October 13th 2010

Japan Plots Next Yen Intervention

Almost one month has passed since the Bank of Japan (BOJ) intervened in forex markets on behalf of the Japanese Yen. In one trading session, it spent a record 2.1249 trillion yen ($25.37 billion) to obtain a 3.5% jump in the Yen. Since then, the Yen has continued to appreciate, and now it seems like it’s only a matter of time before the BOJ intervenes again…and again and again.

Prior to intervening, Japan’s main concern was that there would be a bitter backlash from the rest of the world. On the one hand, Japan’s fears were validated by accusations that it was engaging in “currency war.” It also received a mild rebuke from US policymakers, who fretted that its intervention would cause China to reconsider allowing the Yuan to appreciate.

Others were more forgiving, however, going so far as to excuse Japan’s actions as a necessary response to Korean and Chinese intervention. After all, given that Japan competes directly with these two countries for export market share, how could it sit by idly as they actively devalued their currencies. US Treasury Secretary Timothy Geithner let Japan completely off the hook by telling reporters that he didn’t think Japan “set the fire”for the current dynamic in forex markets.

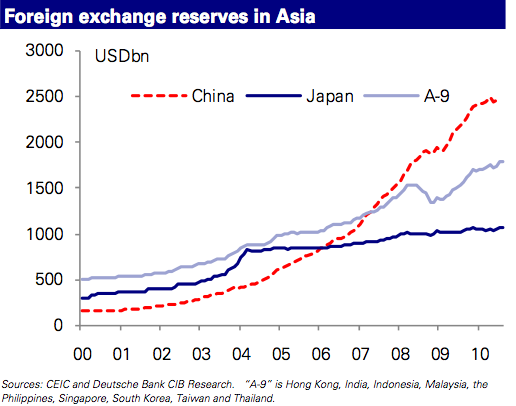

Deutsche Bank(which created the chart below) added, “It must be frustrating for Japanese policymakers to see other Asian economics getting away with such persistent intervention to weaken their currencies. Perhaps the final straw was the Chinese purchases of JGBs [Japanese government Bonds] which some Japanese officials argue played a prominent role in the recent JPY appreciation.” In other words, not only was China holding down its currency against the Dollar, but now it had started to target the CNY/JPY exchange rate.

At next week’s G7 meeting, Japan will try to achieve a formal permission slip for its program, by arguing that, ” ‘Our intervention isn’t the kind of large-scale operations that aim to achieve certain rate levels over the long term.’ September’s intervention was only ‘aimed at curbing excess fluctuations’ in the yen’s rates.” Depending on how the G7 responds (via its official statement), it may influence the likelihood of further intervention.

From an economic standpoint, Japan also doesn’t have much to fear. The only downside from printing money wholesale and using it to buy US Dollars is the risk of inflation. In Japan, however, this would be seen as a positive development, and is hardly a constraint to further intervention: “With Japan’s economy still in the grip of deflation, the authorities have the ability and the incentive to prevent further gains in the yen.” In fact, the Bank of Japan recently “slashed its overnight ratetarget to virtually zero and pledged to purchase 5 trillion yen ($60 billion) worth of assets in a fresh dose of economic stimulus.” As the Fed prepares to do the same [more on that later this week], the BOJ’s hope is that this time around, “The yen won’t be reflexively favoured by investors turning bearish on the greenback.”

Really, then, the only question is when the BOJ will intervene. The Japanese Yen has already fallen below 82 USD/JPY, disappointing analysts that predicted the point of intervention would take place at 83/84, near the point of last month’s intervention. That it has allowed the Yen to continue to slide is somewhat baffling in that it exposes the futility of its previous efforts. The BOJ claims that it isn’t embarking on a program on continuous intervention, but this is really the only chance it has of being successful for any length of time. The Swiss National Bank (SNB) established a “line in the sand” of 1.50 EUR/SWF and spent $200 Billion defending it. Where is the the BOJ “line in the sand?” 82? 80?

In theory, this should mean that the Japanese Yen appreciation will soon come to an end. Given the fact that every other major currency (with the exception of the Euro) is being either indirectly or competitively devalued, however, this is far from certain. If Japan is serious about holding down the Yen, it may have to formally declare war.

October 13th, 2010 at 7:18 am

If the Japanese Yen is successfully devaluated, that leaves the Euro & Swiss to take up the appreciation slack.

Isn’t it possible that if the USD is falling in value, and the Yen is rising in value, that the BOJ simply won’t be willing to risk the amount needed to stabilize the Yen?

There must be a better way. Public bonfires where money is burned…etc.