April 28th 2009

Euro Resumes Decline After Brief Pause

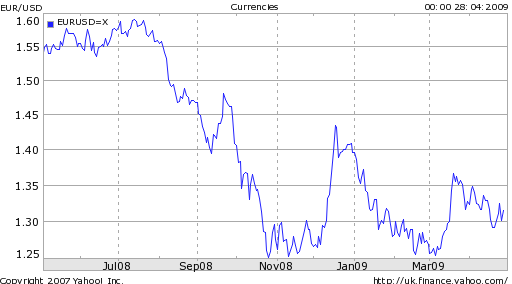

The one-year chart of the EUR/USD depicts a general downward trend, punctuated with steep “blips.” Every couple of months or so, it seems traders are temporarily jarred loose from their mindset of Euro bearishness, and find an excuse to bid up the common currency. Invariably, the Euro then resumes its downward course a few weeks later.

The Euro’s recent trading activity fits this mold perfectly. The global stock market rally in March was accompanied by a spike in the Euro. While equities, commodities, and even other currencies continued to rise, however, the Euro peaked after a couple weeks and has since hovered around the $1.30 mark. As one currency strategist summarized: “A breakdown of the correlation between the euro-dollar exchange rate and the S&P index indicates the currency pair ‘ has become a trade that is less about risk, a little more about euro rate specifics.’ ”

In other words, the decline in risk aversion has not expanded to include the Euro. This is somewhat surprising, since EU economic indicators have rebounded in the last month. The oft-cited German IFO index “rebounded from a 26-year low,” while “retail sales declined the least in 11 months in April after government stimulus packages improved consumer confidence.” On the other hand, EU lending activity, which is more correlated with economic growth, continues to decline. “The European Central Bank Wednesday released figures showing that banks in the currency area cut their lending to both companies and households in March.”

This is a huge problem for the EU, where the banking sector represents a comparatively important component of the economy.. “At the end of 2007, the stock of outstanding bank loans to the private sector amounted to around 145 percent of gross domestic product, compared to 63 percent in the United States.” This is belied by newspaper headlines that maintain the banking crisis is most severe in the US. In nominal terms, this might be true, but in relative terms, the EU is in much worse shape. Given that exchange rates are all relative, it is worth paying attention to this phenomenon.

The ECB is doing all that it can to help the situation, but many analysts and even some of the Bank’s own members remain critical. “The ambiguity of the ECB’s stance is not helping [the Euro,” offered one analyst. The ECB’s next meeting is scheduled for May 7, when economists predict the benchmark lending rate will be lowered to 1%. This will appease some investors, but not all. The head of Germany’s IFO organization, for instance, has urged the ECB to slash rates down to .25%.

As ECB President Jean Claude Trichet has pointed out, lower rates will not automatically stimulate the economy: “Owing in particular to the very low rate on our deposit facility of 0.25 percent, this difference in policy rates doesn’t translate into equivalent differences in money market rates.” In fact, money market rates have largely converged across the EU and US, despite the divergence in short-term rates, vindicating Trichet.

More important, then is the ECB’s non-monetary initiatives. To quote Trichet again, “Comparing only the levels of policy rates without consideration of the resulting market rates and other economic variables is looking at just one part of a far broader canvas.” The Economist recently published an excellent comparison of the various Central Banks’ responses to the credit crisis. While some have embraced their newfound prominence, other Central Banks have shied from the spotlight, insisting that their mandates are limited to inflation targeting. The ECB probably falls into this category, as it has thus far stood on the sidelines – for better or worse- as its counterparts have turned on the printing presses and flooded their respective credit markets with liquidity. [Chart courtesy of The Economist].

This could soon change, and “A commission headed by Jacques de Larosière, a former head of both the Bank of France and the IMF, has recommended that the ECB chair a new European Systemic Risk Council made up of its member central banks and supervisors.” Not all investors are convinced that the ECB can successfully break with tradition. “Alan Ruskin, head of international currency strategy in North America at RBS Securities…recommends investors sell the euro on ‘upticks’ as the ECB abandons ‘monetary orthodoxy’ and uses unconventional measures to spur growth.”