June 30th 2011

Loonie and Aussie Share Downward Bond

In yesterday’s post (Tide is Turning for the Aussie), I explained how a prevailing sense of uncertainty in the markets has manifested itself in the form of a declining Australian Dollar. With today’s post, I’d like to carry that argument forward to the Canadian Dollar.

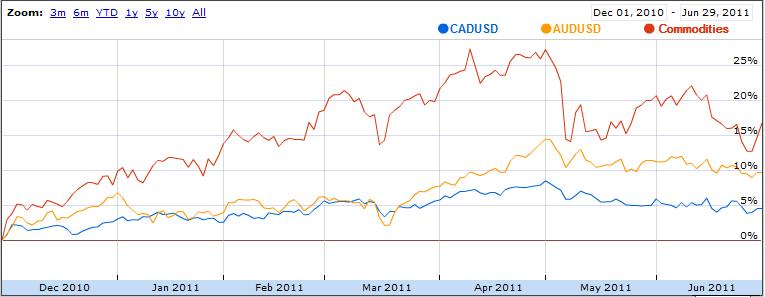

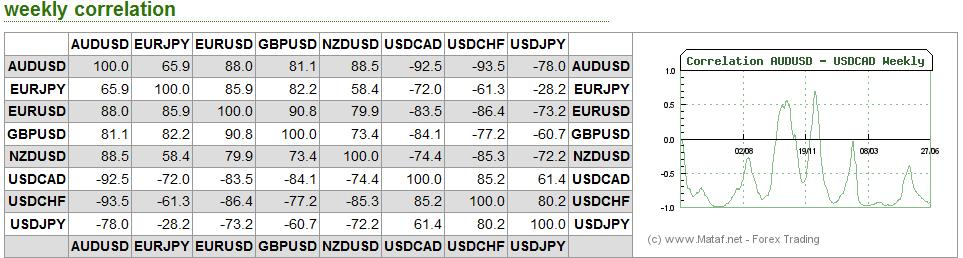

As it turns out, the forex markets are currently treating the Loonie and the Aussie as inseparable. According to Mataf.net, the AUD/USD and CAD/USD are trading with a 92.5% correlation, the second highest in forex (behind only the CHFUSD and AUDUSD). The fact that the two have been numerically correlated (see chart below) for the better part of 2011 can also be discerned with a cursory glance at the charts above.

Why is this the case? As it turns out, there are a handful of reasons. First of all, both have earned the dubious characterization of “commodity currency,” which basically means that a rise in commodity prices is matched by a proportionate appreciation in the Aussie and Loonie, relative to the US dollar. You can see from the chart above that the year-long commodities boom and sudden drop corresponded with similar movement in commodity currencies. Likewise, yesterday’s rally coincided with the biggest one-day rise in the Canadian Dollar in the year-to-date.

Beyond this, both currencies are seen as attractive proxies for risk. Even though the chaos in the eurozone has very little actual connection to the Loonie and Aussie (which are fiscally sound, geographically distinct, and economically insulated from the crisis), the two currencies have recently taken their cues from political developments in Greece, of all things. Given the heightened sensitivity to risk that has arisen both from the sovereign debt crisis and global economic slowdown, it’s no surprise that investors have responded cautiously by unwinding bets on the Canadian dollar.

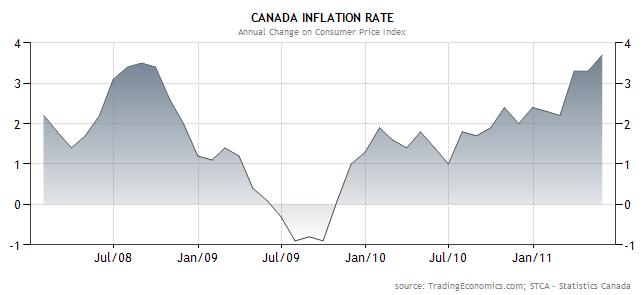

Finally, the Bank of Canada is in a very similar position to the Reserve Bank of Australia (RBA). Both central banks embarked on a cycle of monetary tightening in 2010, only to suspend rate hikes in 2011, due to uncertainty over near-term growth prospects. While GDP growth has indeed moderated in both countries, price inflation has not. In fact, the most recent reading of Canadian CPI was 3.7%, which is well above the BOC’s comfort zone. Further complicating the picture is the fact that the Loonie is near a record high, and the BOC remains wary of further stoking the fires of appreciation by making it more attractive to carry traders.

In the near-term, then, the prospects for further appreciation are not good. The currency’s rise was so solid in 2009-2010 that it now seems the forex markets may have gotten ahead of themselves. A pullback towards parity – and beyond – seems like the only realistic possibility. If/when the global economy stabilizes, central banks resume heightening, and risk appetite increases, you can be sure that the Loonie (and the Aussie) will pick up where they left off.

July 4th, 2011 at 1:58 am

Nice article Sir. How about SPR release? how much SPR will affect oil and commodity currencies?

