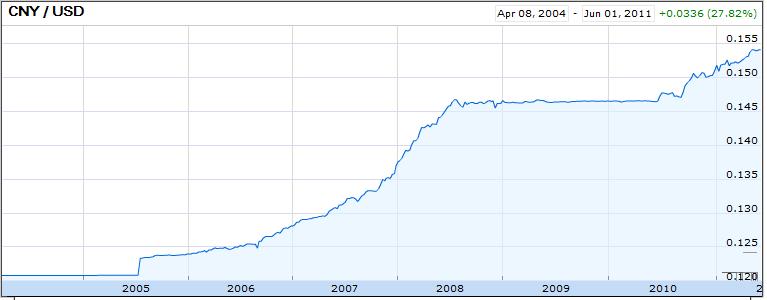

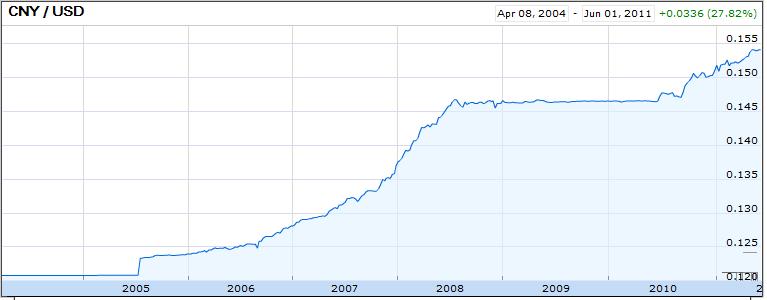

Over the last six years, the appreciation of the Chinese Yuan has been as reliable as a clock. Since 2005, when China tweaked the Yuan-Dollar peg, it has risen by 28%, which works out to 4.5% per year. If you subtract out the two year period from 2008-2010 during which the Yuan was frozen in place, the appreciation has been closer to 7% per year. There is no other currency that I know of whose performance has been so consistently solid, and best of all, risk-free!

As I wrote in an earlier post on the subject, the economic case for further appreciation is actually somewhat flimsy. When you factor in the 5-10% inflation that has eroded the value of the Yuan over the last few years, its appreciation in real terms has more than exceeded the 25-40% that economists and politicians asserted as the margin by which it was undervalued. While prices for many services remain well below western levels, prices for manufactured goods already equal or exceed those that Americans pay. (As a resident of China, I can assure you that this is the case!). Given that Chinese GDP per capita (a proxy for income) is 12 times less than in the US, that means that relative price levels in China are already significantly greater than the US. Thus, further appreciation would only cause further distortion.

Regardless, investors continue to brace for further appreciation, and expectations of 5-6% for the foreseeable future are the norm. Even futures contracts – which typically lag actual appreciation because of their non-deliverable nature – are pricing in higher expectations for appreciation. Perhaps the greatest indication is that 9% of all of the capital pouring into China is so-called “hot-money.” That means that despite the 27% appreciation to date, a substantial portion of investment in China is connected only to the expectation for further Yuan appreciation.

Even though the Yuan is not fully-tradeable, its continued rise has serious implications for forex markets. First of all, there will be follow-on effects for other currencies. Almost every emerging market economy competes directly with China, and all are thus keenly aware that China pegs its currency against the US dollar. By extension, many of these economies feel they have no choice but to intervene daily in forex markets to prevent their respective currencies from appreciating faster than the RMB.

At the very least, the appreciation in Asian and Latin American currencies will keep pace with the Yuan: “This is a long-term secular trend for emerging market currencies especially in Asia. Asian currencies have long been undervalued and they are on a convergence path with the United States and the G7 more broadly and that’s going to lead to an appreciation,” summarized one analyst.

All of this action will cause the dollar to depreciate. The Chinese Yuan alone accounts for 20% of the Federal Reserve Bank’s trade-weighted dollar index, and Asia ex-Japan accounts for another 20%. Regardless of the other G4 currencies perform, that means that a conservative 7% annual appreciation in Asia will drive a minimum 3% annual decline in the trade-weighted value of the dollar. Even worse is that this cause a broad loss of confidence in the dollar, driving the dollar lower across-the board. And this doesn’t even aaccount for the multiplier effect that net exporters will no longer need to indiscriminately accumulate dollar-denominated assets. China, itself, has unloaded part of its massive hoard of US Treasury securities for five consecutive months.

The implications for how long-term investors should position themselves are clear. Unfortunately, while further appreciation in the Chinese Yuan is all but guaranteed, achieving exposure to this appreciation is beyond difficult. Neither of the ETFs that claim to represent the Yuan (CNY, CYB) have budged over the last couple years, and they are a poor substitute for the actual thing. In other words, your only chance for exposure is indirectly via Chinese stocks and bonds, which are far from transparent and an extremely dubious investment. Or you could try opening a Chinese Yuan bank account with the Bank of China (which now has branches in the US), but it’s unclear whether you will be able to capture 100% of gains from the Yuan’s appreciation.

Otherwise, emerging market Asia seems like a pretty good proxy. Of course, you need to be aware that even though the Korean Won, Malaysian Ringgit, Thai Baht, New Taiwan Dollar, Indonesian Rupiah, Philippine Peso, etc. will probably at least match the rise in the Yuan, they are imperfect substitutes for the Yuan, since they are driven more by country-specific factors than by association to China.