May 4th 2009

Spike in Treasury Yields is Good News for US Dollar Bulls

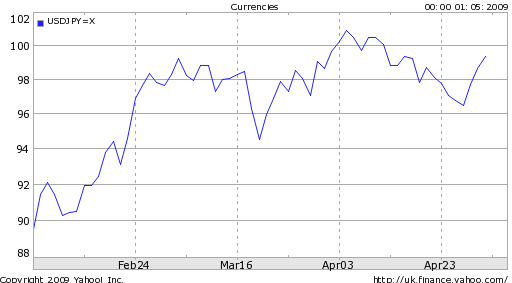

By no coincidence, the Dollar’s best day in April was a mirror image of its worst day in March. Recall what happened when the Fed initially announced its quantitative easing program: “The dollar plunged a record 3.4 percent against the euro on March 18 as traders speculated the Fed’s purchase Treasuries would debase the currency.” On April 29, meanwhile, “The dollar rose the most against the yen this month after the Federal Reserve refrained from increasing purchases of Treasuries and mortgage securities.”

The implication is that as risk aversion has dropped, investors have turned their gaze towards interest rates. Previously, this phenomenon would have worked against the Dollar, as both short-term and long-term interest rates are generally lower in the the US than they are abroad. On the short end of the curve, this is a product of a low Federal Funds Rate, as guided by the Fed. On the long end, this is a function of high demand for US Treasury securities, which keeps prices high and rates proportionately low.

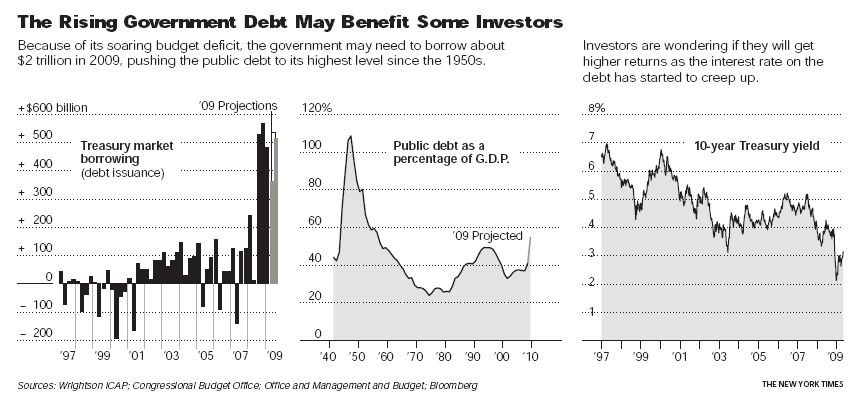

However, this trend is very quickly reversing itself. Aside from a few hiccups (including a big one on March 18!), Treasury yields have risen continuously since touching an all-time low in January. Since then, the yield on the 10-year note, for example, has risen from 2.2% to nearly 3.2%. The impetus for higher rates is coming both from a decline in risk aversion (which is leading investors to seek alternatives to Treasuries) as well as a concern that the Fed will not be as active in buying US bonds as it had initially intimated.

A decline in demand for Treasury securities is making some investors understandably nervous that the government will not be able to fund its deficits (projected at 10% of GDP in 2009). Writes one columnist, “We cannot take it for granted that the global bond markets will prove deep enough to fund the $6 trillion or so needed for the Obama fiscal package, US-European bank bailouts, and ballooning deficits almost everywhere.” The fear is that the government will turn to the Fed, which will stoke inflation by printing money, and induce a devaluation of the Dollar.

If the Fed limits its purchase of Treasuries, by extension, not only will this limit inflation, but also it will lead to higher interest rates on US government bonds, which should help prop up investor demand. One currency strategist observed that “The dollar-yen is very closely correlated with the back end of the yield spread.” In other words, as US long-term yields rise, so may the Dollar.

Of course, the key is to strike a balance between too much demand and not enough. If investors got really spooked by the fact that “The Congressional Budget Office expects interest payments to more than quadruple in the next decade as Washington borrows and spends, to $806 billion by 2019 from $172 billion next year,” then it could lead to a skyrocketing of interest rates as investors beat a mass retreat away from Treasuries, which would certainly entail a devaluation of the Dollar. To apply Alan Greenspan’s famous analogy, has anyone coined the term “Goldilocks Treasury Yields” yet?