March 31st 2010

Fed Rate Hike Still Distant

Analysts and Fed-watchers have been speculating for almost half a year about the possibility of a Federal Funds Rate (FFR) hike. With each prognostication of a rate hike comes a flurry of market activity, followed by an invariable ebb, as investors accept that the Fed will hold the FFR at 0% until at least its next meeting.

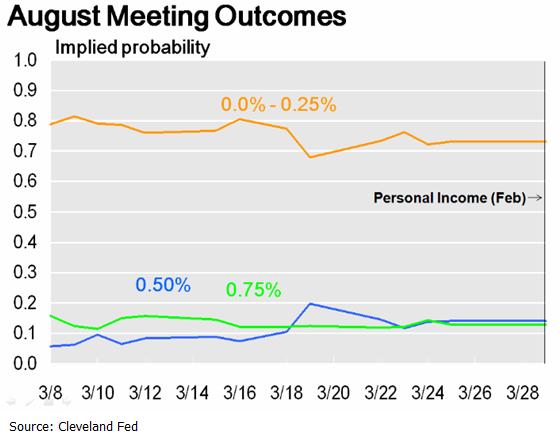

Many traders (forex and other) look to interest rate futures for guidance as to when the Fed will ultimately hike. If you “believe” that futures prices are an accurate predictor, then there is currently a 68% chance that the FFR will rise by 25 basis points at the Fed’s December meeting. Until then, markets are pricing in a very low probability of any rate hikes. Besides, there is very little reason to put any stock in interest rate futures more than a few months away, because uncertainty is high and volume is low. Think about it: if you had looked at interest rate futures in the summer of 2008 (right before the onset of the credit crisis), you would have been anticipating a continued tightening of monetary policy, rather than the torrential loosening that followed the collapse of Lehman Brothers.

In fact, “Researchers at the Federal Reserve Bank of Cleveland said, in 2006, the fed funds futures market isn’t terribly good at predicting actual rate moves more than a few months into the future, even when the Fed is actively adjusting its target.” That being the case, there really isn’t any point in scrutinizing futures contracts that mature after May 2010. With regard to contracts that mature during the next two months, well, you don’t need to monitor futures prices to know that there is very little likelihood that the Fed will hike rates any time soon.

But don’t take my word for it. What do members of the Fed’s Board of Governors have to say about the matter? In his semi-annual testimony before the House of Representatives last week, Chairman Ben Bernanke said that ” ‘the economy continues to require the support of accommodative monetary policies.’ And in response to questions, he reaffirmed that the high level of unemployment and low rate of inflation will continue to justify very low rates ‘for an extended period.’ ”

Janet Yellen, President of the San Francisco Fed, has also insisted that “the U.S. economy still needs ‘extraordinarily low’ rates.” That “Yellen is the Fed’s extended-period language personified” is worth noting, since she is reputed to be President Obama’s pick to serve as vice-Chairman of the Fed. If it isn’t enough that Bernanke is a monetary Dove in the extreme, now he may be joined by Yellen, who will certainly echo his belief in the need for low rates.

Without a doing a further role call of the Fed’s power players, suffice it to say that low rates are in the cards for the near future. You’re probably wondering: Who cares?! With so much else to focus on in currency markets these days (namely the still-evolving EU fiscal crisis), is it really worthwhile to pay close attention to the Fed? The answer is Yes. While long-term interest rates (i.e. those that are most impacted by sovereign debt concerns) weigh heavily on all asset prices, currencies are driven largely by short-term interest rate differentials.

The related phenomena of the Carry Trade, Fisher Effect, Purchasing Power Parity, etc. are all based on short-term interest rates. If the Fed leaves rates low for an extended period as it promises, and/or other Central Banks (Australia, Canada, Brazil) nudge their respective rates higher, it probably won’t bode well for the Dollar. It helps that the Dollar is still ahead of the curve compared to the other majors (EU, UK, Japan) both monetarily and fiscally, which means that the Dollar should fare okay against their currencies. When you put the Dollar head-to-head against some of the smaller currencies, its position is much less favorable, due in no small part to the Fed.

April 1st, 2010 at 3:19 am

I agree with your conclusion and would add that the Euro is at a crossroads heres and plenty of tradingg opportunities exist as it heads down. Whilst the US debt remains, we could see the USD becoming the new carry trade, that would be amusing.