June 15th 2010

No US Rate Hike in 2010

In the midst of the Eurozone debt crisis, forex investors have largely stopped paying attention to interest rate differentials and focused the brunt of their attention on risk. Soon enough, however, there will be a resurgence in the carry trade, at which point interest rates will return to the forefront of investors consciousness.

From the standpoint of the carry trade, the US Dollar should be one of the least favorite currencies, since it offers investors a negative real return (without taking exchange rate fluctuations into account). If not for the sudden increase and volatility and consequent ebb in risk appetite, the Dollar would probably still be falling, and would continue to fall well into the future. To understand why, one need look no further than the current Fed Funds Rate (FFR), from which most other short-term rates are (indirectly) derived.

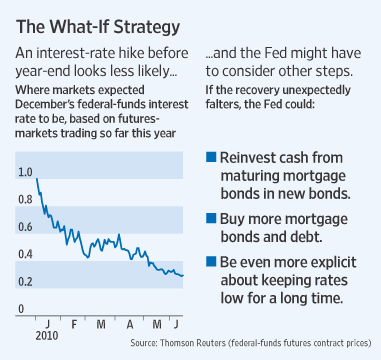

The FFR currently stands at 0 -.25%. Moreover, the debt crisis could potentially hamper the US economic recovery and the appreciation in the Dollar is causing inflation to moderate, which has removed almost all of the impetus for the Fed to hike rates anytime soon. There is also the problem of high US unemployment and recent stock market declines. There is currently a tremendous amount of uncertainty, as nobody can say definitively whether the US economy has turned the corner or whether it is headed for double-dip recession.

Most at the Fed think that the US recovery still remains on track. According to Federal Reserve Bank of Chicago President Charles Evans, “As the recovery progresses and businesses become more confident in the future, employment will increase on a more consistently solid basis. My forecast is that real gross domestic product will grow about 3.5%.” In fact, some of the hawks at the Fed see this as a justification for preemptive rate hikes and/or an unwinding of the Fed’s quantitative easing program. The President of the Kansas City Fed argued recently, “Even if the target was increased to 1 percent, policy would remain very accommodative,” while the Philadelphia Fed President added that the Fed should start selling some of $1 Trillion in Mortgage Backed Securities currently on its balance sheet.

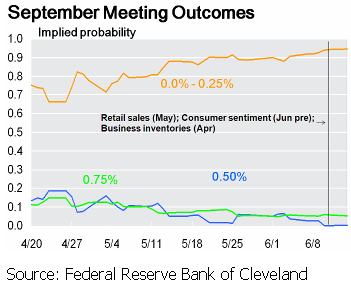

Still, such voices represent the minority, and besides, most of the hawks don’t current have any voting power. In other words, it will probably be a while before the Fed actually hike rates. Futures contracts currently reflect an infinitesimally low probability of rate hikes at any of the Fed’s summer meetings. “The February 2011 fed-funds futures contract priced in a 48% chance for the FOMC to lift the funds rate to 0.5% at its Jan. 25-26 meeting.” Meanwhile, an internal Fed analysis has concluded that based on previous rate-setting patterns, it is unlikely that the benchmark FFR will be lifted before 2012.

In short, US short-term rates will remain low for the indefinite future. For now, the “safe haven” mentality dictates that investors are less focused on yield and more concerned about capital preservation, which means no one is paying attention to the Fed. When risk appetite picks up, however, the Dollar will probably be dumped very quickly in favor of higher-yielding alternatives.