February 8th 2011

CFTC / NFA Enhance Regulation of Forex

In 2010, the US Commodity Future Trading Commission (CFTC) formally released a series of new regulations governing all retail foreign exchange dealers. Having given all applicable firms almost six months to bring their operations up to speed with the new regulations, the CFTC is now moving to bring enforcement actions against those that are still not in compliance.

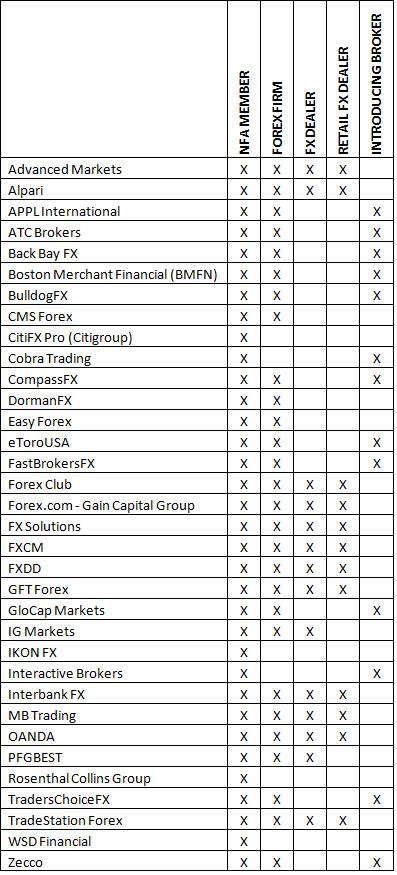

Among other things, the regulations required all retail forex broker-dealers to register accordingly with the National Futures Association (NFA), and for firms that “solicit orders, exercise discretionary trading authority or operate pools with respect to retail forex” to register as introducing brokers. Out of curiosity, I scoured the NFA Background Affiliation Status Information Center (BASIC) to see if/how forex brokers have registered themselves.

As you can see from the table above, there are approximately [I would be grateful if you could inform me of any known omissions!] 28 registered forex firms, and the CFTC recommends that (US) retail forex traders that manage their own accounts should deal with these firms exclusively.

Unfortunately, many firms continue to advertise that themselves as forex brokers when they aren’t registered as such, or even worse, aren’t registered at all. As a result, the CFTC recently filed simultaneous enforcement actions against 14 forex firms, alleging that, “In all but two of the complaints…a defendant acted as an RFED; that is, it offered to take or took the opposite side of a customer’s forex transaction without being registered. In the remaining two complaints, ZtradeFX LLC and FXPRICE, the CFTC alleges that the defendant solicited customers to place forex trades at an RFED without being registered as an Introducing Broker.” The following companies stand accused:

To be a fair, NFA membership doesn’t necessarily imply compliance with NFA regulations, nor does it even guarantee upright behavior. In fact, the NFA is currently scrutinizing all of its member firms “for any signs they are designing computer systems to take advantage of what is known in the industry as ‘slippage,’ or small price movements that happen between the time a customer orders a trade and when that trade is actually executed.” In October, the NFA settled two such cases with IKON FX and Gain Capital, assessing a combined $800,000 in fines. Let’s hope that this isn’t the real explanation for the fact that forex trading is vastly more profitable for brokerages than other types of retail securities trading.

While the NFA hasn’t indicated that this is the case, the current retail forex MO (whereby brokers also act as market-makers) could be under attack. As one advocate for traders told the WSJ, “If a foreign-exchange firm is acting as a market-maker, or taking the other side of a client’s trades, it is doubtful the investor is getting the best possible price.” The problem is at the moment, the industry remains far from transparent, and if not for the NFA investigations, traders probably wouldn’t be able to establish whether their broker(s) acted unscrupulously.

February 8th, 2011 at 9:21 am

not sure how you decided who’s who but IG Markets and PFG are still RFEDs to the best of my knowledge. you can also add dbFX to the list but they as well as Citi answer to the SEC (or FINRA?) so they couldn’t care less about NFA/CFTC

February 9th, 2011 at 10:56 am

PFGBEST does offer retail forex, but we are not RFED. Kindly note, Futures Commission Merchants offering forex transactions to its retail customers but acting primarily or substantially as a traditional FCM are exempt from registering as an RFED but must be approved as a Forex Firm and designated as a Forex Dealer Member of NFA.

Susan O’Meara

Chief Compliance Officer

PFGBEST

February 9th, 2011 at 5:43 pm

Transparency is a real issue concerning forex brokers. A trader needs to trust their broker..

March 30th, 2011 at 7:54 am

Forgot about PFGBEST… You can’t trust anyone these days, but do we have a chance :). I am still with IG, but willing to switch for a while.

December 13th, 2011 at 1:43 pm

dear sir im affected by a online forex broker. i can prove with reasonable e mails .the brokers name was not listed in the top 100 brokers in usa where can i complain this accused and how can i get a relief from this fraud. please guide me. thanks