April 13th 2011

What’s Next for the Yen?

After the G7 intervened in forex markets last month, the Yen fell dramatically and bearishness spiked in line with my prediction. Over the last week, however, the Yen appears to have bottomed out and is now starting to claw back some its losses. One has to wonder: is the Yen heading back towards record highs or will it peak soon and resume its decline?

Some analysts have ascribed tremendous influence to the G7, since the Yen fell by a whopping 5% following its intervention. From a mathematical standpoint, however, it would be virtually impossible or the G7 to single-handedly depress the Yen. That’s because the Yen holdings of G7 Central Banks are decidedly small. For example, the Fed holds only $14 Billion in Yen-denominated assets (compared to the Bank of Japan’s $800+ Billion in Dollar assets), of which it deployed only $600 million towards the Yen intervention effort. Even if the Bank of Japan is covertly intervened (by printing money and advancing it to other Central Banks), its efforts would still pale in comparison to overall Yen exchanges. Trading in the USD/JPY pair alone accounts for an estimated $570 Billion per day. Thus, given the minuscule amounts in question, it would be unfeasible for the Central Banks alone to move the Yen.

Instead, I think that speculators – which were responsible for the Yen’s spike to begin with – purposefully decided to stack their chips on the side of the G7. Given the unprecedented nature of the intervention, and the resolute way in which it was carried out, it would certainly seem foolish to bet against it in the short-term. In fact, the consensus is that, “Investors are confident that the G7 won’t let the yen go below 80 versus the dollar again.” Still, this notion implies that if speculators change their minds and are determined to bet on the Yen, the G7 will be virtually powerless to block their efforts.

For now, speculators lack any reason to bet on the Yen. Aside from the persistent financial uncertainty that has buttressed the Yen since the the 2008 credit crisis, almost all other forces are Yen-negative. First, the crisis in Japan has yet to abate, with this week bringing a fresh aftershock and an upgrading of the seriousness of the nuclear situation. The hit to GDP will be significant, and a chunk of stock market equity has been permanently destroyed.

Thus, foreign institutional interest in Yen assets – which initially surged as investors swooped in following the 20% drop in the Nikkei 225 average – has probably peaked. The Bank of Japan will probably continue to flood the markets with Yen, and the government of Japan will need to issue a large amount of debt in order to pay for the rebuilding effort. Given Japan’s already weak fiscal situation, it seems unlikely that it can count on foreign sources of funding.

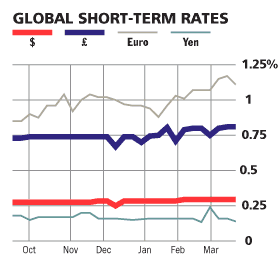

Even worse for the Yen is that Japanese retail traders (which account for 30% of Yen trading) seem to have shifted to betting against it. They are now driving a revival in the carry trade, prompting the Yen to fall to a one-year low against the Euro (helped by the recent ECB rate hike) and a multi-year low against the Australian Dollar. “Data from the Commodity and Futures Trading Commission (CFTC) showed speculators went net short on the yen for the first time in six weeks and by the biggest margin since May 2010 at a net 43,231 contracts in the week to April 5.”

It’s certainly possible that investors will take profits from the the Yen’s fall, and in fact, the recent correction suggests that this is already taking place. However, the markets will almost certainly remain wary of pushing things too far, lest they trigger another G7 intervention. In this way, Yen weakness should become self-fulfilling, since speculators can short with the confidence that another squeeze is unlikely, and simply sit back and collect interest.

It’s certainly possible that investors will take profits from the the Yen’s fall, and in fact, the recent correction suggests that this is already taking place. However, the markets will almost certainly remain wary of pushing things too far, lest they trigger another G7 intervention. In this way, Yen weakness should become self-fulfilling, since speculators can short with the confidence that another squeeze is unlikely, and simply sit back and collect interest.