February 3rd 2011

Despite Recent Rise, Euro Still Looks Weak

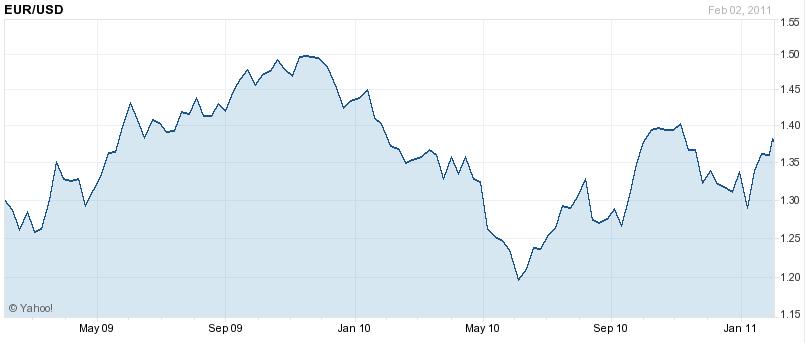

As the Euro moves past $1.38 per Dollar towards a 1-year high, many traders are wondering if perhaps the common currency’s woes aren’t in the past. This would be a mistake. That’s because most of the forces behind the Euro’s rally actually have very little to do with the Euro.

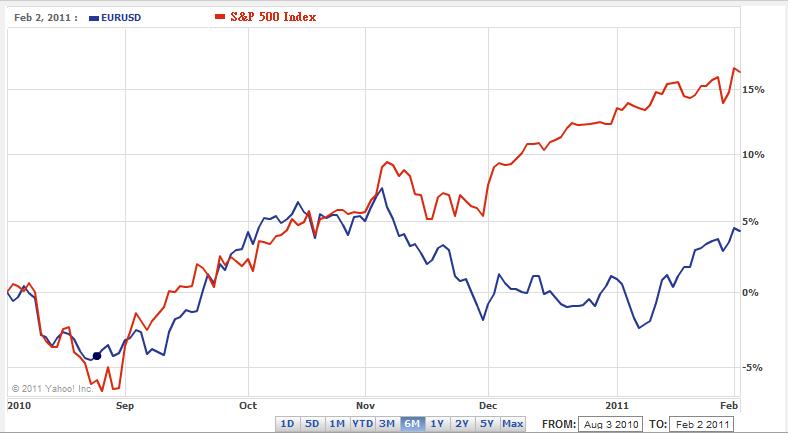

The main cause of Euro strength has been a pickup in risk appetite. Investors are becoming increasingly more confident in the prospects for global economy recovery, and the crisis mentality is rapidly fading. Ironically, the flurry of positive economic data emanating from the US has been terrible for the Dollar. You can see from the chart below that except for a gap in 2010 Q4 (due to a flareup in the EU sovereign debt crisis….more on that below), the US stock market rally has coincided with a shift away from the Dollar and towards the Euro.

In fact, the Euro still remains extremely vulnerable to the ebb and flow of investor risk tolerance. That applies not only to events endogenous tot the EU, but also to global market shocks. That means that any reminder of the Eurozone’s fiscal issues (such as last week’s downgrade of Ireland’s credit rating) is likely to be reflected in a weaker Euro. For another example, look no further than the recent political turmoil in Egypt and the wider Middle East. Summarized one analyst, “In itself, Egypt is not that big an economy. But there is some worry about the supply of oil through the Suez Canal. It does impart a negative vibe on risk.”

The Euro’s recent appreciation is also rooted in technical factors. What began as a modest rally quickly turned into a upward surge as investors moved to cover their short positions. The WSJ reported that “much of the recent rally was fueled by hedge funds and other speculative investors covering short positions…Investors are ‘not going out and buying the euro because they love it.’ ” This apparent short squeeze can be seen in the sudden and massive reversal of positions that was documented in the most recent CFTC Commitment of Traders Report.

On a related note, there are signs that Euro puts (which allow investors to hedge Euro exposure by giving them the right to sell) are unusually cheap at the moment. “Demand for euro puts, which give investors the right to sell the euro in the future, appears to be growing, relative to euro calls, which allow them to buy, analysts say. That reverses a recent trend that had investors actively selling euro puts or sitting on their hands as the euro climbed…[and] suggests investors are becoming more biased towards selling the euro.” If speculators think that the options market is mis-pricing risk, they might start buying up puts and exert downward pressure on the Euro.

The only factor which could be construed as legitimately positive for the Euro pertains to interest rate differentials. Currently, Euro rates are just as low as in the US and the rest of the G4 world. However, that could soon change. The European Central Bank (ECB) is notoriously hawkish when it comes to conducting monetary policy. If you recall, it foolishly raised its benchmark interest rate during the height of the credit crisis. With inflation already running above 2%, you can bet that it will only be a matter of time before it reacts in kind. For the sake of contrast, consider that the Fed is still in the process of easing, via QE2.

While rate hikes would certainly provide a boost for the Euro, it is unlikely that rate differentials will be wide enough to spur any serious among yield-seeker in the immediate future. In short, I think the downside risks to the Euro (which is apparently on the verge of “disintegration,” according to George Soros) far outweigh any further upside support, and I think the rally will peter out soon.

February 3rd, 2011 at 11:21 pm

I think the dollar will weaken against the euro on 04-02-2011 because I’m doing technical analysis shows that the eur / usd has been oversold. I use Ichimoku and MACD

February 5th, 2011 at 1:58 pm

Great article providing an eye opening insight into the mindset of the market. Good work.

February 7th, 2011 at 10:24 pm

Good article thanks Adam. Given that a few weeks back head of ECB Trichet was happy to make “hawkish” comments when the EURO was well under pressure, and then on Feb 3rd seemingly throwing the car into reverse and making “less hawkish” than expected comments when EURO again began to climb, it seems he is happy to “jawbone” in an attempt to attain some stability in the currency. His few timely “less hawkish” comments lowered the cash rate expectations from the ECB, and this saw the EURO soften. With Germany being Europe’s power house exporter, and also the largest contributor to the European Financial Stability Facility, it is easy to see why the head of the ECB would not want the EURO to gain strength too quickly. Overall, agreed, there are still far to many uncertainties globally, to expect that the worst is over for the EURO currency just yet, and we also expect any rally to be not sustained.

February 8th, 2011 at 5:05 am

I tend to agree! The failure of EU leaders to agree a more viable EFSF rescue mechanism at the summit on Friday makes the future of the common currency all the shakier too. Simply put there are too many conflicting interests. The Germans aren’t willing to dilute their credit rating by holding the debt of less solvent EU members, and these less solvent members aren’t willing to sacrifice their fiscal independence. The union is at a standstill!