driving the creation of new asset price bubbles.

While their goals are largely the same, their tactics differ. Some are testing the old approach of simply buying Dollars on the spot market. Thailand, Israel, South Korea, Philipines, and Russia, for example, are now intervening heavily on a regular basis. “Experts estimate that some of the largest emerging economies may have spent as much as $150 billion on currency intervention over the past two months, judging from the growth of their international reserves, according to data from Brown Brothers Harriman.”

Other Central Banks have resorted to policy-making measures; Taiwan and Brazil are perhaps the best examples here. The former has essentially banned foreigners from opening new time deposits in the country, while the latter has just imposed a 1.5% tax on investment in Brazilian ADR shares to match the 2% tax on new FDI. In addition, sources claim that other measures are being considered, including “an overseas sovereign bonds issue denominated in Brazilian reals and a change in rules that would allow foreign equities investors to deposit guarantees overseas.”

South Korea and Sri Lanka have been even more creative in restraining their currencies. Sri Lanka is now making it easier for its citizens to take money out of the country, while South Korea is now placing limits on the hedging activities of exporters, who “have sold large amounts of dollars in the forward market to hedge foreign orders, putting upward pressure on the won.”

Still other Banks are still in the “rhetorical” stage of intervention, whereby they simply convey to investors that they are monitoring forex markets for “instability” and “irregularities.” Such code-words are designed to signal that rapid currency appreciation will not be accepted idly. “People see the central bank looking closely at the dollar and think maybe it’s a good time to unwind some of their positions,” explained one analyst in response to “rhetorical intervention” by the Bank of Chile.

Unfortunately for these Central Banks, their efforts are ultimately unlikely to be successful. They can probably succeed in slowing, or even temporarily halting the rise in their respective currencies, but won’t be able to achieve a permanent cessation. That’s because the forces they are fighting against are simply too large ($3 Trillion per day of forex turnover) and too determined (Russian and Brazilian interest rates are both above 8%, compared to 0% in the US) to be stopped. “It’s [intervention] not working, and it’s a good thing that it’s not working. Emerging-market currencies are appreciating and they’re going to keep on appreciating against currencies from the old world. [Central Banks] has to adapt to that,” declared one trader. Still, you can’t blame them for trying.

November 26th, 2009 at 2:59 pm

Great opening, because its true. Karl Marx really would be proud, but i think there-s a way for capitalism to strike back. I think we can take advantage of these volatile times by investing in forex trading. Let me know what you think

-Danielle