May 4th 2010

Emerging Markets Mull Currency Controls

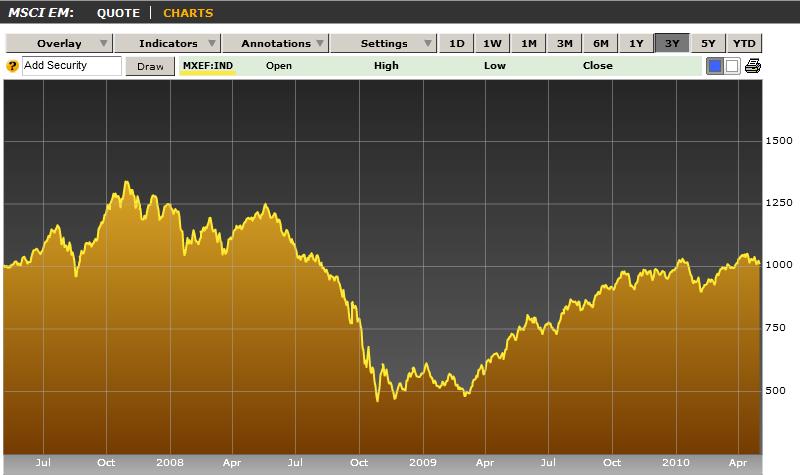

The rally in emerging markets that I wrote about in April is showing no sign of abating. The MSCI emerging market stocks index is back to its pre-crisis level, while the EMBI+ emerging market bond index has surged to a record high. While no such index (that I know of) exists for emerging market currencies, one can be quite certain that at the very least, it too would also have returned to its pre-crisis level.

The Greek fiscal crisis, far from discouraging risk-averse investors from emerging markets, appears to instead be spurring them closer. From a comparative standpoint, emerging market governments are in much better shape than their industrialized counterparts, to say nothing of Greece. Credit ratings on a handful of emerging market debt issues are gradually being raised, whereas Greece was downgraded to junk status. Summarized one investor: “This is a group of countries with relatively strong balance sheets offering attractive levels of yield.”

It’s no wonder then that capital inflows into emerging market debt has already set an annual record (for 2010), despite the fact that we are only four months into the year! “The World Bank predicts as much as $800 billion in global capital flows this year, compared with about an annualized $450 billion to developing economies in the second half of 2009.” In addition, whereas institutional investors previously insisted on funding only those issues that were denominated in foreign currency (such as Dollars or Euros), now they seem to have a preference for so-called local currency debt. According to one emerging markets fund manager, “We expect local currency to be our biggest theme going forward.”

The real story here, however, is less the growing investor interest in emerging markets (which is now well established), and more the growing ambivalence of emerging markets. No doubt grateful to be attracting record sums of capital at lower-than-ever interest rates, emerging market governments are nonetheless unhappy about the resulting currency appreciation.

Taiwan has emerged as the unlikely voice of emerging markets on this issue. Its Central Bank recently “asked 65 banks for details of their foreign-currency lending to make sure exporters and importers aren’t using the loans to speculate on the island’s dollar,” and urged its peers to “adjust their monetary policies to address the disorderly movements of exchange rates.”

It doesn’t need to prod too hard, however, since a handful of Central Banks have either already intervened or are seriously considering intervention. Last month, Poland intervened by selling the Zloty against the Dollar. The Central Bank of South Africa cut interest rates by 50 basis points in March, despite surging inflation. Brazil continues to hold auctions to buy Dollars on the spot market, while India mulls implementing some form of a Tobin tax on currency transactions.

Not long ago, such measures would have been criticized as protectionist and against liberal, free-market principles. Not anymore. The International Monetary Funds (IMF), recently “urged developing nations to consider using taxes and regulation to moderate vast inflows of capital so they don’t produce asset bubbles and other financial calamities.” Private-sector economists agree, with Standard Chartered Bank arguing that “Emerging markets need to take ‘urgent action’ on the surge of liquidity and capital flowing into their economies because they could spur inflation and trigger another crisis,” much like “excess liquidity contributed to problems in the Western developed economies ahead of the financial crisis.”

In short, emerging markets have the green light to go ahead and stop their currencies from appreciating. But will they act on it?