April 8th 2010

Volatility, Carry, Risk, and the Forex Markets

Upon reviewing my previous post on the Brazilian Real (BRL), I now realize that it lacked context. In other words, while both the interest rate outlook and economic prospects of Brazil are both incredibly bright, who’s to say that this hasn’t already been priced into the Real? At the very least, more information is needed to determine whether the Real is valued fairly on an historical and/or relative basis. [Alas, the focus of this post isn’t on the Real specifically, but on the forex markets in general. Still, the concepts that will form the backbone of this post – volatility, risk, and carry – can be seen clearly through the prism of the Real.]

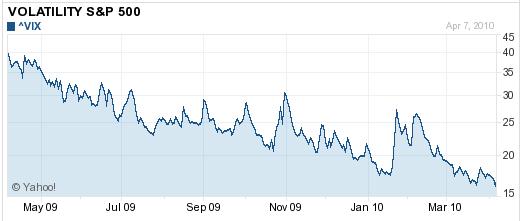

This doubt was sparked by an article that I read recently, entitled “Markets ‘Not Pricing’ Potential Risks,” which explored the idea that the renewed appetite for risk and consequent run-up in asset prices and re-allocation of capital is naively optimistic: ” ‘The unique environment we’re in now revolves around unprecedented level of government involvement in markets, which creates this complacency over risk because of this belief that governments will fix everything.’ Markets are under-pricing the risk that nations such as Dubai and Greece may default, and excess borrowing by others could lead to inflation.” From a financial standpoint, the practical implications of this idea is that the markets are underpricing risk.

In forex markets, complacency towards risk has manifested itself in the form of decreasing volatility. When you look at the 435 most commonly-traded currency pairs (actually most currency pairs involving the 35 most popular currencies), volatility is increasing for only nine of them. In addition, one month-volatility is now below 15% for all (widely-traded) currency pairs, which means that based on the most recent data, the highest, annualized standard deviation percentage change for every currency pair is only 15%. [It’s difficult to translate that concept into plain-English, but the basic idea is that all currencies are (actually, only 68% of the time) currently fluctuating by less than 15% from the mean on an annualized basis. The idea of standard deviation is murky for non-mathematicians, so it’s probably more useful to look at it on a relative and historical basis, rather than in absolute terms. In other words, the 15% figure can not be explained very well in an of itself; one must see how it compares to other currency pairs and to other time periods].

The fact that volatility is currently low suggests that the carry trade, for example, is set to become increasingly viable, especially when you factor in upcoming interest rate hikes. On the other hand, real interest rate differentials are currently modest (from a historical standpoint), and the concern is that rate hikes could be accompanied by rising volatility. The Brazilian Real, for example, “has a risk-adjusted carry of 45 percent, based on Morgan Stanley estimates, which means its carry rates had been better than current levels 55 percent of the time the last five years.” When you look at conditions from a few years ago, when volatility was at record low levels and interest rate differentials were larger than historically average, it’s obvious that the hey-day for the carry trade was in the past. It may come again in the future, but it certainly isn’t now.

From a practical standpoint, if you’re thinking about getting involved in the carry trade, you’ll want to choose a currency pair where the real (after adjusting for inflation) interest rate differential is high and volatility is low. You can cross-reference interest differentials with these charts – which uses recent mean return and volatility as the basis for forecasting confidence intervals – to get an idea about which pairs offer the best value (i.e. higher rate differentials at lower volatility). Just be aware that a sudden upswing in volatility could put a big dent in your risk-adjusted returns.

April 14th, 2010 at 5:11 am

[…] I pointed out in last Friday’s post (Volatility, Carry, Risk, and the Forex Markets), volatility has been declining in forex markets since peaking after the collapse of Lehman […]