February 12th 2010

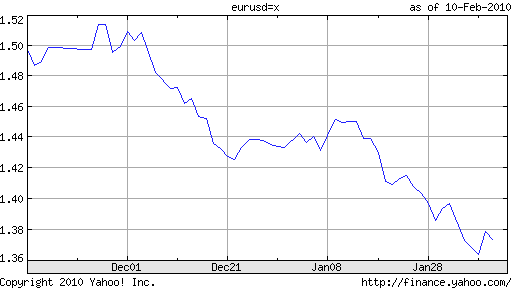

Could Greece’s Fiscal Problems Really Sink the Euro?

Currency markets operate in funny ways. Greece’s fiscal problems are hardly a new development. During years of boom and bust alike, it ran unsustainable budget deficits. Why investors have decided to fret now – as opposed to last year or next year, for example – on the distant possibility of default, is somewhat mysterious.

After all, the credit crisis exploded in 2008, and conditions now are inarguably more stable than they were at this time last year, when volatility and credit default spreads (insurance against bond default) – two of the best measures of investor risk sensitivity – were still hovering around record highs. On the other hand, the unveiling of Dubai’s hidden debt problems, has certainly provided impetus to investors to re-evaluate the fiscal situations in other highly leveraged economies. In addition, Greece just estimated that its budget deficit for 2010 at 12.7%, 4% higher than earlier estimates, which were also shockingly high. Regardless of 1, the markets are now focused firmly on Greece – and by extension, the Euro.

How serious are Greece’s fiscal problems? Serious, but not insurmountable. Its sovereign debt recently surpassed 125% of GDP, higher than the US, but lower than Japan, for the sake of comparison. Of course, the Greek economy is hardly a picture of robustness. Neither is the US, these days, for that matter, but its size means that it is pretty much immune from speculative attacks on its credit and capital markets. Greece, on the other hand, remains extremely vulnerable to the whims of international investors.

On the whole, these investors still remain willing to finance Greece’s budget deficits; the last bond issue was five times oversubscribed, which means that demand exceeded supply by a healthy margin. Still, interest rates are rising quickly, and spreads on credit default spreads have risen above 400 basis points, suggesting that nervousness is growing and Greece cannot take for granted that future bond issues will be met with such healthy demand.

In this context, in stepped the European Union. In fact, it isn’t even clear if Greece asked for help. As I pointed out above, the Greek debt “crisis” is largely playing out in capital markets, and doesn’t necessarily reflect a change in the fiscal reality of Greece. Still, leaders of the EU were alarmed enough to convene a meeting between the finance ministers of member states, to discuss their options.

After weeks of denial that any kind of aid to Greece was being considered, EU political leaders announced that they were prepared to step in to help after all, but they were vague on the details. There were no ledges of specifc dollar amounts, only hazy promises of support should conditions warrant it. In the end, what was clearly intended to comfort the markets achieved the opposite effect, as investors took no comfort in the “moral support” and worried about the new uncertainty.

It’s premature to say whether this whole episode will threaten the viability of the Euro. Much depends on whether Greece (Portugal and Spain, too, for that matter) can get its fiscal house in order (Among other things, it has promised to reduce its 2010 budget deficit by 4%). More importantly, it depends how, and to what extent, the EU responds to this crisis as a community. The Euro is already 10 years old, and you would think that it would have been accepted already within the EU, as it has by the rest of the world. On the contrary, it remains deeply divisive and fraught with politics. Many of its critics have seized on this opportunity to challenge to raise fresh calls for its abolishment. If the problems of Greece deteriorate to the point that other EU members are actually required to intervene, you can expect these calls to crescendo.

February 12th, 2010 at 1:42 pm

[…] gold and silver in troubled times.James Chen sees a continuation of the steep downtrend Euro/Dollar.Adam Kritzer wonders if the Greek problems could sink the Euro.That’s it. Have a great weekend!Want to see […]

February 13th, 2010 at 4:44 pm

Interesting post, but there’s no way the viability of the Euro is threatened. It is just as likely as the viability of the Dollar being threatened. Greece will get bailed out – if it turns out that they really need to be bailed out.

February 15th, 2010 at 11:04 am

“Greece’s fiscal problems are, as I have argued many times, but the tip of a global iceberg.”

Nouriel Roubini on “Teaching PIIGS to Fly”

http://www.project-syndicate.org/commentary/roubini22/English