April 17th 2009

Interview with Karl Denninger: “This is not a time to be in the markets”

As part of a new series, the Forex Blog will begin interviewing other financial columnists/bloggers. The following represents an interview with Karl Denninger of The Market Ticker.

Forex Blog: Your blog is sub-titled “Commentary on the Capital Markets,” so I would like to begin by asking you to outline what you perceive to be the most important themes predominating in today’s financial markets.

Yep. That’s the purpose for The Market Ticker; this has, unfortunately, wound up being populated with plenty of political material out of necessity.

Forex Blog: Your recent posts have danced around- or even directly targeted- the idea that the government’s approach to the credit crisis is misguided, especially the practice of injecting money into banks. Is it safe to say that you think bankruptcy, should it come to that, represents a better solution? In other words, the notion of “too big to fail” doesn’t resonate with you?

The problem with “injecting capital” or any other such nonsense is that it ignores the true problem – too much debt in the system at all levels. There is only one way to fix that, and that is to default it. Whether you CALL that bankruptcy it is bankruptcy; in such a reorganization stockholders are wiped out and the bondholders typically are crammed down in the capital structure, becoming the new stockholders.

IF a firm is “too big to fail” and CANNOT be put back on an even footing through such a process then after we cram down the debt to equity THEN I can justify capital injections – into a firm that would have, at that point, no debt.

Without getting the debt-to-GDP ratio under control we cannot return to sustainable prosperity – this is what governs my position.

Forex Blog: You have suggested that the current crisis is a product of dubious “accounting” practices. Do you think that increased regulation would be necessary, or at least useful, to increase transparency in banks?

Yes.

Glass-Steagall must be restored and strict regulation of banks reinstated. Fractional lending is a government-granted PRIVILEGE and must be so-treated. This means STRICT leverage limits and NO PROPRIETARY TRADING by banks – period. Glass-Steagall was passed because the very same mistakes were made during the 20s and led to unsustainable debt-to-GDP ratios, which was the true cause of The Depression.

The law of exponents makes the outcome of debt-to-GDP expansion inevitable; there is absolutely nothing that can be done about it, and the longer an economy waits to apply the proper corrective action the the worse the damage. In our case we blew it in 2000 by refusing to accept what should have been a severe recession or even a mild Depression at that time, and now are destined to suffer something 2-3x as bad. If we manage to “put it off” again the relief will be even more fleeting in time and the “second leg down” has a high probability of not only being an economic collapse but a political failure as well. Thus my comment that Barack Obama could easily be both “The first Black President AND the last President.”

My fundamental view on this is driven by middle-school level mathematics. Nothing more complex is required to understand it; if you have the mathematical tools to figure out compound interest (exponents) you can “get it”. That we continue to ignore mathematical facts is, in my opinion, truly frightening.

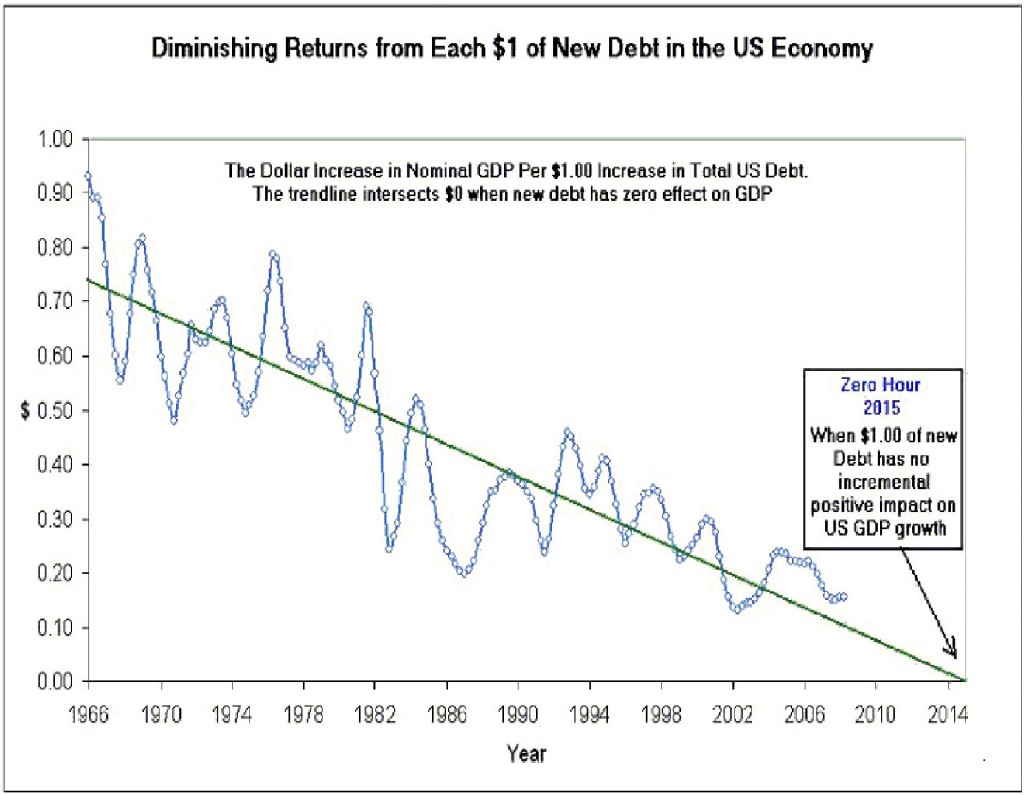

Forex Blog: You published an interesting chart (displayed below) that illustrates the diminishing returns from new debt that finds its way into the economy. Can you elaborate on this idea, and what will happen if/when the “zero point” is reached?

