November 10th 2010

New Zealand: No Forex Intervention

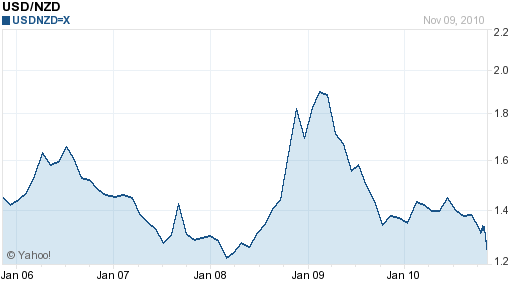

Despite reaching a temporary stalemate, the currency war rages on, and individual countries continue to debate whether they should enter or watch their currencies continue to appreciate. Nowhere is that debate stronger than in New Zealand, whose Kiwi currency has fallen 37% against the US Dollar since its peak in early 2009, and over 15% since June of this year.

With most countries, the war cries are coming from the political establishment, who feel compelled to demonstrate to their constituents that they are diligently monitoring the currency war. This is largely the case in New Zealand, as Members of Parliament have argued forcefully in favor of intervention. Prime Minister John Key is a little more pragmatic: He “says his Government is concerned about the strength of our dollar, but is not convinced intervention would work…politicians who think intervention can happen without economic consequences, are fooling themselves.” Showing an astute understanding of economics, he pointed out that trying to limit the Kiwi’s appreciation would manifest itself in the form of higher inflation, higher interest rates, and/or reduced access to capital.

This is essentially the position of Alan Bollard, Governor of the Central Bank of New Zealand. He has insisted (correctly) that the New Zealand is being driven up, so much as its currency counterparts – namely the US Dollar – are being driven downward, by forces completely disconnected from New Zealand and way beyond its control. Thus, if New Zealand tried to intervene, it would quickly be overpowered (perhaps deliberately!) by speculators. Ultimately, it would end up spending lots of money in vain, and the Kiwi would continue to appreciate.

Mr. Bollard has pointed out that a stronger currency is not without its perks: such as lower (relative) prices for certain natural resources, such as oil. In addition, since New Zealand is largely a commodity economy, its producers are being compensated for an expensive currency in the form of higher prices for milk, wool, and other staple exports. While its other manufacturing operations have been punished by the expensive Kiwi, its economy is still relatively robust. Thanks to a series of tax cuts and the lowest interest rates in New Zealand history, GDP is forecast to return to trend in 2010 and 2011.

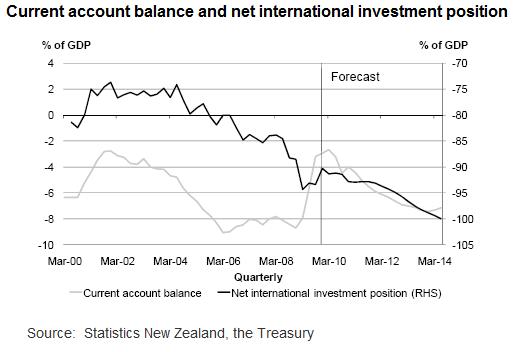

New Zealand’s concerns are understandable, and there is an argument to be made for preventing the Dollars that are printed from the Fed’s QE2 from being put to unproductive purposes in New Zealand. At the same time, New Zealand is not such an attractive target for speculators. Its benchmark interest rate, at 3%, is relatively low compared to developing countries. Its current account balance is projected to continue declining, perhaps down to -8%, which means that the net flow of capital is actually out of New Zealand. In addition, while the Kiwi has appreciated against the US Dollar, it has fallen mightily against the Australian Dollar en route to a multi-year low.

Going forward, there is reason to believe that the New Zealand Dollar will continue to appreciate against the US Dollar as a result of QE2 and a general sense of pessimism towards the US. The same is true with regard to currencies that actively intervene to prevent their currencies from appreciating. Still, I don’t think the New Zealand Dollar will reach parity – against any currency – anytime soon, and after the currency fracas subsides, it will probably trend towards its long-term average.

November 12th, 2010 at 2:44 am

Sooner or later this intervention will come, especially because of the old saying that when a politician tells you one thing, you can be sure the reality is the other way around. The US Feds are stimulating the market by pumping-in money, the Japanese are eager to devalue their Yen in case the US stimulus will continue to devalue the USD, Australia recently had some interventions… NZD’s time will come, that’s for sure…

November 17th, 2010 at 2:24 am

Reading the above suggesets that anyone exporting commodities is directly compensated for an appreciating currency by appreciating commodity prices. The reality on the farm in New Zealand is quite the opposite, particlarly sheep and beef where appreciating currency results in falling schedules as our product becomes too expensive for our overseas customers. With a NZ average, over the past twenty odd years, return on equity of 1.5% for a sheep and beef farm and 2.5% for the average NZ dairy farm, currency speculators may do very well out of the NZ dollar but the primary producer very rarely does. Theory is all well and good but reality is not always so clear cut.