March 18th 2010

EU Debt Crisis: Perception is Reality

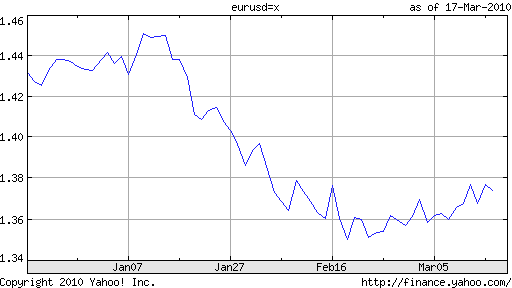

I wonder if I wasn’t a little glib in my last post (Dollar Returns to Favor as World’s Reserve Currency)when I implied that the Euro would necessarily continue falling because of ongoing sovereign risk crises. In actuality, the situation is much more nuanced, and I want to qualify this idea below.

As I’ve said before, the sudden sovereign debt crisis in Greece is one of many. While its fiscal problems are certainly serious, they are not markedly worse than those of other countries, and it’s somewhat hard to understand why the markets suddenly decided to gang up on Greece. As many analysts have been quick to point out, Portugal, Ireland and Spain are in equally bad shape. Perhaps, it is the unique combination of factors which has led investors to focus on Greece in particular: “Greece stands out for the size of its debt stock, the scale of its budget deficit and the grimness of its growth prospects given high domestic costs and an inability to devalue.” But again, this inability to devalue its debt is shared by every other member of the EU. By virtue of belonging to the Euro, all of these countries must face their debt problems as they are, and cannot attempt to alleviate them through currency depreciation.

It is for this reason that I think that the EU will continue to be the main loser from real (and perceived) debt crises. As you can see from the table below, of the ten countries whose debt positions are least sustainable, seven of them are current members of the EU. This is problematic for the Euro, because as far as currency markets are concerned, one country’s problem is automatically a pan-EU problem.

If you look again at the Greek debt crisis specifically, there are really only three possible outcomes: “one of the most excruciating fiscal squeezes in modern European history – reducing the deficit from 13 per cent to 3 per cent of gross domestic product within just three years; outright default on all or part of the Greek government’s debt; or (most likely, as signalled by German officials on Wednesday) some kind of bail-out led by Berlin.” While such a bailout would temporarily stabilize the crisis, it would set a dangerous precedent in terms of dealing with fiscal crises in other EU countries and would do nothing to solve Greece’s underlying structural problems. Only under the first outcome, then, would the Euro not suffer, and unfortunately this one seems least likely.

Of course, the ultimate resolution of the crisis is still many years away. For now, currency traders are perhaps less interested in whether Greece will get its fiscal house in order and/or receive an EU bailout, and more concerned with how perceptions of the crisis will evolve. Recently, many investors have been taking their cues from the market for credit default swaps (CDS), which functions as insurance against and can be used to gauge the likelihood of sovereign default. In the case of Greece, CDS premiums have been rising (now implying a 4%+ chance of default), even though demand for Greek bond issuances remain strong at moderate interest rates. This discrepancy can best be explained by the presence of speculators, which are also working to push the Euro down.

Interestingly, the EU is currently mulling a ban on speculative (naked) CDS purchases, which would theoretically lead to lower CDS premiums and in turn, assuage other investors that the likelihood of a Greek default is low. On the face of things, this would probably – investment and lending in the EU, as sovereign risk would be less of an issue. However, there is still the possibility that speculators would continue to push down the Euro, for lack of a better strategy. In fact, they could even redouble their short bets against the Euro, since the CDS ban would deprive them of a valuable strategy for betting directly against Greece. (In fact, CDS speculation, while leading to higher interest rates and making it more difficult for Greece to finance its deficit, actually has no direct effect on the Euro, since it doesn’t necessitate a cross-border transaction).

Alas, then, it’s actually hard to predict (as always!) the near-term direction of the Euro. Since the crisis is still more perceived than actual, it’s clear that the Euro decline is a product of speculation and uncertainty, neither of which will disappear anytime soon. The best hope, then, for the Euro is probably just that investors will simply get bored with the story – as they eventually always do – and turn their attention to something else.

March 19th, 2010 at 5:01 pm

[…] Adam Kritzer analyzes the EU debt crisis in an interesting way. As expected, EUR/USD went up only to plunge. […]

March 24th, 2010 at 3:38 am

[…] around, however, the problems are deeper, and are economic rather than political. Last week [EU Debt Crisis: Perception is Reality], I wrote that Greece only has three possible choices in dealing with its fiscal problems: clean up […]

April 1st, 2010 at 5:08 am

[…] and several other Eurozone countries are on the periphery. I addressed the EU in a previous post (EU Debt Crisis: Perception is Reality), so I think it makes sense to focus on the others […]