July 1st 2009

Forex Reserve Diversification Builds Slowly

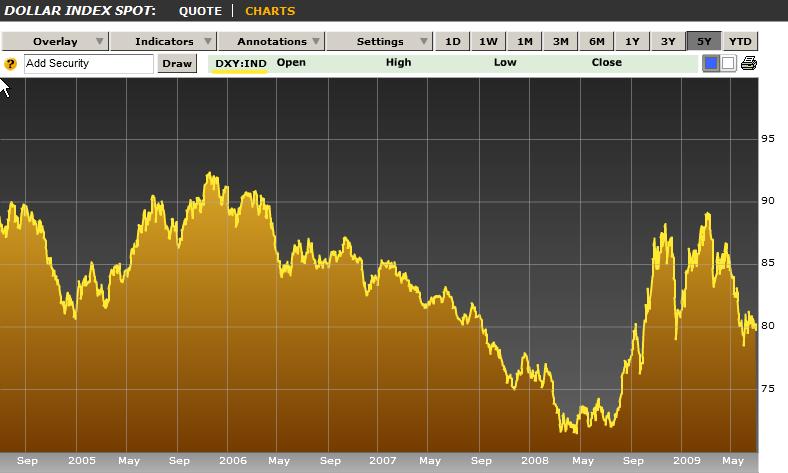

With this week slow for news and other economic developments, some forex traders are taking a step back to look at the long-term picture. The US Dollar, in particular has come into focus, because of the uncertain consequences of its current economic policy and the related talk of central bank diversification away from the Dollar. “The United States’ expansionist fiscal and monetary policies, which are raising fears of inflation down the road that could erode the value of the dollar, is surely driving diversification out of dollar-denominated asset…The dollar has weakened whenever talk about an alternative reserve currency makes the headlines.”

This week brought a couple small developments on this front. First, China released its annual report on the economy, in which it renewed calls for a “supra-national” currency, to be administered by the IMF: “To avoid the inherent deficiencies of using sovereign currencies for reserves, there’s a need to create an international reserve currency that’s de-linked from sovereign nations.” Analysts caution however that the move is politically motivated, and it could be a while before it’s squared with economic reality: “There may be signs here of tensions mounting between the PBOC’s economic concerns over China’s holdings of dollars and the Chinese government’s diplomatic reasons for doing so.”

Still, China is walking the walk. Having already entered into swap agreements with Argentina and several other developing countries, it is moving to conduct as much of its trade in Chinese Yuan as possible. This week, it inked a deal with Brazil, “for the gradual elimination of the US dollar in bilateral trade operations which in 2009 are estimated to reach US$ 40 billion.” Previously, such trade had been settled primarily in Dollars, a bane for Brazilian companies, which collectively “have lost hundreds of millions over the last two years due to dollar weakness.”

There is also activity closer to home. “The government said on April 8 that it will allow Shanghai and four cities in the southern Guangdong province, including Shenzhen and Guangzhou, to settle international trade in yuan.” An agreement with Hong Kong, meanwhile, aims to settle at least half of bilateral trade in Yuan. “Hong Kong Financial Secretary John Tsang said the city will be a ‘testing ground’ for use of the yuan outside mainland China.” If successful, this program could quickly expand to encompass the rest of East Asia ex-Japan.

In the short-term, these baby steps won’t have much of an impact on the Dollar. Besides, most Central Banks remain committed to the Dollar, if only for lack of a viable alternative. “The Fed’s holdings of Treasuries on behalf of central banks and institutions from China to Norway rose by $257.2 billion this year, or 15 percent, according to data compiled by Bloomberg. That compares with an increase of $127.3 billion, or 10 percent, in the first half of 2008.”

Even China has stated that its reserve policy will not feature any sudden changes. In sum, “It seems safe to say that the Chinese are pursuing a rather logical path. They will continue to accumulate dollar reserves, as doing so fits their three-adjective criteria [liquidity, safety and returns], while also pushing for international acceptance of an alternative to the dollar in a new global currency.”