July 17th 2009

Swiss National Bank Still Committed to FX Intervention

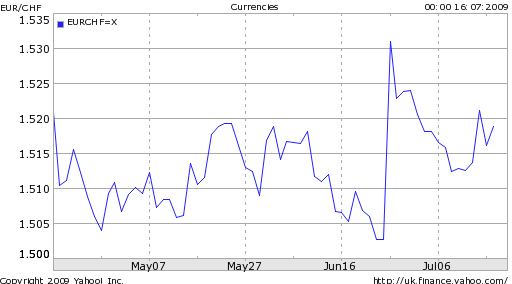

When the Swiss National Bank (SNB) intervened three weeks ago in forex markets, the Swiss Franc instantly declined 2% against the Euro. Since then, the Franc has risen slowly, and it’s now in danger of touching the “line in the sand” of 1.5 EUR/CHF that analysts have ascribed to the SNB.

That’s not to say that the Central Bank lacks credibility. Quite the opposite in fact. Every time a member of the SNB speaks about the possibility of intervention, the markets react. For example, “Swiss National Bank Governing Board member Thomas Jordan said the central bank remains willing to intervene in currency markets to prevent a further appreciation of the Swiss franc..The franc declined against the euro after the remarks.” Also, “The Swiss National Bank is sticking decidedly to its policy to prevent an appreciation of the Swiss franc, SNB Chairman Jean-Pierre Roth said in an interview published on Friday…The Swiss franc dipped after Roth’s comments.”

In addition, given that the SNB premised its intervention on deflation fighting, its credibility is now higher than ever, since the latest figures imply an inflation rate that is well into negative territory: “Swiss consumer prices dropped 1 percent year-on-year in June, the same rate as in May when prices fell at their fastest rate in 50 years, underscoring deflation dangers although most of the drop was due to oil.” Despite a fiscal stimulus, coupled with an easing of monetary policy and quantitative easing, the Swiss money supply is barely growing. At this point, the only thing the SNB can do is (threaten to) manipulate its exchange rate.

Perhaps this is why traders are willing to push back against the SNB, backed by “foreign-exchange analysts [that] argue that the SNB won’t have an appetite to continue buying foreign currencies in large amounts much longer.” The SNB is also fighting against the perception that Switzerland is one of a handful of financial safe havens. The fact that the Swiss Franc is probably undervalued is also contributing to the steady inflow of capital into Switzerland.

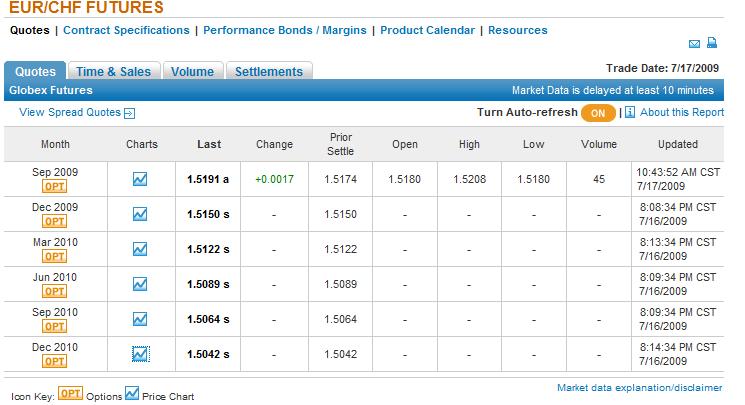

Still, investors are afraid to step across the line. Futures prices for the EUR/CHF are all hovering slightly above 1.50, for the next 18 months. Prior to the latest round of intervention, the expectation was for a steady rise in the Swiss Franc.

In addition, “There are significant options in place for the euro near the CHF1.50 level on the expectation the SNB will carry through another intervention if its resolve is questioned.” While the SNB would probably prefer a slight buffer zone, it will nonetheless rest assured as long as the Franc doesn’t appreciate further: “The SNB is just trying to stop the franc from becoming a one-way bet. ‘If the euro stays in the [current] CHF1.50 to CHF1.54 band, I think the SNB would be satisfied.’ “

August 14th, 2009 at 6:02 am

[…] Adam Kritzer deals with one of my favorite issues: intervention by central banks. He states that the SNB is still committed to such intervention. I claim that the effect of intervention is short-lived. […]