May 19th 2010

Failed Euro Bailout Would Buoy Yen

Given that only a week has passed since the bailout of Greece was formally unveiled, it’s still too early to determine whether the plan will be success. Regardless of how it ultimately plays out, though, the bailout (not too mention the concomitant crisis) is shaping up to be THE big market mover of 2009. As investors reposition their chips, some early front-runners are emerging. It might surprise you that one such leader is the Japanese Yen.

Given that only a week has passed since the bailout of Greece was formally unveiled, it’s still too early to determine whether the plan will be success. Regardless of how it ultimately plays out, though, the bailout (not too mention the concomitant crisis) is shaping up to be THE big market mover of 2009. As investors reposition their chips, some early front-runners are emerging. It might surprise you that one such leader is the Japanese Yen.

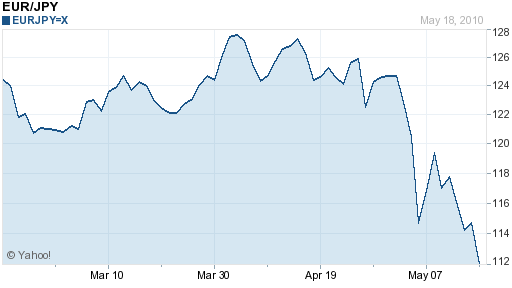

On the surface, the Japanese Yen would seem to be an excellent candidate for shorting, especially in the context of the the Greek fiscal crisis. Its fiscal and economic fundamentals are abysmal, and by most measures, it’s debt position is among the least sustainable in the world, behind even Spain, Portugal, and the US. At the same time, the Yen has risen by an unbelievable 8% against the Euro in the last week alone, and many analysts are predicting it will emerge as one of the winners of this episode.

Why? First of all, with confidence in the Euro flagging, the Yen (and the Dollar) gain luster as the only viable reserve currencies. Regardless of what you think about Japan’s fiscal fundamentals, the longevity at the Yen means that it is inherently safer than the Euro, which may not even exist (in its current form, at least) in a few years time. Second, the current consensus is that the Euro bailout will fail, and as a result, risk tolerance is running low at the moment. With this in mind, it’s no surprise that traders are unwinding their carry trades and that the Yen – “The low-yielding currency of a deflation-prone economy of high savers…entrenched as the world’s funding currency” – has rallied.

Analysts have been quick to point out that the rest of Asia (among other regions) are on the other side of this trend. The concern is that the bailout won’t be enough to prevent a repeat credit crunch and that confidence in investments/currencies that are perceived as risky will remain low.

China could be hit especially hard. Since the Chinese Yuan is pegged to the Dollar (and even it wasn’t), it has risen by a whopping 15% against the EUro over the last six months, severely crimping exports to the EU. In addition, “Chinese exporters rely very heavily on bank letters of credit to finance their shipments…When banks have trouble borrowing money themselves — as has been happening as a result of worries about European banks’ possible losses from the region’s sovereign debt crisis — they tend to cut sharply the issuance of letters of credit for trade finance.” It’s no wonder that the Chinese stock market has tanked 21% so far in 2010, and that the Central Bank continues to delay revaluing the RMB.

Of course, if the plan turns out to be a success, than the opposite will probably obtain. “In this case…the currency of any emerging market or advanced economy exposed to the Asian region’s impressive, China-led economic growth,” will probably rally. “It could be the South Korean won, the Australian dollar, or the currencies of commodity-producing countries like Brazil.” The Japanese Yen, meanwhile, will probably be hit with a dose of reality, followed by a double dose of the carry trade.

May 19th, 2010 at 8:10 pm

Long term Japan’s prospects don’t seem too bright; significan population decline will make it difficult to generate any domestic growth.

May 21st, 2010 at 3:33 am

The yen form Japan is likely to emerge as the best candidate for shoring. This can be seen prominently in the case of Greek Fiscal crisis.