March 26th 2010

Swiss Franc Surges to Record High: Where was the SNB?

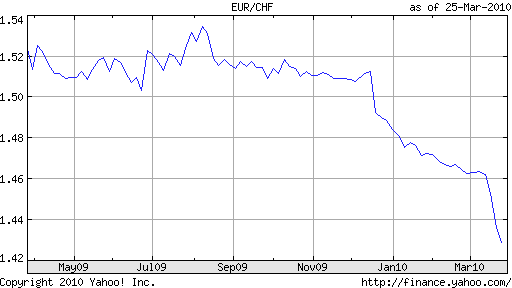

One of the clear victors of the Greek sovereign debt crisis has been the Swiss Franc, which has risen 5% against the Euro over the last quarter en route to a record high. 5% may not sound like much until you consider that the Franc had hovered around the €1.50 for most of 2009. Every time it budged from that mark, the Swiss National Bank (SNB) moved swiftly to return the Franc to its “resting spot.” So where was the SNB this time around?

Beginning last March, the SNB was an active player in forex markets: “Quarterly figures indicate the central bank spent some 4 billion euros worth of francs in March, 12 billion in the second quarter, some 700 million euros in the third quarter, and some 4 billion in the fourth.” In fact, the SNB might still be intervening, and it won’t be until 2010 Q1 data is released that we will be able to say for sure. The Franc’s rise has certainly been steep, but who’s to stay that it couldn’t have been even steeper. For comparative purposes, consider that the US Dollar has risen more than 10% against the Euro over this same time period.

But the fact remains that the “line in the sand” was broken and the Swiss Franc touched an all-time high of €1.43. According to SNB Chairman Philipp Hildebrand, “We have a broad range of means to prevent an excessive appreciation and we are going to do this to ensure that the recovery can continue. The instruments are clear: We buy foreign currencies. We can do that in very large quantities.” In other words, he is sticking to the official line, that the SNB forex policy has not yet been abandoned. On the other hand, “SNB directorate member Jean-Pierre Danthine said Swiss companies and households should prepare for a market-driven exchange rate some time in the future.”

Actually, I don’t think these two statements are necessarily contradictory. The Franc is rising against the Euro for reasons that have less to do with the Franc and more to do with the Euro. At this point, if the SNB continued to stick to its line in the sand, it would look almost illogical, especially since by some measures, the Swiss Franc is already the world’s most manipulated currency. Besides, by all accounts, the interventionist policy has been a smashing success. The forex markets were cowed into submission for almost a year, which prevented the Swiss economy from contracting more and probably paved the way for recovery. 2009 GDP growth is estimated at -1.5% with 2010 growth projected at 1.5%.

By its own admission, the SNB did not target currency intervention as an end in itself. “If you want to assess the success, then you should not only look at a certain exchange rate, but look at the success of the Swiss economy.” Rather, its goal was monetary in nature. Since, it cut rates to nil very early on, the only other way it could tighten is by holding down the value of the Franc. Along these lines, the SNB will continue to use the Franc as a proxy for conducting monetary policy: “An excessive appreciation is if deflation risks were to materialise. We will not allow this to happen.”

Going forward then, it seems the Franc will continue to appreciate. “I think the marketwill cautiously continue to sell the euro against the Swiss franc and perhaps see whether the SNB will step in and try and stop the Swiss franc strength,” said one analyst. As long as the Swiss economy continues to expand and deflation remains at bay, there is little reason for the SNB to continue. Besides, intervention is not cheap, as the SNB’s forex reserves grew by more than 100% in 2009. On the other hand, the SNB has probably intervened in forex markets on 100 separate occasions over the last two decades, which means that it won’t be shy about stepping back in if need be.

March 26th, 2010 at 4:02 pm

[…] Adam Kritzer asks where was the SNB in the last moves of the Swiss Franc, especially against the Euro. […]

March 29th, 2010 at 3:50 am

Great insight – thank you. I was to busy focusing on the majors to really see the opportunities arising on the still present Swiss Franc an other European currencies. An eye opener thanks for that man.