March 3rd 2010

Chinese Yuan Still Pegged, and US Treasury Purchases Continue

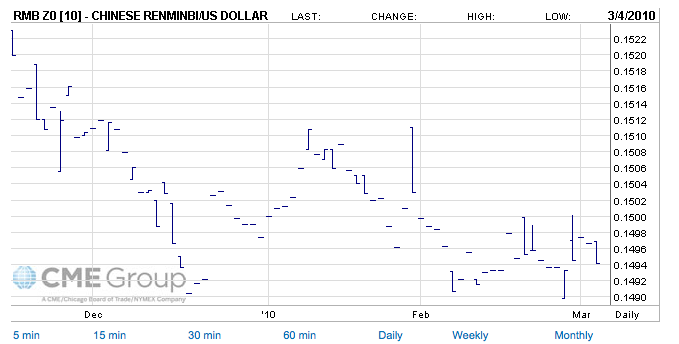

It’s still anyone’s guess as to if and when China will allow the Yuan (RMB) to continue appreciating. You can see from the chart below – which shows the trading history for the RMB/USD December 2010 futures contract – that expectations of revaluation have eroded steadily since December 2009. At that time, it was projected that that Yuan would finish 2009 at 6.57 RMB/USD, 4% higher than the current level. Fast forward to the present, and investors now only expect a modest 2% appreciation rise on the year.

What’s behind the change in expectations? The answer is a combination of economics and politics. On the economic side, China’s trade surplus is much smaller than in recent years, as import growth outpaces export growth. “Double-digit annual growth in exports is all but assured in coming months due to a low base of comparison in early 2009, but…sequential growth momentum went into reverse in January, with exports down 16 percent from December.” Moreover, while GDP growth appears strong, it appears tenuously connected to exports and fixed-asset investment. In addition, if the Central Bank of China raises interest rates to counter property speculation, it will have even less room to maneuver in its forex policy if it wishes to maintain high GDP growth. In terms of politics, the CCP doesn’t want to lose a crucial bargaining chip in international relations, and it also doesn’t want to mitigate the threat to its political legitimacy posed by a prolonged economic slowdown.

On the other hand, China still desires to turn the Yuan into a global reserve currency, again both for economic and political reasons. In order to accomplish such a feat, one of the prerequisites would be dual convertibility. Financial institutions and foreign Central Banks are still extremely reluctant to hold RMB currency since it’s difficult to convert into other currencies. “Citing data from the Bank of International Settlements (BIS), it [Citigroup] said the renminbi’s share in the global foreign-exchange market turnovers was only 0.25 percent in 2007, ranked 20th in the world and fifth among Asian emerging-market currencies.” This is pretty incredible considering that China’s economy is the world’s third largest, and will only change when the exchange rate regime is loosened.

While some analysts predict that the Yuan will continue rising as soon as next month – and at least by a slight margin for 2010 – the modest pace of appreciation will ensure that China’s foreign exchange reserves continue to grow. They are currently estimated at $2.4 Trillion, and while their composition is largely a secret, analysts estimate that more than 2/3 is denominated in USD-denominated assets. Recently, there was a perception that China had begun to diversify its reserves out of Dollars, as US Treasury data indicated that its Treasury purchases had all but stopped. As it turned out, China had merely moved to conceal its purchases by conducting them through a UK Bank.

The biggest threat to the USD posed by China is not an end to the RMB peg – for such is unlikely – but rather a change in its structure. Currently, the RMB is pegged directly to the Dollar, which means that the Bank of China MUST stockpile its trade surplus in USD-denominated assets, namely US Treasury securities. If the peg were to shifted to a basket of currencies, however, it would have more flexibility in the denomination of its reserves. Until then, China’s forex policy will continue to favor the Dollar.

March 5th, 2010 at 5:01 pm

[…] Adam Kritzer discusses the continued Chinese currency peg and how it influences currency trading. […]

March 8th, 2010 at 10:34 am

The revaluation of the Chinese RMB is long overdue. Market forces will eventually catch up.

March 13th, 2010 at 12:57 pm

The Yuan becomes more interesting to trade by the day. The other markets are mostly ranging lately.