July 30th 2009

Eastern European Currencies Recover, but Risks Remain

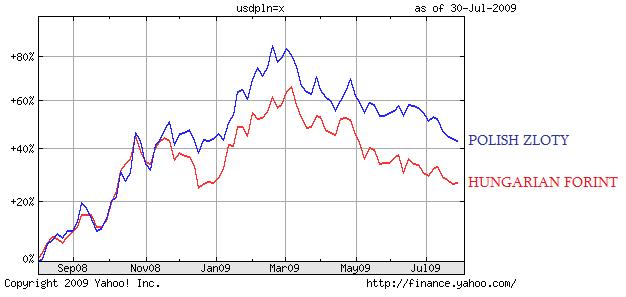

Emerging market currencies have soared over the last few months, thanks to a commensurate recovery in investor risk appetite. This trend is on full display in Eastern Europe, where, “The Hungarian currency, which has dropped 14 percent in the past year, has been the best performer in the past three months of the 26 emerging-market units tracked Bloomberg, having advanced 10 percent.” The Polish Zloty, meanwhile, can claim the distinction of best performer against the Euro, having risen 6% in the last month alone. [The chart below, which plots both currencies against the USD, is inverted].

This marks a stunning reversal for these currencies, both of which had fallen by over 40% over the previous six months. Explains one analyst, Poland “is back in favor after Prime Minister Donald Tusk pledged to support the zloty, the International Monetary Fund provided a $20.6 billion flexible credit line and the country posted the only positive quarterly growth rate among the EU’s 10 eastern members.”

As a result, investors are now pouring money into Poland at an even faster rate than they were extracting it during the height of the credit crisis hysteria. “Foreign investors poured 2.6 billion euros ($3.7 billion) into Polish bonds and stocks in April and May,” driving share prices up and risk premiums down. Incredibly, Polish assets still remain cheap by most valuation metrics. meanwhile, its currency has yet to erase the gap with its Eastern European counterparts that was opened last fall, and “Brown Brothers Harriman recommends buying the zloty for gains of 7.4 percent by yearend to 69.3 against Hungary’s forint and of 3.4 percent to 6.33 per Czech koruna.”

Speaking of Hungary, it is projected for “Gross domestic product to drop 6.7 percent this year, the most since 1991. Hungary, along with other emerging economies across Europe, has been hurt by a collapse in demand for its exports including Nokia phones and Audi cars. ‘The Hungarian economy is unlikely to recover from the current recession much before 2011.” The Central Bank recently moved to cut interest rates by a whopping 1%, and may cut rates by a further 2.5% before the year is out. Investors, evidently, are indifferent to this prospect, and continue to push Hungarian stocks, bonds, and currency back towards the levels of the bubble years.

This disconnect between economic fundamentals and asset prices seems to be playing out throughout the EU. On one front, “Bulgaria and the Baltic states of Latvia, Estonia and Lithuania, also EU members, have had to resist pressure to devalue their currencies as eastern Europe’s recession takes its toll.” According to another source, “Nonperforming loans are rising across the EBRD countries and have doubled in the past year in Turkey, Romania, Ukraine and Albania, according to the EBRD. Recent data from national central banks show commercial banks in Romania are no longer collecting interest on more than 8% of the loans they’ve extended, and the figure is nearing 5% in Turkey, where credit cards are already defaulting at a double-digit pace.” At the same time, the Dow Jones Eastern Europe Stock Index just touched a 10-month high. Go figure.