December 2nd 2009

Debunking the Myth: The Dollar and the Deficit

Last week, I opined on the official US forex policy (“Strong Dollar” Policy is a Joke). Most of my analysis was directed towards the lackluster efforts of US policymakers in failing to execute this policy, and I paid short shrift to the policy itself. With this post, then, I would like to address whether a Strong Dollar is, on balance, actually good for the US economy, specifically as it bears on the balance of trade.

Dean Baker, of the American Prospect, in a post germane to this discussion, wrote that “Folks who took econ 101 know that currency fluctuations are the mechanism through which trade imbalances adjust.” Unfortunately, as anyone who follows the forex markets no doubt understands, reality is much more complicated. As the WSJ reported, US exports skyrocketed during the last decade when the Dollar was falling. Case closed, right? However, exports also rose during the 1990’s, when the Dollar was in fact rising. This contradiction should make make anyone think twice before assuming a cut-and-dried relationship between the Dollar and exports think twice.

While exchange rates certainly correlate with export volume, there are a few confounding variables. Fist is the lag time between fluctuations in exchange rates and corresponding changes in exports. That’s because the majority of international trade is conducted by large companies and because global supply chains are not completely fluid. In other words, if the Dollar collapses tomorrow, it will take years before companies can fully modify their sourcing arrangements accordingly.

In addition, it is mainly on non-durable goods that companies have relative flexibility on choosing sourcing locations. In this age of ODM and OEM, it’s not difficult for Nike to shift production to Vietnam if the Chinese Yuan is suddenly revalued. On the other hand, it is significantly more complicated to move an automobile manufacturing plant or oil refinery. Investments in production facilities for durable goods are made on a long-term basis, then, and aren’t responsive to short-term changes in exchange rates. If you look at the breakdown of US exports, it is heavily concentrated in services and high-tech products, many of which it’s not (yet) practical to outsource.

For goods and services that are low-skilled labor-intensive, it’s obviously cost-effective to produce them overseas, because wages are lower. This is not a product of exchange rates, but rather to disparities in standards of living and levels of development. In China (where I am based), factory wages rarely exceed 8RMB per Dollar (about $1.25 at current exchange rates). Conservatively, that’s probably less than 1/20th of US counterpart wages, when you look at salary and benefits. That’s why the weak Dollar hasn’t done much to dent US demand for imports. Personally, I don’t expect to see the RMB rise 1500% in the next few years to erase this discrepancy, which means that’s unrealistic to ever expect the US Dollar to depreciate enough to ever make the US competitive enough in certain export categories.

Obviously, the inverse is true for imports. From the perspective of the US, the shifting of non-durable goods production outside the US represents a permanent structural changes in the US economy. Regardless of how low the Dollar sinks, it’s not reasonable to assume that the US will once again become the hotbed of low-tech manufacturing activity that it once was.

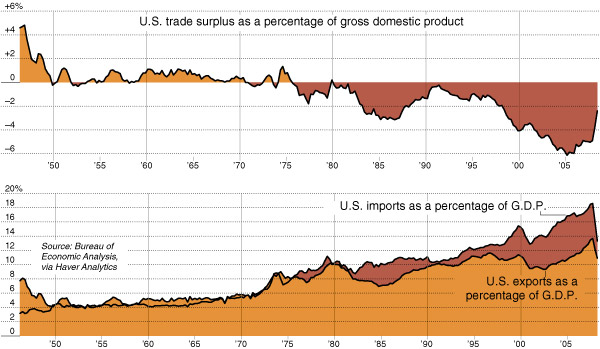

Overall, exports have actually risen steadily over the last decade (and the last 50 years, on average); the problem is that imports have risen even faster. In fact, ebbs and flows in the trade deficit can be better explained by global economic cycle than by short-term fluctuations in exchange rates. Despite the weak Dollar, the US trade deficit has exploded over the last decade because of a comparable explosion in US consumption, which was made possible by cheap credit. When that cycle came to an abrupt end in 2008, the trade deficit narrowed dramatically, despite the rise in the Dollar that took place simultaneously.

Given that the US has basically committed itself to importing certain goods, a Strong Dollar is actually beneficial, because it reduces the cost of those imports. In the short-run, then, a 20% decline in the Dollar might be expected to correlate with a 20% rise in the trade deficit. The hope is that this can be offset over the long-term, with the relocation of production facilities (yes, foreign companies also outsource to the US; it’s a not a one-way exodus) to the US and the creation of new products/services that can fill the void of those that have already been outsourced.

In short, it’s not clear that a weak Dollar will dramatically improve the US trade imbalance. This can best be accomplished not through a weak exchange rate, but through incentives that stimulate innovation and discourage consumption of low-quality, non-durable goods, the majority of which are produced overseas. When you consider the inflation (Strong Dollar keeps prices in check) and financing (Strong Dollar increases the willingness of foreigners to invest in and lend to US entities) perks, the Strong Dollar probably provides a net benefit to the US economy. If Bernanke and Geithner actually believe this, it would be nice if they conducted policy accordingly.

December 3rd, 2009 at 4:32 am

Nice article although I do not believe that financial “terrorists” as Geithner, Bernanke and Larry Summers are very interested in a high US$. All they look for is a much lower US$ with a hyper inflation. This will make it much easier to repay the multi trillion debt, if ever repayable. I doubt sincerely whether the afore mentioned men have any other interest than destroy the US economy, destroy the US$ with it and introduce a replacement of the US$. I do not want to deviate too much from the content of your article but do believe that my comment is very actual under current circumstances.

December 3rd, 2009 at 4:10 pm

Im pretty sure the dollar decided to give its best performace vs. the yen in six weeks the other day. Dont give up on the dollar just yet, there’s still power there.

-danielle

December 4th, 2009 at 7:27 pm

[…] Adam Kritzer debunks the myth about the US dollar and the deficit. This is a follow up to a post that debunked the “strong dollar” policy. […]