April 23rd 2010

Greece Weighs on the Euro…Still

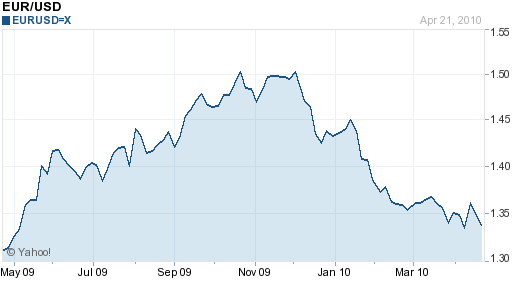

This has really become the story that simply won’t go away. Just when it seemed investors had fully digested the implications of the Greek debt crisis, they once again turned their attention to it and attacked the Euro with renewed vigor. Summarized one analyst, “Fears regarding Greece have been reignited.” As a result, the Euro is already down nearly 10% on the year, and we are barely into the second quarter!

Since I last posted on this issue, there have been a handful of key developments, the most important of which was the approval of an emergency loan packaged. Under the terms of the agreement, the EU will lend €30 Billion to Greece, and the IMF will lend an additional €15 Billion. Both loans will have 3-year terms and 5% coupons. While George Papaconstantinou, Finance Minister of Greece, “insisted that this was ‘not tantamount’ to asking for a bailout,” the markets were of the opposite mindset, which is why the Euro immediately advanced 1.5% when news of the loan package broke on April 12.

Since then, the Euro has cooled, the Greek stock market has dropped, and borrowing costs have surged: “The spread between the government’s 10-year bonds and benchmark German debt [has risen] to 549 basis points, the highest in at least 12 years. Credit- default swaps tied to Greece’s debt jumped 149 basis points to a record 635.” What happened?!

It seems that despite the assurances of Eurozone countries that “parliamentary approval would take ‘one week or two weeks at the maximum’ ” and analysts’ assertions that “Greece is as close to activating the rescue package as one can imagine,” the markets were simply not convinced. Some EU member countries have warned that “new legislation” will be required to lend money to Greece and “a group of German professors are readying a challenge to the rescue plan in Germany’s constitutional court.” In short, until Greece has the money in hand, nothing can be taken for granted. In addition, Greece must refinance €8 Billion in short-term debt that expires on May 19, and investors are skeptical that it can do so at tolerable interest rates, if at all. For example, a US Dollar-denominated bond offering that was projected to bring in $5-10 Billion attracted only $1-4 Billion in institutional interest.

Of course, there is also the concern that even if Greece can raise enough short-term cash to remain solvent, it will once again face trouble in the medium term: “An infusion of cash won’t fix Greece’s long-term problems, and the ‘only choice’ for Greece could be a ‘dramatic economic contraction,’ ” said one expert.Even if default wasn’t previously inevitable, it is quickly becoming self-fulfilling, since investors’ nervousness is leading to higher interest rates (aka borrowing costs), which is making it more difficult for Greece to reduce its budget deficit, which will cause investors to become more nervous, etc etc.

Unsurprisingly, experts have begun to look at alternative scenarios, such as leaving the Euro. The consensus is that it would be mechanically and legally feasible, but economically catastrophic. It would result in massive currency devaluation and economic recession, and wouldn’t even eliminate the sizable chunk of Greek debt that is denominated in foreign currency. In short, it remains a last resort or last resorts, and isn’t even on the table at the moment.

If investors learned anything from the credit/housing crisis, it is that things can quickly go from bad to worse, and they don’t want to have to learn that lesson a second time with Greece and the Euro. In the end, investors will stay away until there is more clarity surrounding Greece’s finances. Until then, betting on the Euro would be an “aggressive call.”