July 15th 2009

Summer Could Provide a Boost to the Dollar

There is a pattern in the following smattering of forex soundbites: “It feels like we’re already in the summer doldrums;” “[We] are moving into summer trading;” “We are in a summer period.” From three different analysts, three identical conclusions- summer has arrived. Granted, summer officially began on June 21, but given all that’s transpired since last summer, I think we can excuse investors from delaying their summer vacations this time around by a few weeks, until the kickoff of second quarter earnings season.

Summer usually means a couple things for the financial markets: less liquidity/volume and less fluctuations. The decline in volume is largely self-explanatory, due to what can best be summarized as more play and less work. The decline in volatility is due to a different, but related cause, which is a delay in important investment decisions until the fall, when traders return to their desks and resume monitoring the markets full-time. Both phenomena tend to cause asset prices to move sideways.

This is especially true for forex markets. “Traders noted major currency pairs remain largely range-bound…Markets for now are hung up by uncertainty over the shape of any future economic recovery, he said. Economic data at this point ‘can be spun either way,’ likely leaving currency markets next week to key off of any earnings surprises from U.S. companies,” observed one analyst. As far as the decline in volume is concerned, “Emerging markets are becoming particularly volatile as liquidity declines over the summer period,” and “Bid-offer spreads are quite wide.”

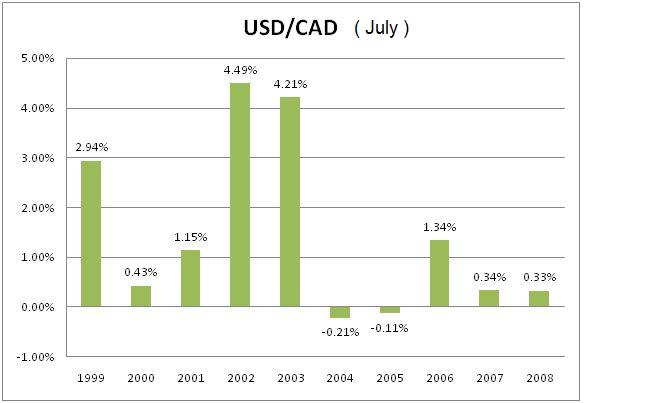

Kathy Lien, of Forex 360, has observed another summer trend: “Over the past 10 years, the Canadian, Australian and New Zealand dollars have seen their steepest slides in the month of July. In addition, we have seen the U.S. dollar outperform the Canadian and New Zealand dollars 8 out of the past 10 years during this month.” This could be a byproduct of delayed allocation, as investors shift capital out of risky markets/positions/currencies. The lesson might be to stick to the majors.

Based on all current indications, this summer will be no exception to this rule. While investors have certainly grown more complacent about risk over the last few months, there is a lingering uncertainty. “Economic data at this point ‘can be spun either way,’ likely leaving currency markets next week to key off of any earnings surprises from U.S. companies.” Even with across-the-board positive earnings results, investors will likely remain wary and could hold off on taking any risky (overseas) positions until the fall.