February 22nd 2011

Chinese Yuan: Further Appreciation is Inevitable

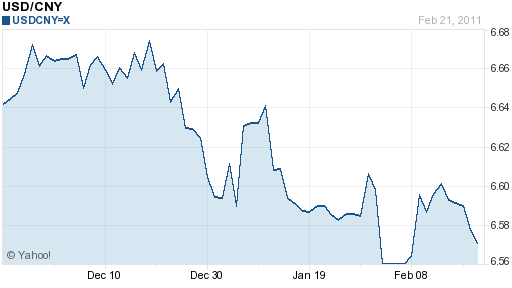

Relatively speaking, the Chinese Yuan has been on a tear, appreciating ~1% in a little more than a month. One has to wonder whether this is a concession by the People’s Bank of China (PBOC) that its exchange rate regime is not viable or whether its instead a political sop. The question on everyone’s minds, of course, is, will it continue?

Countries around the world have continued to criticize China for its unwillingness to allow the Yuan to appreciate. At last week’s G20 meeting, US Treasury Secretary Timothy Geithner and Fed Chairman Ben Bernanke separately took aim. “They’re still heavily leaning against the forces trying to push their currency up,” complained Geithner. “The maintenance of undervalued currencies by some countries has contributed to a pattern of global spending that is unbalanced and unsustainable,” intimated Bernanke.

However, it was only when fellow emerging market economies – namely Brazil – voiced similar concerns, that China was finally forced to concede partial defeat. It signed on to an official G20 communique that declared that exchange rates and current account balances would be used to determine whether a particular country’s policies were contributing to global economic imbalances. Alas, the Communique (and the G20, for that matter) is deliberately vague and unenforceable; it’s more symbolic than anything else.

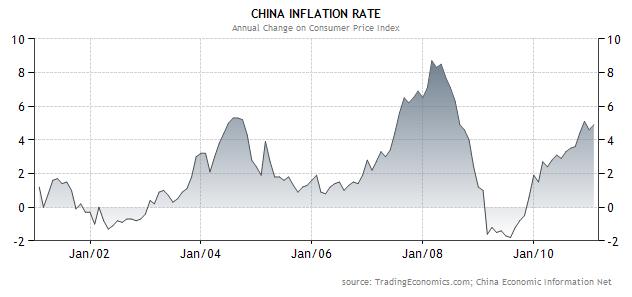

Still, China is not one to take its cues – especially on issues as important as the Yuan – from the international community. That the Yuan is now appreciating at a steady clip (~5% in annualized terms) is almost certainly being driven more by pragmatism than politics. Specifically, it represents the most effective tool to combat inflation, which has already breached 5% and continues to tick higher.

China critics forget that China’s fixed exchange rate regime is not a free lunch. While it almost certainly gives the export sector a competitive advantage, it also deprives the PBOC of the ability to conduct monetary policy and is inherently inflationary. That’s because the policy necessitates soaking up all of the foreign currency that enters the country (hence the ~$3 Trillion in forex reserves) and instead printing new Chinese Yuan and putting into circulation. When you combine a 15% annual increase in the money supply with soaring economic growth, a surge in bank lending, real estate boom, and rising commodity prices, the inevitable result is inflation. The country’s economic officials have responded by tightening credit and raising interest rates, but these will ultimately fail as long as the Fed’s QE2 program continues to send US Dollars into China.

In addition to allowing the Yuan to slowly appreciate, China has also moved to make the Yuan more convertible. This has the dual advantages of making China less reliant on the US Dollar and on relieving upward pressure on the Yuan. More of its trade is being settled directly in Chinese Yuan. Chinese companies are being encouraged to invest outside of China, and foreign companies inside of China are gradually being permitted to issue Yuan-denominated bonds, rather than import Dollars to fund new investments.

It appears that all of these measures are actually starting to have some impact. China’s trade surplus is shrinking. The IMF has suggested that the Chinese Yuan could one day be an international reserve currency and could be a component of its Special Drawing Rights (SDR) currency. Less hot money (distinct from investment inflows) is finding its way into China.

Unfortunately, most analysts are skeptical that it will last. Futures markets reflect a modest 2.5% appreciation against the Dollar over the next 12 months. I’m personally anticipating a rise of 4-5%, though I think it will ultimately be tweaked depending on inflation.

February 28th, 2011 at 7:19 pm

Mr. Kritzer,

Thank you for drawing attention to the fact that “China’s fixed exchange rate regime is not a free lunch”, and that it bears a great financial burden in supporting the US. I believe this is commonly overlooked in the paranoia that the Obama administration is vulnerable to the political influences of China because it has become the largest foreign creditor. Although the Chinese government should not have held off coming off the dollar peg until before the G20 summit, the fact that they are now allowing the renminbi to appreciate indicates significant progress. The terms “currency war” and “competitive devaluation” have been tossed around repeatedly, without anyone fully understanding the pressures on China to support the US financially. If China wasn’t buying the Treasury bonds, someone else would be. Although China’s policy of intervention in foreign markets seems unwelcome, who else could support the our debt and sustain a high growth rate simultaneously? As a country with a substantial unemployment rate due to its ever-expanding population, maintaining a weak currency stimulates the export industry and provides much-needed jobs.

In the long-run, China agrees that it is unhealthy to enable the US to splurge beyond its means, instead of cutting its spending and saving more. Do you believe there is a way that China can slow the flow of dollars into China, under the Fed’s QE2 plan? Americans need to remember that theirs was not the only financial institution that suffered when the crisis occurred, and where the problems originated from. As you mentioned, China is taking measures to become “less reliant on the US dollar and on relieving upward pressure on the yuan”. I would have liked for this statement to be explored in your post, with regards to why Hu Jintao is approving of these monetary policies. The yuan has been appreciating steadily at more than 1 percent per month since September 2010, to the credit of government officials, yet their motives are unclear. The fact is also overlooked that China has been reducing its Treasury holdings, as the American economy shows indications of recovery. How long will China need to continue financing the US, and how will the end of the lending impact both lender and debtor? Overall, I find the topic fascinating, and look forward to seeing how the yuan fares in the following months.