August 6th 2009

Bank of Israel Steps up Intervention on Shekel

Over the last year, Israel has quietly amassed one of the world’s largest repositories of foreign exchange reserves. On average, the Central Bank of Israel has purchased $100 million worth of Dollars every day since July 2008, bringing its total reserves to $52 Billion. The Bank’s goals are twofold: to sterilize the inflow of speculative money pouring into Israel in order to mitigate inflation, and to stem the appreciation of the Shekel.

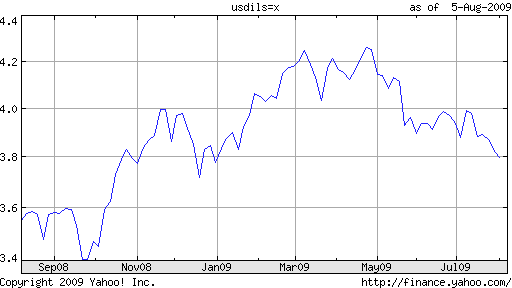

Towards this latter, the Bank received a boost by the credit crisis, which caused an outbreak of risk aversion and sent investors rushing to shift funds into so-called safe haven countries/currencies. As a result, the Israeli stock market tanked, and the Shekel plummeted 30% in a matter of months.

Thanks to the recent upswing in risk appetite, however, the Shekel has bounced back, having risen 10% since April. While the Shekel still remains well off its its 2008 highs, the sudden rise still elicited the attention of the Bank of Israel, which announced that it would respond to the, “Unusual movements in the exchange rate that are inconsistent with underlying economic conditions, or when conditions in the foreign exchange market are disorderly,” by intervening heavily in the open market. It “is believed to have purchased between $1.5-1.7 billion this week so far.”

The Bank has also taken steps to inadvertently degrade its currency by lowering its benchmark interest rate to .5%, and buying bonds on the open market. “The central bank will have bought a total of 18 billion shekels ($4.7 billion) of bonds when it completes the program….The bank said in its statement that it does not intend to sell the securities it purchased and will continue buying foreign currency.” While its unclear whether the program has succeeded in stimulating the economy – which contracted by 3.7% last quarter – it has provoked inflation, which is still running in excess of 3% per year.

The forex markets have taken notice of both developments, sending the Shekel down 4% since Monday. Still, it’s not clear whether the Bank of Israel has any real credibility with traders. By its own admission, its intervention program is temporary: “It is clear that we won’t carry on buying foreign currency forever. Everybody understands that the central bank can’t beat the market, but sometimes the market does things that are not justified.”

Analysts, meanwhile, insist that the Shekel’s appreciation is not unusual, and that the intervention runs counter to fundamentals. “[The] market pressures strengthening the shekel against the dollar, are, in fact, consistent with underlying economic conditions. Fundamental economic conditions favoring the revaluation of the shekel include the accumulation of a balance of payments credit of $4.3 billion over the past thee quarters.” These analysts, then, are more concerned about rising inflation then about the competitiveness of Israeli exports.

Barclays, an investment bank, evidently subscribes to this school of though, and predicts the Shekel “will increase 2% after breaching their so-called resistance levels.” Merrill Lynch, meanwhile, sees the Shekel appreciating an additional 10% over the next year.

November 5th, 2009 at 4:39 pm

i am Israeli that left my country of birth . i went to give to the world the true Israel that in my case isn’t nice . that other people will know what is Israel and what can happen to them . you buy property in Israel and most of the property run by government agency. call menhal mkarkae israel . they tax to death . just to start to build the ask us 200.000$ after we won “lottery ” and pay 12.000$ in place called mosav mazor my birth place. Israel is communist socialist country as (usa partly ). if you ask me Israel is country of thieves and crock that tax are high. they steal everything legally. when we try to sell. we couldn’t sell this land eventually the government and the community stole at. the problem that we face and lost 20.000$ in 1992 . is not only in israel. all over the world government steal people money and the court do nothing in many cases the judge fool by people or dont care at all. in my opnion the fraud start with the crap called bible “new testament” and “old testament” suppose is come from “god ” yes i know to many fooled by this brain wash. but in my case i went to say to anyone that thinking to invest in israel dont go there. or any jews in the right mind to immigrate to israel they bunch of thieves and crock. i write this post with sadness. but i know in my heart that other places is worth and all the government steal people money. i also in future will tackle the crime of religious all of them greenfeld meir