December 13th 2010

Canadian Dollar: Parity Vs Reality

After a stellar 2009, the Canadian Dollar (“Loonie”) has had a relatively lackluster 2010 against the Dollar, rising by only 3-4%. As the Loonie has inched (back) towards parity, it has encountered significant resistance. I think there is reason to believe that the currency has reached its limit, and that there are little prospects for further appreciation for at least the first half of 2011.

Everyone likes to think of the Canadian Dollar as a commodity currency, but I don’t think this is an accurate representation. Net energy exports account for only a small portion (2.9%) of Canadian GDP, a fraction which is dwarfed by the export of automobiles, for example. In fact, eastern Canada, which is comparatively poor in natural resources, is actually a net energy importer. I think that investors have largely come to the same conclusion, and significant rallies in oil and other commodity prices in the second half of 2010 spurred only a modest appreciation in the Loonie.

The currency has risen so fast over the last couple years that Canada has run a trade deficit for six consecutive months, including a record $2.5 Billion in July. (In some ways, doesn’t this prove that economic imbalances will ultimately self-correct?!). In addition, to say that Canadian export sector is heavily reliant on the US would be an understatement: “The U.S. bought 70 percent of Canada’s exports in October, down from 75 percent in June, and a record of about 85 percent in 2001.” It’s no wonder that Canadian economic officials have defended the Fed’s QE2 monetary easing program; they know that Canada’s economic health is contingent on a strong US economy.

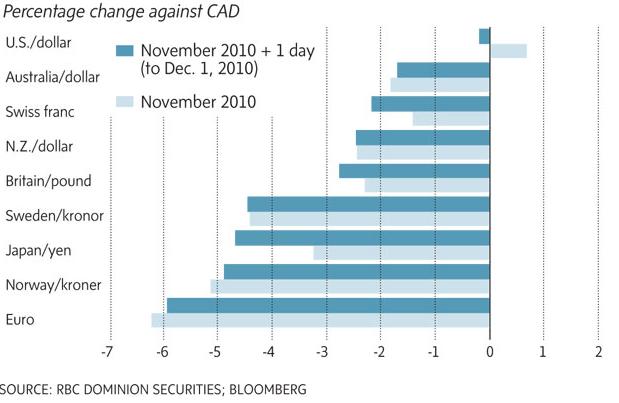

As for how fluctuations in risk affect the Loonie, it’s not clear. On two separate occasions, the WSJ reported first that “With investors more willing to take on riskier assets than they were the day before, the Canadian dollar was able to move sharply higher,” and then that “Canada’s relatively strong fiscal and economic fundamentals attract safe-haven flows when investors are fleeing from risk.” What a blatant contradiction if there ever was one! Personally, I think that Canada’s economic structure and relatively high debt levels disqualify the Loonie from consideration as a safe-haven currency. That being said, it has notched some impressive gains against other non-safe haven currencies.

If not for its low interest rates, nobody would even mention it in the same breath as the US Dollar or Japanese Yen. Speaking of low rates, the Bank of Canada voted last week to keep its benchmark interest rate on hold at 1% and indicated that it won’t consider raising them for quite some time. Said Central Bank Governor Mark Carney, “There are limits to the divergence that there can be between Canada and the United States.” In other words, the BOC probably won’t hike rates until the Fed does, at which point there will be very little basis for buying the Loonie over the US Dollar.

Analysts tend to agree with this assessment: “The loonie will trade at parity by the end of March and weaken to C$1.01 per dollar through the end of third-quarter 2011, according to…a Bloomberg survey: ‘We still think the Canadian dollar will continue to hover around here and test parity; we don’t think the Canadian dollar is going to back up against the U.S. dollar until the new year.’ Interestingly enough, Canadian investment advisers echo this sentiment: “We’re saying to clients that the Canadian dollar is strong right now, so buying U.S. assets is cheaper than it would be if the dollar were weak.”

It’s a bad sign for the Loonie when even Canadians think it’s overvalued.

December 13th, 2010 at 8:13 pm

I agree. The Loonie has peaked out. Time to look elsewhere. Pay attention to their central bank as they are going to follow the Fed.

December 18th, 2010 at 11:57 am

I have also generally thought of the Loonie as a commodity currency also, one that correlated heavily with oil. Thanks for bringing some deeeper light on the subject.