May 14th 2009

The Sucker’s Rally and the Dollar

“The Dow Jones Industrial Average has bounced an astounding 30% from its March 9 low of 6547. Is this the dawn of a new era? Are we off to the races again?” Asks Andy Kessler provocatively in a recent Op-Ed for the Wall Street Journal.

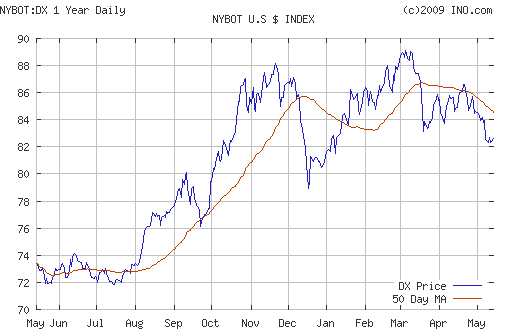

This is an important question not only for stock market investors, but also for forex traders. By no coincidence, the stock market rally has coincided with a steady decline in the Dollar, which recently broke through a key level of resistance and touched a four-month low against a basket of currencies, and is similarly nearing a four-month low against its chief rival, the Euro. ”

Experts” point to a decline in risk aversion as the chief driver of the rally; when investors become more comfortable with risk, they buy stocks, which in turn causes investors to become even more complacent with risk. Hence, a 30% rally only six months after stocks recorded their worst day and worst week ever.

In this case, however, the experts are not in complete agreement. Economic fundamentals, for example, remain relatively weak, and corporate profits are still anemic. Andy Kessler blames the Fed for distorting “asset allocation formulas” by dropping yields to zero and for its quantitative easing program, which “gets money into the economy the fastest — basically by cranking the handle of the printing press and flooding the market with dollars (in reality, with additional bank credit). Since these dollars are not going into home building, coal-fired electric plants or auto factories, they end up in the stock market.”

Sure enough, trading data suggests that in fact this rally is being driven by retail investors, as opposed to institutions. Says Lou Ritholz, ” ‘The ‘dumb’ retail money is leading the gains. ‘In this type of environment, the market is guilty until proven innocent. We have to assume this remains a bear market until we see a more normalized economy.’ ” In short, it looks like analysts have confused the chicken with egg, by emphasizing the decline in risk aversion, rather than the self-fulfilling nature of the rally.

If the rally does end, it will almost certainly be good news for the Dollar, at least in the short-term. There has emerged a strong correlation between global stock prices and emerging market currencies, for example, which virtually ensures an outflow of capital from emerging markets. One professional idiot– err investor- Jim Rogers has prognosticated an end both to the stock market rally and the Dollar rally. Credit Rogers for his long-term thinking, but he seems to have impugned a direct relationship, when recent trends suggest it is actually inverse.

I agree with Kessler, and abide by the same maxim “Only a fool predicts the stock market…” My point here is not to convince you that the market rally is unsustainable, but rather to emphasize the importance of knowing where you stand. I’m personally quite bearish on the Dollar in the long-term (food for a future post), but a damper in the stock rally would almost certainly be positive for the Dollar.