It is possible to get into a negative-feedback cycle where essentially all of the debt must be either liquidated (paid down) or defaulted. The further under zero you go the higher the risk of this event initiating.We had a small version of this in the 1930s. As we are now levered worse than we were then, the consequences could easily be far worse.

Forex Blog: Do you think currency markets currently reflect economic and monetary fundamentals?

Sometimes. Many people believe that the dollar will be destroyed. On the contrary – if we’re screwed the least (even if screwed) the dollar will end up the stronger of the currencies. I am particularly concerned about the Euro, which I believe has a high probability of self-destructing due to the diversity of interests, economic paths, debt levels and general economic health of the nations employing it. This generates extreme internal stresses as the proper liquidity levels for each nation are DIFFERENT. (It is liquidity that controls true interest rates, not the other way around.)

Manipulation can be done but it requires an effective authoritarian government – China is an example of a nation that can and does play with its FX. That we continue to refuse to call it what it is and act on it is extremely damaging to The United States but we have become a parasitic pair with China and their recycling of dollars spent on imports from them. The problem is that if this cycle totally breaks down (as opposed to being somewhat tampered with as has occurred to date) their internal funding needs will cut off the recycling capability and then we’re both screwed.

Forex Blog: On a related note, some analysts predict that the “safe haven” trade, in which risk-averse investors prioritizing capital preservation over yield has contributed to a rally in the US Dollar, will soon give way to trades based on economic growth trajectories. What’s your take?

Risk-aversion allows the government to borrow on the short end and make the mess look better than it really is by decreasing their interest costs. Treasury has done this over the last ten years, shifting the average duration dramatically towards the short end. The danger is the obvious: How do you get out of that hole? If investors shift out of those assets (short-term T-bills) the rise in interest rates that occurs will instantaneously hammer government finances. Then what? If you keep people “in fear” what happens to capital formation and debt other than Treasuries?

This is a trap that can quite easily blow up in our face, and is one of my areas of great concern.

Forex Blog: Finally, what advice do you have for investors that want to beat the market during the credit crisis?

If you’re an INVESTOR this is not a time to be in the markets. I called a long-term SELL signal in January of 2008; you should be in cash or cash equivalents (short-term T-bills) and preserving capital.

IF we get the worst-case scenario there will be a time when assets will be puked up for literally pennies. That’s when you get rich – by buying $200,000 houses for $10,000 – CASH. Of course you have to have the cash; if you’re stuck in anything illiquid, including metals, you’re dead. There were thousands of people who became fabulously wealthy during The Depression. They didn’t short the market – they got out in 28 or 29 and sat on their cash, then bought hard assets when they were puked during the depths of the downturn. 20 years later they were multi-millionaires – and that was a time when having a million bucks was a BIG DEAL. 10 or even 100x profits are entirely possible to realize.

There are places in the residential real estate market where you can do this now, and in my opinion it is just getting started. We’re not at the bottom by any stretch of the imagination – I continue to look for true “stink bid” opportunities and when the time is right I will be all over it. The same is true for stocks; there will be a true buy of a lifetime, but it’s not today.

If you’re a trader, on the other hand, there are tremendous profits to be made in this market. While the drawdown last year looked bad, I believe there is a worse one in terms of percentage moves coming. The exact timing cannot be predicted but the outcome of our present policies is a matter of mathematics – unless the trajectory is altered we are simply arguing over timing. I have a nicely positive account delta since the start of 2008 – close to 10% – yet I never put more than 10% of my capital at risk. That is NEVER possible in a Bull Market without risking the loss of everything, yet the bounce off “666” in the S&P 500 was just such an opportunity recently. Here, unfortunately, that rally is long in the tooth and you’re “chasing” – I’m searching for a good opportunity to get short on a broad index perspective here but at present have no position in that regard as I took the long-side profits and yet believe it may be a bit early on the next major leg down. I’d rather miss the first 10% of a move than end up eating a 20% loss.

If you believe in hyperinflation in our future (I don’t) then I would buy LEAP CALLs on the broad indices 20% or so out of the money as far out in time as you can get. If that scenario occurs you can protect your wealth with a roughly 10% “insurance premium”, in that such a scenario would have the DOW and other indices skyrocket in numerical value while the dollar collapsed. This is, in my opinion, vastly superior to metals which at best will maintain parity with any devaluation, meaning that you have to stick ALL of what you want to protect in there and if you’re wrong Gold could collapse to $200/oz quite easily, costing you 80% of your money. If you’re wrong and buy the CALLs you’re only out the purchase cost; this, to me, appears to be a far-superior strategy – or a hedge, if you think you need it.

I do not have that trade on as I have no expectation of such a “hyperinflation” outcome and place the probability of such in the vanishingly-small category.

Thanks Karl. To keep up with Mr. Denninger’s latest thoughts check out The Market Ticker.