May 27th 2009

Canadian Dollar Inches Closer to Parity

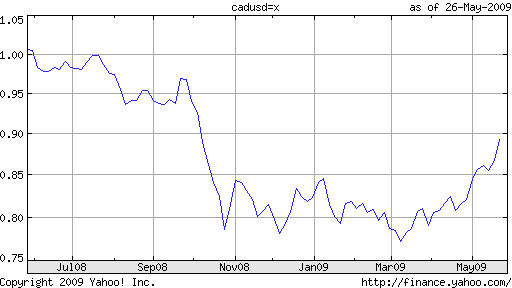

After finishing 2008 on a low note and getting off to a disastrous start in 2009, the Canadian Dollar (“Loonie”) is slowly clawing its way back. It has now risen over 14% since the beginning of March, and is up 7 cents in May alone, en route to a seven-month high. Circumstances have changed so rapidly that no one could have seen this coming. “The rising Canadian dollar has taken some forecasters by surprise; recent predictions by some Canadian banks said the dollar would be in the high 70-cent US to mid-80-cent range by June.”

After all, Canadian economic fundamentals remain abysmal by any standards, because of the collapse in commodity prices and a decline in exports to its biggest trade partner, the US. “Canada’s central bank has said the country’s gross domestic product fell 7.3 percent in the first three months of 2009, dropping at the steepest pace in decades. The Bank of Canada said that’s the biggest contraction since comparable records began being kept in 1961.” Meanwhile, the economy has shed almost 300,000 jobs, and the government is predicting a record budget deficit of 50 billion Canadian dollars.

After all, Canadian economic fundamentals remain abysmal by any standards, because of the collapse in commodity prices and a decline in exports to its biggest trade partner, the US. “Canada’s central bank has said the country’s gross domestic product fell 7.3 percent in the first three months of 2009, dropping at the steepest pace in decades. The Bank of Canada said that’s the biggest contraction since comparable records began being kept in 1961.” Meanwhile, the economy has shed almost 300,000 jobs, and the government is predicting a record budget deficit of 50 billion Canadian dollars.

Due in part to a rise in commodity prices (which could soon make it profitable for drilling of the famous oil sands) as well as the government’s $32 billion economic stimulus package, Canada’s luck is expected to turn. The economy is now expected to grow by a healthy 2.5% in 2010, following a projected decline of 3% in 2009. This return to prosperity will be made possible be a shift in economic strategy, as a part of which East Asia could supplant the US as Canada’s biggest export market.

So, why is the Loonie rising? In a nutshell, it is for the same reason that most other currencies are outperforming the Dollar. One analyst offered the following pithy summary: “This is not a made-in-Canada story, but a negative U.S. dollar story.” In other words, currency traders are focusing more on lowered risk aversion and the Fed’s money printing activities, rather than economic fundamentals. As commodities and stocks recover, the Loonie is being driven up indirectly- not because investors suddenly perceive it as having some kind of economic advantage.

In the near-term, “Canada’s dollar will weaken to C$1.18 by the end of this year, according to the median forecast of 41 economists and analysts surveyed by Bloomberg News.” Perhaps with a similar inkling in mind, the Bank of Canada appears unlikely to intervene in currency markets at the moment. To be sure, it has already exhausted the main weapon in its monetary arsenal by cutting rates to .25% and is certainly looking for ways to stimulate the economy. But for the time being, it is prepared to accept currency appreciation as long as it is offset/accompanied by improvements in other areas. Said one analyst, “I think the Bank of Canada could tolerate some back-door tightening from the currency if it’s happening at a time when everything else is looking sunnier.”