July 4th, 2011 at 2:58 am

Traders like me are also currently treating the Loonie and the Aussie as inseparable.

July 14th, 2011 at 7:07 am

the main benefit of highly correlated pairs is that you can easily spot conflicting signals telling you to avoid a trade or in a best case scenario you see a strong buy or sell signal on both pairs. Great post!

July 25th, 2011 at 3:45 am

It is surprising to read that the AUD/USD and CAD/USD are trading with a 92.5% correlation. Thanks for this great information.

July 31st, 2011 at 4:27 am

Hi Adam,

Your blogposts are indeed very interesting and insightful. I am an MBA student at Manchester Business School, UK and was wondering if I could speak to you regarding a forex hedging issue I am researching on. Would it be possible for you to share your e-mail address?

Would appreciate your inputs!

Sudhanshu

sudhanshu.saxena@mba.mbs.ac.uk

August 28th, 2011 at 8:08 pm

Hello Adam,

It’s been some time since you last posted. I’ve been reading and following your blog for some time and was just curious as to the status of this blog.

Hope you are just taking a break; I know the markets have been a bit volatile lately.

Best,

Aaron.

September 1st, 2011 at 9:06 am

You no longer have written on this pair. What is the forecast for September-November 2011

September 14th, 2011 at 8:48 am

Thanks, you have made it very easy for me to understand.

November 8th, 2011 at 5:03 am

Hi Adam,

I like the broadbased and easy to read format, just interested to know why the latest update is in June? I like all the sources which are collated, building a broader view although I feel maybe some levels would be useful. I am probably used to being over-dosed with levels, so even though I am guessing your timeframe is longer term, I would be interested to know?

Best Regards

John Corcoran

November 18th, 2011 at 4:20 pm

I was just wondering, what happened to this blog and his people? I really miss the activity here

November 20th, 2011 at 7:03 am

Good article and analogy of the prices of physical goods and how they corelate with the prices of money in these particular markets. Still way over my head though, so I’ll keep on the studies and hope the central banks don’t throw us a curve ball. Manipulation is ever present so it seems.

November 26th, 2011 at 3:06 pm

Interesting comments here , when are you going to be doing some more updates ?

November 30th, 2011 at 7:27 am

I studying forex technical analysis and the information above very helpful to know where currency going and the most important when.

Thank you.

December 8th, 2011 at 11:48 am

There is undeniably further downside in both the AUD and CAD, especially considering today’s central bank developments.

December 20th, 2011 at 2:43 pm

Nice Piece Adam. We scored a nice payday on the rise in appetite fronm both the aussie and euro today. Well over 1%!

Bill

December 21st, 2011 at 8:11 am

Thank you for your detailed technical analysis. But why there is no any updates so far?

Ppl please keep posting!

January 19th, 2012 at 10:56 am

The aussie really had a nice run these last 6 months, I took a long position a few months ago that yielded some nice profits, great post

February 28th, 2012 at 10:37 am

Your theory is much better than those guys, ryan ng in Statistical Traders Singapore Pte Ltd. I really shock tat my name showing in the their advertisements. OMG! I have to frank and remind everyone that never proceed for those forex courses especially statistical traders where their intention is to grab people money without gave you any right approach and close up their business within a year. Just to remind you all guys!

March 11th, 2012 at 4:03 am

Interesting article. While I may disagree with somewhat I am writing for another reason. Correlation. Its just one my annoyances with trading. I never fight it… I like not losing money:) But a heard mentality werte everything trades lockstep risk on risk off is rather ridiculous. The financial world IA just not that simple. Furthermore its realty these odd correlations that drive me crazy. WHY should the aud / use correlate so much with the usd / chf???? So often I hear “well I believe financial instrument x is likely to appreciate so I want to trade instrument y to take advantage of correlations” WHY NOT JUST TRADE THE ASSET YOU HAVE CONFIDENCE IN!!!!! By using proxies you introduce more risk in your trade. While there are often sound reasons for many correlations there are many factors that fundamental determine any assets value. You risk conflicting fundemntal factors overriding a correlation. Of coarse this is assuming traders are bright enough to understand the difference and brave enough to trade outside of lockstep mindless correlations. Hmmm today I like the prospect of shorting the aud vs the usd so you know what I think I will short the usd vs the chf. I am so clever. Oops I got stoles out cause the Swiss intervened on the chf.

March 11th, 2012 at 4:04 am

Sorry that last sentance was meant to say stoped out not stole out.

September 7th, 2012 at 3:35 pm

German Chancellor Angela Merkel has expressed her support for the European Central Bank’s plan to buy sovereign bonds under strict political conditions. But members of her center-right coalition have voiced opposition. The German chancellor on Friday welcomed the decision by the European Central Bank (ECB) to buy unlimited sovereign bonds of eurozone crisis states, saying that the bank had attached important political conditions to the move.