April 21st 2010

Canadian Dollar and Parity

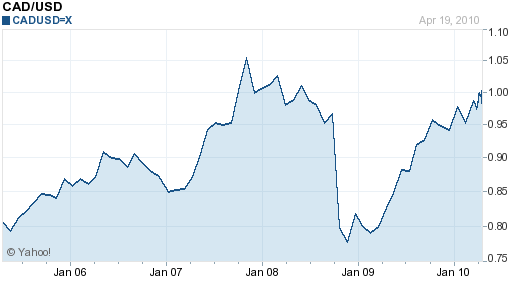

The Canadian Dollar’s performance of late has been eerily redolent of its sudden rise in 2007, when propelled by nothing more than sheer momentum, it rose 20% against the Dollar and breached the parity mark (1:1) en route to a 30-year high. [Of course, we all remember what happened next: the credit crisis struck, and the Loonie plummeted even faster than it had risen].

Last week, the Canadian Dollar breached parity again, and after a brief retreat, it touched parity again today. On the one hand, this latest rise was simply a matter of making up for the ground lost in 2008, when risk-averse investors shifted capital en masse to the US. On the other hand, Canadian fundamentals are fairly strong, and that the Loonie is once again at parity is deservedly so.

Last week’s jobs report was pretty solid, but the Canadian unemployment rate is still high, at 8.2%, mirroring the “jobless recovery” phenomenon in the US. According to the Bank of Canada’s own estimates, GDP growth is projected at a healthy 3.7% for 2010, thanks to a strong recovery in oil and commodity prices. As a result, the Bank of Canada has finally given the indication that it is ready to hike interest rates, perhaps as soon as July. After concluding its monthly meeting yesterday, it noted, “With recent improvements in the economic outlook, the need for such extraordinary policy is now passing, and it is appropriate to begin to lessen the degree of monetary stimulus.”

On the other hand, one has to wonder how long the momentum in the Canadian Dollar can continue. While Canada’s economic recovery has indeed been strong, it is no more impressive than the recovery in the US. (In fact, it should be noted that the two economies remain deeply intertwined). In addition, the (Canadian) economy is already expected to slow down slightly in 2011 (3.1%), and slow further in 2012 (1.7%), which makes me wonder whether the Bank of Canada will have to tighten slightly in order to achieve its inflation objectives. Moreover, while the BOC will probably hike rates slightly before the Fed, the arc of monetary policy followed by the two Central Banks will probably be pretty similar for the next few years, regardless of what happens. This means that interest rate differentials between the two economies should remain pretty close to the current level (near 0%), and won’t expand enough to make a CAD/USD carry trading strategy viable.

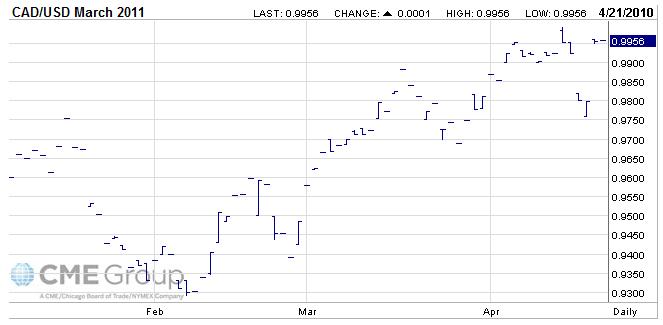

It seems the futures markets concur, as the Canadian Dollar is projected to hover around parity with the USD for the bulk of the next 12 months. Granted, futures prices have pretty closely mirrored the Canadian Dollar’s performance in the spot market, but the point is that investors seem to expect the CAD/USD exchange rate to settle down for a while.

Remarked one analyst, “The Canadian dollar parity party is in full swing, however further Canadian gains will be at a much slower pace as the existing long Canadian positions get trimmed on profit taking in the absence of new bullish Canadian catalysts.” Incidentally, this is exactly what the Bank of Canada wants, and spent the better part of 2009 trying to convey to forex markets. If the Loonie were to rise further, it could threaten the economic recovery, and at the very least, the BOC would proba1bly hold off on hiking rates.

In the end, 1:1 does seem like a reasonable exchange rate. I haven’t seen any economic models that argue one way or the other, but it certainly makes sense from the standpoint of convenience and market psychology. Barring any unforeseen developments, I don’t see it fluctuating very much in the short-term, one way or the other.

April 28th, 2010 at 1:47 pm

Hi,

why do you speak of the futures market “projecting” or forecasting an exchange rate?

Isn´t future´s pricing based on a simple arbitrage relationship involving interest rate differentials?

What I mean is, it seems as though you speak of futures conveying a certain market expectation. Is this valid?

Thanks

Marcus