May 2nd 2010

China’s Forex Reserves Surge to New Record

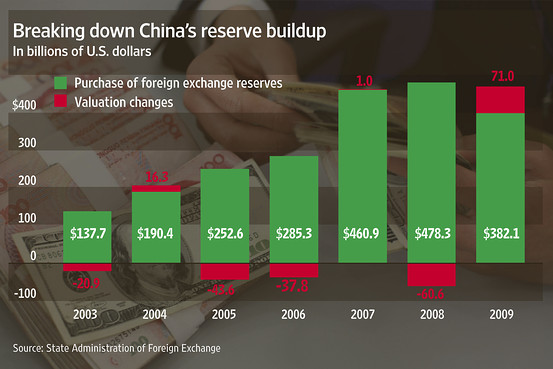

Interesting, the rate of reserve accumulation has slowed markedly from 2009. In the first quarter of 2010, the reserves grew by “only” $45 Billion, compared to growth of $125 Billion in the fourth quarter of 2009. There are a couple key explanations for this slowing. First, China’s trade balance has narrowed considerably over the last twelve months, to the point that it in March, it recorded its first trade deficit in six years. Second, China tallies its reserve growth on a net basis – after accounting for changes in valuation. Given that the majority of China’s reserves are still denominated in US Dollars, then, the Dollar’s appreciation over the last quarter may have shaved $40 Billion from the accumulation of new reserves. With this in fact in mind, the actual slowdown is probably much less pronounced than the numbers would suggest.

Besides, exports and foreign direct investment both continue to grow at healthy clips, which means there is nothing (barring a revaluation of the RMB) which could significantly slow reserve accumulation going forward. Even with a revaluation (that many experts believe is imminent), the need to further accumulate reserves will not be impacted, because the RMB will certainly continue to be pegged to the US Dollar. In order to prevent price inflation (which is already creeping up) from reaching dangerously high levels, then, the government will have no choice but to continue to soak up all capital inflows for as long as the RMB remains pegged.

Experts estimate that more than 2/3 is still denominated in USD. Since the Chinese RMB is also pegged to the Dollar, that means that as the RMB appreciates against the Dollar, the value of its reserves will fall in local currency terms. Rectifying this problem is basically impossible, as the EU sovereign debt crisis has demonstrated. It has looked into the possibility of investing in alternative assets such as Gold, Oil, and other commodities but there is simply not enough global supply to soak up more than a small fraction of China’s $2.5 Trillion. For all of the problems with the Dollar, the alternatives are just as bad, if not worse. At this point, the best China can hope for is to “cut its losses” by revaluing sooner rather than later.

May 4th, 2010 at 5:08 pm

Ummmm, how is revaluing “cutting losses”??

If you revalue the Yuan higher vs. the dollar in reserve, your reserves go down and you lose money. you meaning the Chinese gov’t.

June 11th, 2010 at 6:54 am

Forex market is complicated but still challenging to get cash from there. It’s about how to trade in this market for long term.