May 6th 2010

Greek Debt Crisis Widens

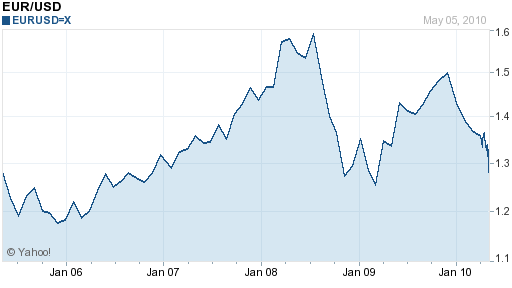

I must confess: I never expected the Greek debt crisis to reach such a dire threshold in such a short time period. Over a matter of mere months, the Euro has fallen 15% against the Dollar. That’s the kind of drop that you would have expected from the Greek Drachma, not from the Euro!

Moreover, it’s not as if this slide is anywhere close to abating. “I don’t think you’d want to bet on a bottom, at this stage, in euro. We’re headed closer to $1.2000 at some point in the game. It’s just a question of when,” said one prominent analyst. Meanwhile, net shorts against the Euro have reached a record 89,000 contracts, according to the weekly Commitments of Traders report. What is producing this swell of bearish sentiment, which is causing the markets to trade in a manner best described as “panic mode?”

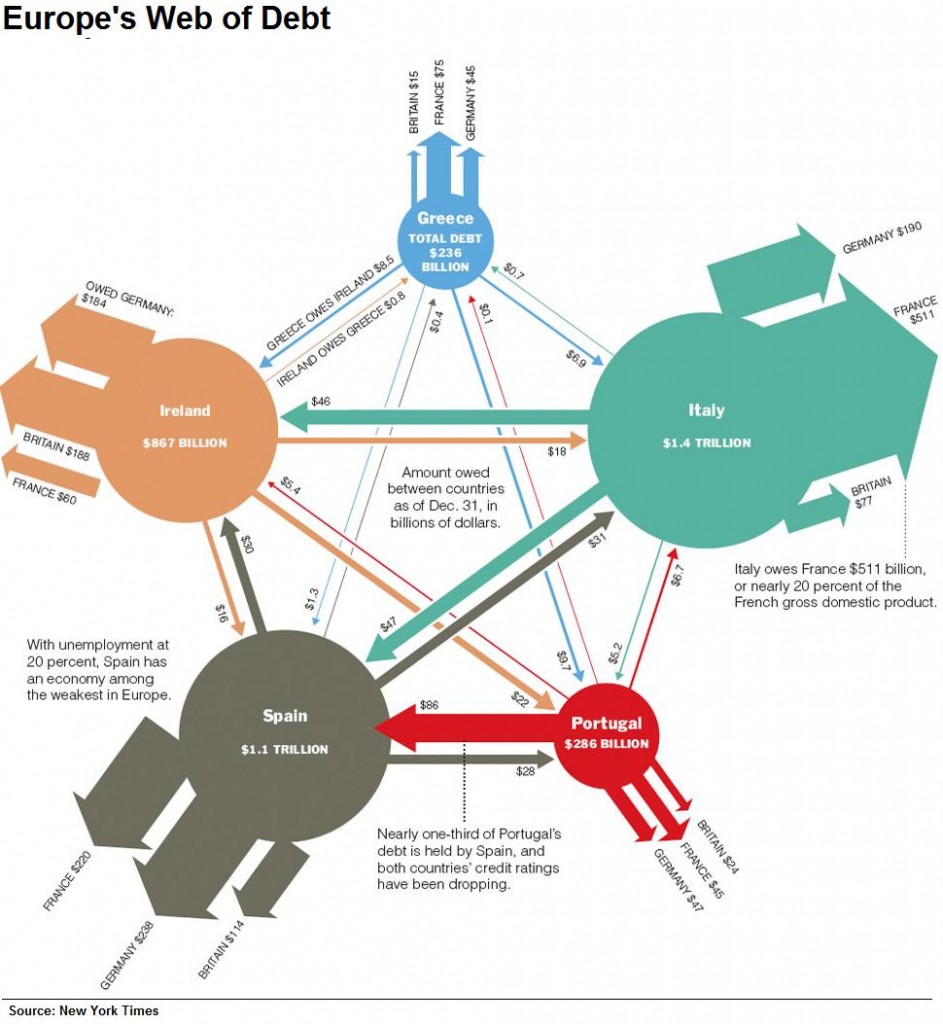

The answer, it seems, is a self-fulfilling belief not only that Greece will default on its debt, but also that the credit crisis will spread to the rest of Europe. Greek interest rates recently topped 8%, and the spread with comparable German bonds (this spread has become a crude way of gauging the seriousness of the crisis) is close to an all-time record. Credit default swaps, which insure against the risk of default, surged to 674 bas points, reflecting a 15% probability of default. Meanwhile, credit default swap spreads on Spanish and Portuguese debt is also creeping up.

At this point, there seems to be very little that Greece can do to mitigate the crisis. It has already announced a series of austerity measures, including wage cuts and tax hikes, designed to narrow its budget deficit. In addition, it has successfully obtained an aid package from the EU and IMF, valued at $160 Billion. In April, it successfully refinanced $12 Billion in debt, even though experts insisted that such would be very difficult, given current investor sentiment.

On the other hand, the austerity measures were met with riots, which left 3 people dead, and signaled that the Greek citizenry would sooner vote out the incumbent government than accept their proposals to reduce the budget deficit. Speaking of which, under the best case scenario, the deficit will decline to a still-whopping 8% of GDP in 2010 (from a revised 13% in 2009), and Greece’s budget will remain in the red until at least 2014, by which point its gross national debt is projected to have reached 140% of GDP. Of course, this assumes that GDP growth will turn positive in 2012, and this is no guarantee. Meanwhile, the aid package will probably be enough to tide Greece over for only about 18 months, after which point it will have to return to the capital markets. Even before it can tap the bailout, it must first refinance another $10 Billion in debt in May.

In other words, even if Greece can forestall default for 2010 and 2011, who’s to say that it won’t default in 2012? With this possibility in mind, it makes it very unlikely that investors will continue to buy Greek bonds at all, let alone at affordable interest rates. “People are becoming well aware of the fact that the solvency issue for Greece hasn’t been resolved with the aid package. They still have to repay the money. They still have to repay the interest.”

Finally, there is the risk that the crisis will spread to the rest of Europe. Both the IMF and the Spanish government have been busy refuting rumors that Spain is seeking a similar bailout. Regardless of its veracity, the fact that such a rumor even exists will be enough to make investors sweat. When investors get nervous, they stop buying government bonds and/or demanding higher interest rates, which ironically only makes it more likely that the government in question will default. Fortunately, it seems that Spain (and its neighbor, Portugal) are in strong enough shape that they could survive a sudden speculative attack from investors.

Greece, however, is basically a lost cause. “Greece is functionally bankrupt,” and the only solution is for it to leave the Euro and/or default. Until that day comes, uncertainty will persist, and investors will continue to doubt the Euro.

May 8th, 2010 at 3:33 pm

does it look probable that the EUR/US exchange could hit $1.2000 within the next week depending on the outcome of German elections?

May 12th, 2010 at 10:23 am

[…] Forex « Greek Debt Crisis Widens | Home […]

May 12th, 2010 at 1:26 pm

This is an excellent post which clearly shows the mamouth scale of europe’s debt. Lets hope the currency and markets dont get too volatile for the sake of interest rates.