November 16th 2010

Euro Correction is Here

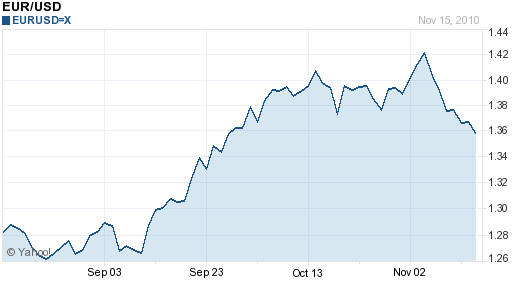

You can think of this as a follow-up to my last post, entitled “Euro Due for a Correction,” in which I proclaimed that “investors got ahead of themselves when they pushed the Euro down 20% over the first half of 2010, but now they are in danger of making the same mistake, and are pushing the Euro too far in the opposite direction.” Since then, the Euro has indeed fallen 4%. In this case, however, I’m reluctant to toot my own horn, since there were other forces at work.

Namely, he sovereign debt crisis has officially spread beyond Greece, and “Contagion is definitely back on the table.” Of chief concern is Ireland, whose banking sector is in serious financial turmoil: “Irish banking losses are estimated at up to 80 billion euros ($109 billion), depending on the forecast used, or 50 percent of the economy. As long as housing prices continue to fall, these losses cannot be capped.” At this point, it’s unlikely that the banks can remain afloat without (additional) government help. The only problem is that the government has already raided its welfare fund, and it is projected that additional support would leave a gaping hole in the budget, equivalent to 32% in GDP. Allowing the banks to fail, meanwhile, would lead to economic losses of 50% of GDP.

Namely, he sovereign debt crisis has officially spread beyond Greece, and “Contagion is definitely back on the table.” Of chief concern is Ireland, whose banking sector is in serious financial turmoil: “Irish banking losses are estimated at up to 80 billion euros ($109 billion), depending on the forecast used, or 50 percent of the economy. As long as housing prices continue to fall, these losses cannot be capped.” At this point, it’s unlikely that the banks can remain afloat without (additional) government help. The only problem is that the government has already raided its welfare fund, and it is projected that additional support would leave a gaping hole in the budget, equivalent to 32% in GDP. Allowing the banks to fail, meanwhile, would lead to economic losses of 50% of GDP.

Portugal and Spain (rounding out the so-called PIGS countries) are also in trouble, with budget deficits of around 9% of GDP. Given that both countries are struggling economically, it is possible that austerity measures and budget cuts could backfire and worsen their respective fiscal situations. Like their Irish counterparts, Portuguese banks remain heavily reliant on access to cheap ECB credit in order to function. Spanish banks, meanwhile are plagued by distressed loans, which account for “5.6 percent of total Spanish bank loans — the highest level since 1996.”

Currently, their governments insist that they can get by without help from the European Commission. To be fair, they have managed both to issue new debt and refinance existing debt without serious difficulty. In addition, Ireland and Portugal have modest reserve funds which could tide them over for close to a year, if need be. The medium-term, however, looks less rosy.

If rising bond yields are any indication, these countries could be in serious trouble. Bond investors are not concerned about an EU bailout, which is seen as inevitable, at least for Ireland. After all, the European Financial Stability Facility that was created in May still has more than $500 Billion left in it. Rather, investors are concerned that they will be asked to take part in the bailout.

Germany, for example, is toughening its stance towards fiscally strained countries, and Angela Merkel has insisted that, “Highly indebted eurozone countries struggling to repay will be forced to restructure their debt in a process of ‘managed insolvency’ and that their creditors will need to take large ‘haircuts.’ ” Up until now, the EU has intimated that will provide a backstop against sovereign default, in order to assuage bond market investors.

This is changing, as German and French politicians insist that they are more beholden to their constituents/taxpayers than they are to their debt-ridden EU brethren. Given that Germany is fiscally sound, it has pretty much nothing to lose (short of a breakup of the Euro) by playing hardball. In fact, it may actually benefit from scaring away investors, since a weaker Euro will strengthen its export sector.

Going forward, it seems safe to say that the Euro correction will continue, as investors continue to reevaluate their exposure to sovereign credit risk. According to the most recent CFTC Commitments of Traders report, “Investors last week slashed their bets in favor of the euro by 40% to a level not seen since early October.” Of course, given that the Dollar is plagued by its own set of problems, it’s unclear whether the EUR/USD will experience serious fluctuations. Against other currencies, however, the Euro will probably decline: “Those who want to go short euro should consider doing it on the crosses.”

November 20th, 2010 at 6:41 am

Great post Adam, it seems the EUR/USD is becoming a bit tricky and punters decide whether the weakness brought about by the PIGS is more significant than the weakness caused by QEv2. I’d expect the Euro zone to assist Ireland sooner rather than later with the EUR/USD following suit.