October 6th 2010

Currency War: Who are the Winners and Losers?

On September 27, Brazilian Finance Minister, Guido Montega, used the term “currency war” to describe the series of recent Central Bank interventions in forex markets. While he may not have intended it, the term stuck, and financial journalists everywhere have run wild with it.

In the current cycle (dating back a couple years), more than a dozen Central Banks have entered the forex markets with the intention of holding down their respective currencies, both against each other and also against the US Dollar. What makes it a war is that the Central Banks are fighting to outspend and outdo each other. It is a War of Attrition, in that Central Banks will fight until they’ve exhausted all of their wherewithal, conceding defeat for their currencies. On the other hand, unlike in a conventional war, there aren’t any alliances, nor is there much in the way of little strategy. Central Banks simply buy large blocks of counter currencies and hope their own currencies will then depreciate on the spot market. In addition, since the counter currencies are almost always Dollars and/or Euros, the participants in this war are not even competing directly against each other, but rather against an enemy that isn’t doing much to fight back. [Chart belowcourtesy of Der Spiegel].

The Swiss National Bank (SNB) was the first to intervene, and staged a one-year campaign over the course of 2009 to hold the Swiss Franc at 1.50 against the Euro. Ultimately, it failed when the sovereign debt crisis caused an exodus of Euro selling. The Bank of Brazil was next, although its interventions havebeen more modest; it seems to have accepted the ultimate futility of its efforts, and will seek to slow the Real’s appreciation rather than halt it. Last month, the Bank of Japan spent $20 Billion in one session in order to show the markets how serious it is about fighting the Yen’s rise. In fact, it was this intervention that sparked Montega’s comments about currency war. (The BOJ hasn’t intervened since). All along, the People’s Bank of China has continued to add to its war chest of reserves – currently $2.5 Trillion – as part of the ongoing Yuan-Dollar peg. And of course, there have been a handful of smaller interventions (South Korea, Singapore, Taiwan) and no shortage of rhetorical (Canada, South Africa) interventions, as well as indirect (US, UK) intervention.

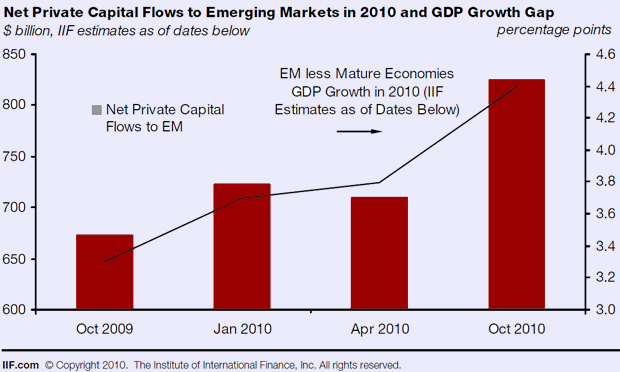

That’s right- don’t forget that the Fed and the Bank of England, through their respective quantitative easing programs, have injected Trillions into the financial markets and caused their currencies to weaken. In a sense, all of the subsequent interventions have been effected in order to restore the equilibrium in the currency markets that was lost when these two Central Banks deflated there currencies through wholesale money printing. Since much of this cash has found its way into emerging markets (See chart below), you can’t blame their Central Banks from trying to soften some of the upward pressure on their currencies.

It’s still too early too early to say how far the currency war will go. The G7/G20 has announced that it will address the issue at its next summit, though it probably won’t lead to much in the way of action. Ultimately, politicians can’t do much more than shake their fingers at countries that try to hold down their currencies. In the case of the Yuan-Dollar peg, American politicians have tried to take this one step further by threatening to slap China with punitive trade sanctions, but this probably won’t come to pass and may disappear as an issue altogether after the November elections. As I reported on Friday, Brazil has taken matters into its own hands by taxing all foreign capital inflows, but this hasn’t had much effect on the Real.

That brings me to my final point, which is that all currency intervention is futile in the long term, because most Central Banks have limited capacity to intervene. If they print too much money to hold down their currencies, they risk stoking inflation. Of course China is the exception to this rule, but this is less because of the size of its war chest and more because of the mechanics of its exchange rate regime. For Central Banks to successfully manipulate their currencies on the spot market, they must fight against the Trillions of Dollars in daily forex turnover. Eventually, every Central Bank must reckon with this truism.

In terms of identifying the winners and losers of the currency war (as I promised to do in the title of this post, the Euro will probably lose (read: appreciate) because the ECB is not willing to participate. The same goes for the Swiss Franc, since the SNB has basically forsaken currency intervention for the time being. The Bank of Japan has deep pockets, and if the markets push the Yen back up above 85 Yen/Dollar, I wouldn’t be surprised to see it intervene again. With the Fed mulling an expansion of its quantitative easing program, meanwhile, the Dollar will probably continue to sink. And as for the countries that are doing the actual intervening, they might succeed in temporarily holding down the valuer of their respective currencies. As capital shifts to emerging markets over the long-term, however, their currencies will soon resume rising.

October 6th, 2010 at 8:47 am

Great analysis. I’ve also addressed the issue earlier today. Do you think that we’ll see a significant revaluation of the yuan some day? Will international pressure mount?

December 17th, 2010 at 10:32 am

It is interesting to see a war where the objective of the war is to shoot one’s own citizens, where the winner is the country who becomes poorest at the end.