August 15th 2009

Brazil Real Edging Up, Despite Efforts of Central Bank

The Brazilian Real has been one of the world’s best performers in 2009, having risen by a solid 25%. The currency is now close to pre-credit crisis levels, and is even closing in on an 11-year high. When you consider that only six months ago, most analysts were painting doomsday scenarios and predicting currency devaluations and bond defaults for the entire continent, this is pretty incredible!

The currency’s rise has been supported by a variety of factors, few of which are grounded in fundamentals. To begin with, while Brazil has staved off depression, it’s not as if the economy is firmly back on solid footing. The economy contracted by 5% in the first quarter, and forecasts for 2009 GDP growth still vary widely, from a slight contraction to modest expansion. Meanwhile, the economy is importing more than it exports, despite the rebound in commodity prices. “The central bank said the net trade result was based on $9.89 billion in receipts for exports and $12.72 billion in import payments overseas.”

“Investment inflows, meanwhile, totaled $33.88 billion, while outflows totaled $29.78 billion.” The disparity between investment and trade data goes a long way towards explaining the Real’s rise. Thanks to a recovery in risk appetite, foreigners have poured cash into Brazil at an even faster rate than they once removed it. As a result, Brazil’s “Bovespa stock index has risen 51 percent this year, the world’s 12th-best performer among 89 measures tracked by Bloomberg, as foreign investors moved 13.7 billion reais into the market through July, the most since the exchange began tracking data in 1993. Brazilian local bonds returned 37 percent in dollar terms after falling 13.8 percent in 2008.” The country’s foreign exchange reserves also just set a new record, surging past the $200 Billion mark.

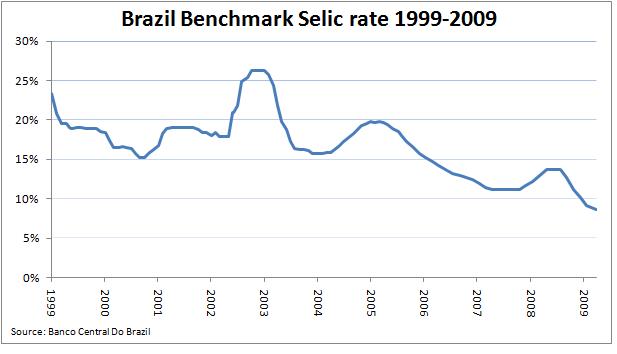

Brazilian interest rates tell the rest of the story. Despite a gradual decline over the last decade (made possible by a moderation in inflation), Brazil’s benchmark SELIC rate stands at a healthy 8.65%, which is the highest in South America, after Argentina. Unlike Argentina – and the dozen or so other economies around the world that boast equally lofty interest rates – Brazil is perceived as relatively safe place to invest. Given interest rate levels in the western world, combined with the expectation that Brazil’s currency will appreciate further, investors are more than happy to accept a little bit of risk in order to earn an out-sized return.

Just like the Bank of Korea, Bank of England (both profiled by the Forex Blog in the last week), the Bank of Brazil is not happy with the resilience in its currency. “Brazil’s central bank said on Wednesday it bought $779 million on the spot foreign exchange market this month to Aug. 7 as dollar inflows to the country surged because of growing demand for local stocks and bonds.” This brings the total intervention expenditure to $9 Billion.

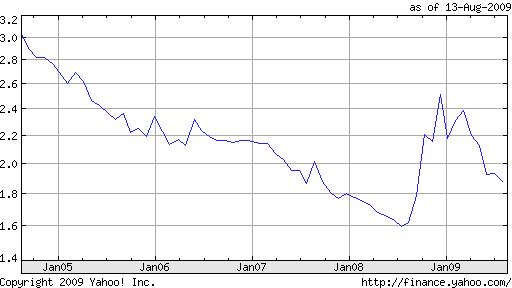

Unfortunately for the Bank of Brazil, the forces in the forex market are way beyond its control. “Dollar inflows to the country totaled $2.26 billion this month to Aug. 7, compared with inflows of $1.27 billion in all of July.” Analysts are also unconvinced, and are racing to revise their Real forecasts upward. One economist, caught completely off guard, just “changed his year-end real forecast to 1.8 from 2.5 at the start of the year. ‘The resilience of the Brazilian economy to weather this crisis has been spectacular,’ ” he explained.