June 14th 2011

S&P 500 Decouples from Euro?

While I have written quite about forex correlations in recent posts, the focus has primarily been on correlations that exist between currencies. In this post, I would like to address a correlation that exists between currencies and other forex markets- specifically the relationship between the Euro and US stocks.

If you look at the chart above, you can see that an unmistakable correlation exists between the S&P500 and the EUR/USD that stretches back at least six months. Generally speaking, when the EURUSD has risen, so has the S&P 500, and vice versa. In fact, this correlation is so airtight that one analyst recently discovered that the two financial vehicles often reach intra-day highs and lows within minutes of one another!

Why is this the case? In a nutshell, it is because the Euro – especially relative to the dollar – is a proxy for risk appetite. The same is necessarily true for US stocks. When investors are confident in the strength of the global economic recovery and the possibility of crisis is distant, the euro will rise. This has nothing to do with fundamentals in Europe, which are probably at least as bad as they are in the US. Of course, it may be connected with dollar weakness, since it is arguably the case that quantitative easing has both depressed the dollar and buoyed US stocks.

As I intimated in the title of this post, however, the S&P recently decoupled from the euro. Since the beginning of June, US equities have declined sharply, to the extent that they have given back most of their gains in the year-to-date. The EUR/USD, meanwhile, continued rising all the way until last week. While this has happened on a couple previous occasions, this was perhaps the sharpest break between the two.

I’m personally at a loss to explain why this happened. It has been conjectured that the driving force behind the correlation is algorithmic trading, and that hence, it must also represent the source of the break. In other words, high-frequency traders – which account for an ever-increasing proportion of forex volume – tweaked their trading algorithms so as not to buy the S&P 500 when the EURUSD rises, and vice versa.

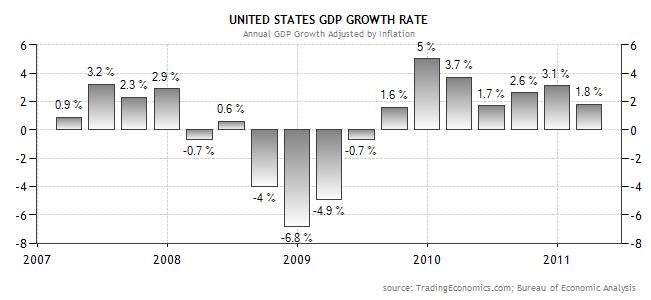

It’s probably also the case that S&P 500 was falling for endogenous reasons- specifically a decline in GDP growth and earnings expectations which need not necessarily reflect itself in a stronger euro. In fact, in a normal functioning market, you would expect an inverse correlation; strong US economic fundamentals should translate into both a strong dollar and rising stocks. Could it be that worsening fundamentals are manifesting themselves in the form of a weak dollar and weak stocks?

Alas, the correlation has re-established itself over the last week, which means this is largely a moot issue. At the very least, it’s still worth being aware of, both insofar as it remains intact and in the event that it breaks down again.