January 2nd 2011

Euro: Which Investors Know Best?

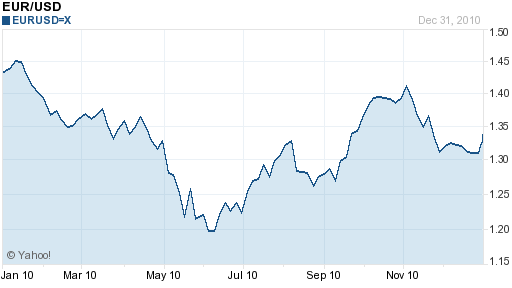

As the WSJ recently pointed out, there is a bizarre disconnect between equities and currency markets regarding the Euro. On the one hand, the Euro was the world’s worst performing major currency in 2010, and some analysts insist that its breakup is inevitable. On the other hand, stock market investors are increasingly bullish about Europe: “We remain positive on the outlook for [European] stocks in 2011, with a favorable macro backdrop, solid earnings and attractive valuations.” Who’s right?

In fact, both sets of investors are justified. As you would expect, stock market investors are focusing on corporate earnings and the macroeconomic environment. In this regard, the fact that the EU economy expanded in 2010 – buoyed by a cheap currency and loose monetary policy – should certainly be reflected in a stronger stock prices. On the other hand, the sovereign debt crisis in EU has not yet abated, and accordingly, it is still being priced into EUR/ exchange rates.

In the immediate short-term, it’s possible that stock market investors will prevail and that that their collective view will be adopted by currency markets. According to Deutsche Bank, “The euro may rise to $1.45 by the end of the first quarter of next year, as concerns about the single-currency area’s indebted periphery diminish.” Meanwhile, China recently pledged its support for the Euro via a promise to purchase up to €5 Billion in Portuguese Sovereign debt. Over the short-term, then, it’s possible that (currency) investors can be persuaded to temporarily forget about the prospect of default, and focus instead on the Eurozone’s nascent economic recovery.

Over the medium-term, however, the markets will have no choice but to return their attention to the possibility of default, which is why the same team of analysts from Deutsche Bank “forecasts the euro will fall back to $1.40 by the end of the second quarter and to $1.30 by the year-end.” For example, Eurozone members will need to issue more than €500bn in debt in 2011, including €400bn that needs to be refinanced by Spain and Italy. In this context, China’s purchases will fade to the point of becoming trivial.

Meanwhile, Moody’s has warned that it could follow up on its 5-notch downgrade of Ireland’s sovereign credit rating with further downgrades for Spain and Portugal. Fitch added that it might bump Greece’s rating to junk status, which would deal a significant blow to its solvency. Default is now rapidly on course to becoming a self-fulfilling prophecy, as fleeing investors cause yields to rise and credit ratings to fall, further scaring away more investors.

The EU response has been to “set up a permanent mechanism from mid-2013,” while investors continue to push for an expansion of the European Financial Stability Facility or the joint issuance of European sovereign bonds. As a result, the Center for Economics and Business Research has issued a striking forecast that there is an 80% probability that the European Monetary Union will dissolve over the next decade: “If the euro doesn’t break up, this could be the year when it weakens substantially towards parity with the dollar.” Already, spot market traders are once again increasing their short bets for the Euro, and options trading remains “skewed toward euro puts.”

To be fair, some analysts continue to insist that it is better to think of the sovereign debt problems as a crisis of credit, rather than of currency. In that sense, there is hope that a solution can be engineered (perhaps encompassing a default) that doesn’t endanger the existence of the Euro. In addition, the Euro finished 2010 on a high note, formally welcoming Estonia into the fold. It is 10% above its June trough, including a 2% rise in the month of December. Given all of the bad news in 2010, that might just be cause for optimism.