May 12th 2010

Euro Still Doomed, Despite Bailout

In my last post, I reported that the markets were incredibly bearish on the Euro, due to concerns that the Greek debt crisis could neither be mitigated nor contained. By following up on this report with another incantation of Euro bearishness, I certainly run the risk of belaboring the point. Still, the fact that since then, a $1 Trillion bailout was announced means that at the very least, I need to offer an update!

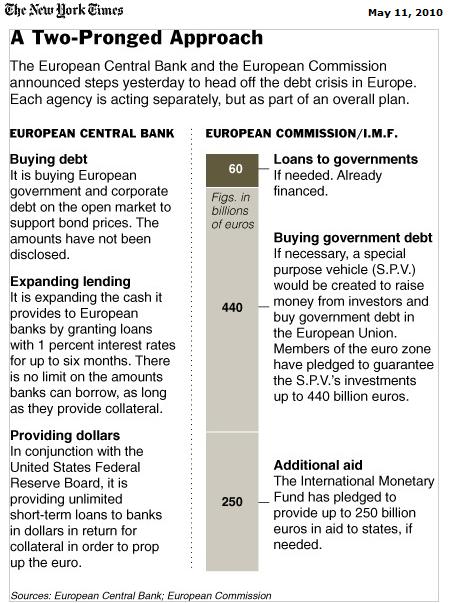

Anyway, in case you have been living in a cave, the EU finally put its money where its mouth was by forming a €750 Billion Special Purpose Vehicle (SPV) to address the fiscal problems of currently-ailing and potentially-ailing economies. The brunt of financing the SPV will fall on individual Eurozone countries, though the European Commission and the International Monetary Fund (IMF) will also make sizable contributions. In addition, the European Central Bank (ECB) has agreed to purchase an indeterminate amount of government and corporate bonds, while other Central Banks will use currency swaps to ease pressure on the Euro.

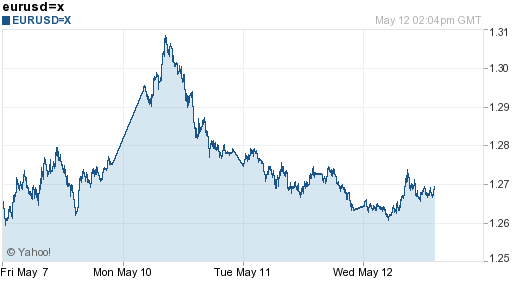

The reaction to the news was quite positive, with the Euro reversing its 6-month slump and rallying 2.7% against the Dollar. Equity shares surged on the news: “A a 50-stock mix of European stocks jumped 10.4 percent, Spain’s market soared 14.4 percent, France’s rose 9.7 percent and Germany’s gained 5.3 percent.” Sovereign debt and credit default swap prices also rose as investors moved to price in a decreased likelihood of default.

The celebration was short-lived, and by Tuesday (yesterday), the Euro had already returned to its pre-bailout level against the Dollar. In hindsight, it looks like the rally was the result of a classic short-squeeze. On Sunday, the Financial Times reported that “Positioning data from the Chicago Mercantile Exchange, often used as a proxy for hedge fund activity, showed speculato,rs increased their short positions in the euro to a record 103,400 contracts, or $16.8bn in the week ending May 4.” After the most exposed short positions were covered, however, the rally quickly came to an end: “By the time markets opened in the United States, and American hedge funds entered the market, the euro’s rally began to flag.”

Indeed, it’s hard to find anyone that has anything positive to say about the bailout, even among the bureaucrats and politicians that contrived it. Here’s a smattering of soundbites:

- “Angela Merkel, the Iron Chancellor, has rolled over and we are being taken to the cleaners.”

- “We’ve just kind of kicked the can down the road. Sovereign debt, like all debt, ultimately has to be repaid.”

- “The bailout is ‘another nail in the coffin…This means that they’ve given up on the euro.”

- “Lending more money to already overborrowed governments does not solve their problems.”

- “It was crucial to stop the panic, and this package has done it, but it doesn’t solve the longer-term problems which are slowly undermining the value of the euro.”

- “It’s pretty disappointing that [the] euro only rallied a couple of cents on the back of a trillion dollars.”

There are a few specific concerns about the bailout. First of all, it’s still unclear how it will be paid for and how it will be implemented. How will specific loans be issued, and what will be the accompanying terms? Second, it does nothing to address the underlying fiscal problems that precipitated the crisis, and may in fact exacerbate them since countries have less of an incentive to rein in spending. As one analyst summarized, “Bailing out economies creates moral hazard. Other countries may continue to skirt the kinds of actions that would lower their budget deficits and debt loads…because they too can expect to be rescued.” Finally, the bailout does nothing to mitigate credit risk for private lenders; it merely transfers and expands it, since money that would have been lent to Greece (and other problem countries) anyway, will still be lent to them, after first being funneled through the SPV. In short, “Once market participants look at the actual details of this plan, they are not going to want to buy the euro either.”

As everyone has been quick to point out, the bailout probably makes a (partial) dissolution of the Euro even more likely, because it is tantamount to deflating the currency. As one economist opined, “The euro zone does not look viable in its current form. The basic premise…to unify monetary policy….while keeping fiscal policy completely separate…has completely broken down.” The only solution which will leave the Euro intact is for the weakest members to leave, and for a solid core of economically and fiscally sound economies to remain behind.

To be fair, the EU has certainly bought itself some time. Given that the amount of money pledged to fight the debt crisis well exceeds Greece’s public debt, it won’t be Greece that brings down the Euro. If/when the debt problems of Spain, Portugal, and Ireland become insoluble, however, the futility of the bailout will become abundantly clear.

May 12th, 2010 at 12:42 pm

Will this be like post WW II?

June 5th, 2010 at 11:40 am

[…] the last time I reported on the Euro, the bad news has continued to pour in. Spain officially lost its AAA credit rating, […]