February 15th 2010

CAD/USD Parity: Reality or Illusion?

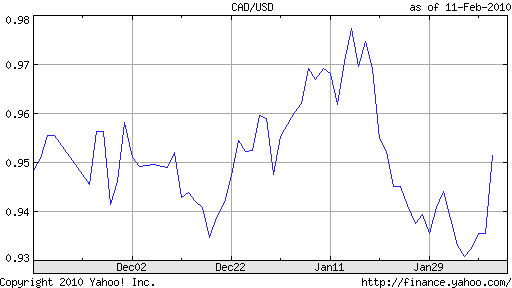

In January, the Canadian Dollar (aka Loonie) registered its worst monthly performance since June. Many analysts pointed to this as proof that its run was over, after coming tantalizingly close to parity. Others insisted that the decline was only a temporary correction, a mere squaring of positions before the Loonie’s next big run. Who’s right? Both!

There are (at least) two separate narratives presently weighing on the Loonie. The first is causing it to decline against its arch-rival, the US Dollar, for reasons that essentially have nothing to do with the Canadian Dollar and everything to do with the US Dollar. Specifically, the mini-crisis that is playing out in Greece and the EU has caused risk aversion to resurface, such that investors are now returning capital to the US. One analyst explains the impact of this seemingly tangential development on the Loonie as follows: “When you get any sort of ‘risk-off’ type of environment like we’ve had over the past week or so, currencies like the Canadian dollar and the Australian dollar will come under pressure.”

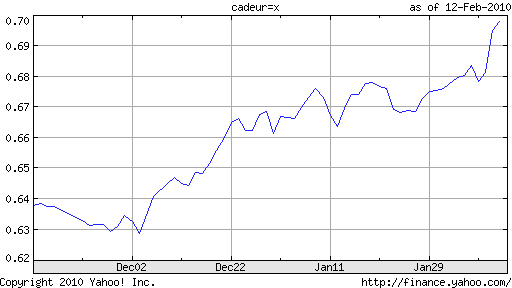

The second narrative explains why the Canadian Dollar continues to hold its own against most other currencies. Specifically, Canada’s economic recovery continues to gain momentum as commodity prices continue their rally. In the latest month for which figures are available, the economy added about 80,000 jobs, more than five times what forecasters were expecting. This turn of events is helping to quash the “view that the Canadian trade sector is incapable of growth with a strong currency,” and making traders less nervous about sending the Loonie up even higher.

Going forward, there is tremendous uncertainty. Both short-term (determined by the Bank of Canada) and long-term (determined by investors) interest rates remain quite low, such that the Loonie is not really a candidate for the carry trade. In addition, the Bank of Canada hasn’t completely ruled out the possibility of intervention on behalf of the Loonie; it may simply leave its benchmark interest rate on hold (at the current record low of .25%) for longer than it otherwise would have. In addition, a series of recent tightening measures by the government in China threatens to crimp demand for commodities and weigh on prices. Finally, the market turmoil in Greece is causing investors to look afresh at the balance sheets (in order to weigh the likelihood of default) of other economies. This probably won’t help Canada, which continues to run large deficits and whose debt level once earned it the dubious distinction of “honorary member of the Third World.”

Still, Canada’s capital markets are among the most liquid and stable in the industrialized world, and if risk-aversion really picks up, it won’t suffer as much as some other economies. “The Canadian economy is not as structurally impaired as the U.S. or the U.K. It creates a sense that Canada is less exposed to the fickleness of foreign investors that are causing uncertainty in other locations.” In fact, the Central Bank of Russia just announced that it will switch some of its foreign exchange reserves into Canadian Dollars, and other Central Banks could follow suit.

While the Canadian Dollar should continue to hold its own against other currencies, the same cannot necessarily be said for its relationship to the US Dollar. “Options traders are the most bearish on the Canadian dollar in 13 months…The three-month options showed a premium today of as much as 1.34 percentage points in favor of Canadian dollar puts.” In other words, the price of insurance against a sudden decline in the CAD/USD is rising as investors move to cushion their portfolios against such a possibility. While this trend could ease slightly in the coming weeks, I personally don’t expect it to disappear altogether. All else being equal, given a choice between owning Loonies or Greenbacks, I think most investors would choose Greenbacks.

February 16th, 2010 at 5:51 am

Interesting analysis indeed. A rise in Canadian inflation is necessary to be seen in order for the loonie to make serious gains towards parity. This could be seen this week and perhaps accelerate the pace of rate hikes.

February 17th, 2010 at 4:20 pm

Parity is at reach for the loonie. Employment in improving, oil demand is persistent, and the BOC will probably the raise interest rate by mid-year.