June 17th 2010

Further Delays in RMB Appreciation

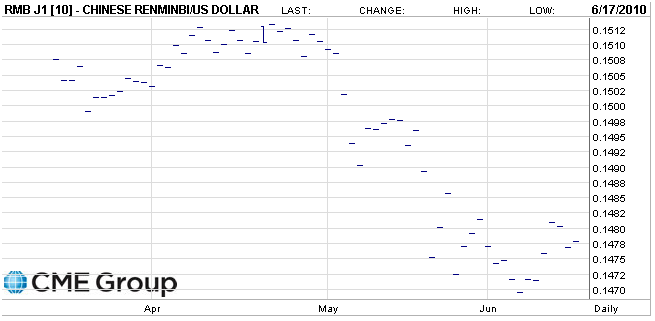

Throughout 2010, I have continuously reported on the apparent inevitability of the Chinese Yuan appreciation. That the currency still remains firmly fixed in place against the Dollar is a testament not only to the unpredictability of forex, but also to the doggedness of Chinese officials.

It seemed that China’s policymakers were all but set in February to allow the currency to resume its upward path (its appreciation was halted in 2008). If anything, the case for appreciation is stronger now than it was then. China’s economy grew by a blistering 11.9% in the first quarter. The bilateral trade surplus with the US has widened on the basis of strong export growth. Inflation has exploded, and there is a property bubble that refuses to cool.

Allowing the RMB to appreciate would cool China’s economy and presumably induce a moderation in inflation. In the short-term, it would lead to a slight expansion in the trade surplus (since prices would rise, but quantity would remain unchanged), but this would also moderate over the medium term. Decoupling from the Dollar would also enable China to pursue a more flexible monetary policy; in this case, that means raising interest rates to cool the property bubble as well as the economy at large. As Treasury Secretary Timothy Geithner himself has noted, ” ‘It’s in China’s interest to move.’ “

In the same speech, Secretary Geithner conceded that China is still dragging its heels: ” ‘I do not know if we are at the point now where we will see meaningful progress in the short-term.’ ” This inkling was confirmed by the Chinese Foreign Ministry, “China will reform its exchange-rate mechanism based on developments in the global economy and its own economic performance.” Chinese President Hu JinTao, meanwhile, has personally pledged to a visiting delegation from the US State Department to “continue reform of his country’s exchange-rate regime.”

This isn’t doing much to assuage American lawmakers, whom are currently being slighted by both sides. While China irks Congress by refusing to adjust the RMB, the Treasury Department is also irritating it by both refusing to label China a currency manipulator and by not establishing a deadline for appreciation. As a result, “There is a broad consensus in Congress for a simple proposition: ‘China is not acting in good faith and is aggressively engaged in a series of troubling and downright protectionist policies that put our economic relationship at risk.’ ” Finally, it seems that rhetoric will become reality, as a bill is currently being mulled that would aim to punish China (via punitive tariffs and WTO action) for failure to revalue.

Analysts are not optimistic. “The yuan’s 12-month non-deliverable forwards were at 6.7415 per dollar…reflecting bets for a 1.2 percent strengthening over that timeframe.” That’s down from expectations in April of a 3.5% appreciation. Some still believe that China will revalue in the third quarter, but there is no longer any force behind those predictions. Meanwhile, China continues to make long-term plans for its foreign exchange reserves, which indicates that it has no intention of unloading it as part of a controlled RMB appreciation. At this point, it’s essentially a game theory problem: when will China budge?

June 22nd, 2010 at 10:38 am

[…] was only last week that I mused about “Further Delays in RMB Revaluation.” Lo and behold, over the weekend, the Central Bank finally budged, by pledging to the […]

August 30th, 2010 at 8:42 am

I do not know if we are at the point now where we will see meaningful progress in the short-term.