May 12th 2009

Inflation or Stimulus: An In-depth Look At the Fed’s Response to the Credit Crisis

These days, The Federal Reserve Bank seems to have very few supporters. A recent poll showed that “Twenty-six percent of Americans said they were ‘a lot less’ confident in the Fed…now than five years ago.” Some people think the Fed is doing too much in responding to the economic downturn, others accuse it of doing too little, and everyone agrees the Fed is culpable for lax regulatory efforts under Alan Greenspan. One of the biggest criticisms being levied at the Fed is that its current policies are sure to generate massive inflation in the medium-term, as a result of the massive liquidity being pumped into the financial system now. In this post, I will attempt to provide some clarity on this aspect.

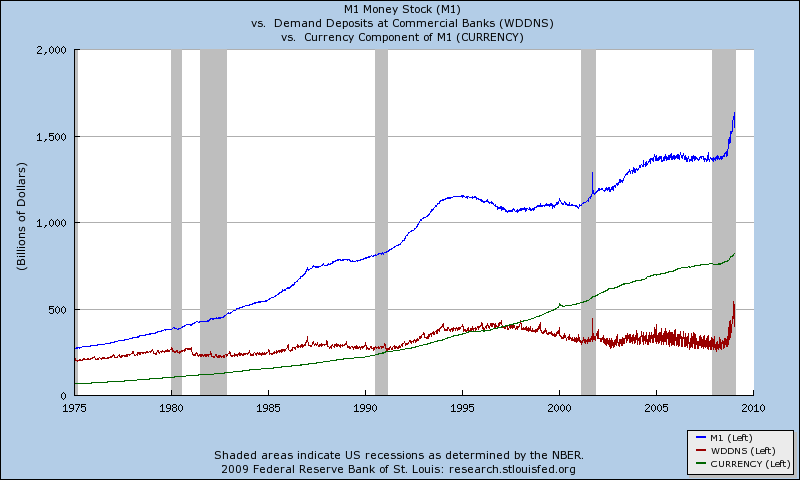

Sure enough, the US monetary base (represented by M1) has exploded since the inception of the credit crisis, rising more than 15% to more than $1.5 Trillion. Plus, given that there is a slight lag in the release of data, these figures don’t necessarily include the effects of the Fed’s expansion in its quantitative easing program, announced on March 18. One commentator explains that, “Of all the Fed’s moves, this ‘quantitative easing’ gets money into the economy the fastest — basically by cranking the handle of the printing press and flooding the market with dollars (in reality, with additional bank credit). Since these dollars are not going into home building, coal-fired electric plants or auto factories, they end up in the stock market.” In the short-term, then, QE has probably contributed only to asset-price inflation, rather than the more serious consumer price inflation.

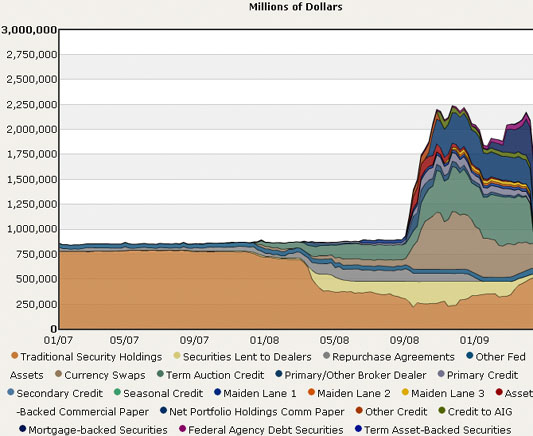

What about the charge that the Fed is dangerously reaching its tentacles into every corner of the financial markets? As you can see from the chart below, there is certainly a huge degree of truth to this claim. Since January 2008, the Fed has “diversified” its portfolio away from relatively benign Treasury securities, into at least 20 different types of securities and loans. In the process, its balance sheet exploded from approximately $800 Billion to $2.2 Trillion, and could expand further as the next phase of quantitative easing is implemented.

This portfolio’s makeup is indeed becoming increasingly risky. For example, “The Federal Reserve took on more than $74 billion in subprime mortgages, depreciating commercial leases and other assets after Bear Stearns Cos. and American International Group Inc. collapsed.” Despite writing down almost $10 Billion from this portion alone, however, the Fed continues to turn consistent profits. “Last year the central bank reported a whopping $43 billion in operating income. That was more or less the same level as in 2007, but meanwhile short-term interest rates had plummeted, ending the year near zero.” The assertions of conspiracy theorists, notwithstanding, the majority of this profit was transferred to the US Treasury. [Chart courtesy of The Economist].

Fortunately, most of the (non-esoteric) securities are highly liquid, and can theoretically be sold to investors if and when it becomes appropriate to do so. “The Fed, for example, is required by law to end some when the need is no longer urgent. It charges a penalty for some programmes so that borrowers will return to private markets once these have healed.” The Commercial Paper Funding Facility (CPFF) and Term Auction Facility (TAF) programs, which together account for over $650 Billion of the Fed’s portfolio, moreover, can be quickly undone. “The maturity of the outstanding [TAF] loans is 84 days at a maximum, ” while CPPF “deals in short-term money market instruments and can also be phased out, if desired, in a short period of time.”

The $400 Billion in swap lines, on the other hand, are slightly more problematic, both because of the longer time frame and because foreign banks “are now heavily dependent on the Fed for dollars.” Then there is the Term Asset-Backed Securities Loan Facility (TALF), which is not yet operational. While this program is also designed to be temporary, “the multi-year maturities of the loans and the potential size of the program—up to $1 trillion—make the impact on the monetary base more persistent than for some of the other liquidity programs.”

In short, inflation isn’t yet on the radar screen, as economists and bankers must first combat disinflation, and perhaps even deflation. Of course, there is always the (very serious) risk that the Fed either won’t be able to, or simply won’t be diligent enough in removing this cash from the money supply when the time comes. There is also a moral hazard component of the Fed’s QE, whereby “governments could come to rely on such purchases to finance budget deficits.” In my opinion, this kind of scenario would be much more likely to engender inflation, but it would be primarily the fault of the government (as opposed to the Fed), and hence beyond the scope of this post.

May 18th, 2009 at 10:41 pm

[…] following up on last week’s post (”Inflation or Stimulus: An In-depth Look At the Fed’s Response to the Credit Crisis“) on the possibility of inflation, I want to focus today’s post on the opposite […]